Last night was debate night for the Republican presidential contenders, which means today is “fact-check” day for the political press. The New York Times, The Washington Post, and the Associated Press are all in on the action, while fact-check specialist Politifact offers a roundup of its earlier related rulings.

While there’s reason to be skeptical about the efficacy of the “fact-check” genre, and none of today’s stories is perfect, they all provide some value. The AP offers a clear take-down of Michele Bachmann’s misleading claim that the Congressional Budget Office said health care reform would destroy jobs, and swiftly rebuts Rick Perry’s nonsense on global warming. The Post is also strong on those points, and it effectively rebuts Perry’s false assertion that Social Security is a “Ponzi scheme.” And the Times, alone among these outlets, takes down Mitt Romney’s “largely untrue” claims about the effect of environmental regulations under President Obama.

But there’s at least one important subject that all these pieces neglect, despite dubious or outright false statements from the candidates last night. That would be the Federal Reserve’s handling of monetary policy, and particularly the level of inflation the economy has been experiencing during the economic crisis.

The context is important here. The Fed has a dual mandate of keeping inflation in check while promoting employment. In normal times, it tries to strike this balance by manipulating short-term interest rates. When the central bank lowers rates, it’s trying to boost employment; when it raises them, it’s trying to put the brakes on inflation. But during the recession and the weak recovery, unemployment has remained scarily high even with short-term rates near zero. So the Fed has tried some unorthodox methods—e.g., “quantitative easing”—to boost the economy; these moves came on top of dramatic steps the Fed took to prop up banks at the height of the financial crisis.

Some critics, both outside and inside the Fed, warn that these expansionary measures create the risk of harmful runaway inflation. Others—who are more numerous than most mainstream coverage acknowledges—say the central bank has not gone nearly far enough in trying to spur job growth, and that a burst of higher inflation could even be beneficial.

The Republican presidential contenders, as a group, are in the former camp. So it wasn’t entirely surprising that when the moderators asked last night about Fed Chairman Ben Bernanke, Newt Gingrich declared that he has been “the most inflationary, dangerous, and power-centered chairman… in the history of the Fed.”

Nobody takes Gingrich seriously as a contender for the nomination, of course. But the next to speak was Mitt Romney, one of the frontrunners. Until recently, Romney has declined to bash the central bank, but he said last night that he’d look for a new Fed chairman, adding, “I think Ben Bernanke has… over-inflated the amount of currency that he’s created.”

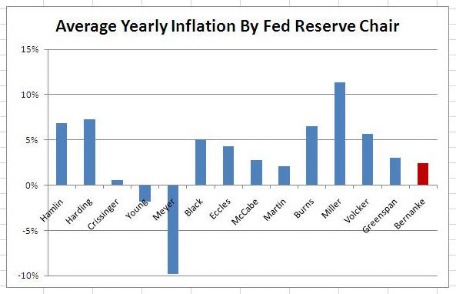

What’s the problem with these statements? It’s that, while some economists worry that the Fed has run the risk of future inflation, so far, the inflation hawks have been wrong at every turn. In fact, under Bernanke’s Fed, the U.S. has seen the lowest inflation rates in decades. And since the recession began, we have come closer to harmful deflation than problematic inflation.

Via Matthew Yglesias, after the debate econ blogger Jodi Beggs calculated the annual inflation rates under every chairman since the Fed’s founding. Here’s her chart (click here for a larger version):

Since the stagflation of the 1970s—that would be the period before Volcker’s chairmanship—the Fed has ratcheted inflation ever lower, to the point that it has come to seem a reflex. That trend has not changed under Bernanke, and to say that it has is untrue. (As Beggs notes, Romney’s comment—which seems to conflate the concepts of price inflation and the money supply, and is expressed as a value judgment—is not demonstrably false in the same way that Gingrich’s is. But, in giving the sense that we have experienced harmful inflation, it remains misleading.)

It’s not terribly surprising that today’s fact-check stories didn’t focus on this issue. The discussion didn’t take up much of the debate. (Oddly, Perry wasn’t asked about his earlier claim that Bernanke’s actions are “almost treasonous.”) And monetary policy is a wonky subject, so readers may not find it immediately salient in the way that that Social Security or global warming are.

But going forward, the campaign press—“fact-checkers” and otherwise—should pay close attention to this issue. Wonky or not, monetary policy is important stuff that affects millions of Americans, and it remains at the center of ongoing debates about how to fix the economy. Part of press’s job in covering the presidential campaign will be reporting where the candidates stand in those debates, and why those stands matter—and that task starts with making sure the candidates are playing straight with the facts.

Greg Marx is an associate editor at CJR. Follow him on Twitter @gregamarx.