In his campaign for the Republican presidential nomination, former Minnesota governor Tim Pawlenty has tried to cast himself as a no-nonsense, straight-shooting expert on fiscal matters. Pawlenty trotted out that line again in his big speech on economic policy Tuesday, declaring that he had “promised to level with the American people. To look them in the eye. And tell them the truth.”

Unfortunately, though perhaps not unsurprisingly, the substance of Pawlenty’s remarks didn’t live up to that claim. So how did our major press outlets do in testing Pawlenty’s plan against his rhetoric? A survey of the coverage finds mixed results.

The outlines of Pawlenty’s proposal are standard Republican fare: cut individual and corporate taxes, cut spending, cut regulations. Besides a gimmicky “Google test”—he argued the federal government shouldn’t be providing services that can be found on the Internet—the main innovation here seems to be Pawlenty’s determination to be further right on taxes than any of his GOP rivals.

That’s well and good. But in outlining his vision, Pawlenty made a couple of statements whose accuracy—and connection to reality—deserve scrutiny from the press. For example, from his discussion of corporate taxes:

American businesses today pay the second highest tax rates in the world. That’s a recipe for failure — not adding jobs and economic growth.

We should cut the business tax rate by more than half. I propose reducing the current rate from 35% to 15%.

But our policies can’t just be about simply cutting rates. They must also promote freedom and free markets. The tax code is littered with special interest handouts — carve-outs — subsidies — and loopholes. That should be eliminated.

Such reform would not only help offset short-term revenue loss from the rate cuts. But it would also reduce cronyism — favoritism — and government manipulating markets for political purposes.

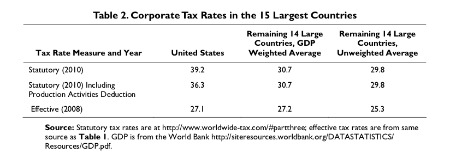

Pawlenty is right that there are a lot of loopholes—or “incentives,” depending on your point of view—in the corporate tax code, and many economists would support his call for eliminating them in the name of greater transparency and efficiency. But the presence of all those subsidies mean that U.S. businesses, in the aggregate, don’t pay taxes at a rate that’s out of line with similar countries, despite the fact that our statutory rate is among the highest in the world.

The Congressional Research Service, an invaluable source of technocratic, nonpartisan analysis, produced a brief (PDF) on just this subject in March. Here’s a representative chart. (You’ll note that even with those loopholes and incentives accounted for, effective rates are well above 15 percent):

Other measures included in the CRS report show marginal effective rates on businesses slightly higher in the U.S. than overseas, thought even there there’s more similarity than difference. But while Pawlenty’s call to slash businesses taxes was, appropriately, featured in much of the coverage of his speech, I didn’t see one story note that part of his justification for the move was misleading.

Media scrutiny of another part of his speech was better, though only in some outlets. Here’s Pawlenty talking about his target for economic growth:

Let’s start with a big — positive goal. Let’s grow the economy by 5%, — instead of the anemic 2% currently envisioned…

By the way — 5% growth is not some pie-in-the-sky number. We’ve done it before. And with the right policies — we can do it again.

Between 1983 and 1987 — the Reagan recovery grew at 4.9%. Between 1996 and 1999 — under President Bill Clinton and a Republican Congress. The economy grew at more than 4.7%.

And later:

5% economic growth over 10 years would generate 3.8 trillion dollars in new tax revenues. With that — we would reduce projected deficits by 40%. All before we made a single budget cut.

Again, Pawlenty is right that 2 percent growth on the heels of a catastrophic recession is unacceptable. And he’s right that restoring the economy to health will do wonders for the long-run budget outlook. But a decade of 5 percent growth for a developed economy is not just “pie-in-the-sky”; it’s pure fantasy. Even his two cherry-picked examples show growth that doesn’t quite reach that level, over a period that’s at best half as long.

And this isn’t some arcane bit of economic knowledge—the Twittersphere was flagging Pawlenty’s economic illiteracy in real-time, and even sympathetic bloggers like James Pethokoukis and Ramesh Ponnuru picked up on it right away.

The straight news accounts of the speech, though, suggest reporters either didn’t pick up on the outlandishness of Pawlenty’s goal, or didn’t feel they could point it out themselves. Stories in The New York Times and The Wall Street Journal—apparently published after reporters had an opportunity to call around for comment—give readers at least some sense of how unlikely this target is, with outside experts and critics given a chance to provide context. But readers of the articles in the Los Angeles Times, The Washington Post, and Politico could all come away thinking the target was ambitious but feasible.

Setting unrealistic goals may not be the worst of offenses, but the failure to call out Pawlenty here grates because, by his own admission, those “pie-in-the-sky” growth targets are central to his plan to balance the budget, which is supposedly topic number one in Washington these days.

And about that budget plan: Pawlenty was vague on how he would address the main drivers of federal spending, but precise about his target. He called for a constitutional amendment capping spending at about 18 percent of GDP, which he described as the “historical average.”

That claim, though, depends very much on your definition of “history.” As this OMB document shows (PDF, see page twenty-six), the last time federal outlays fell below 18 percent of the economy was 1966. With the exception of the tail end of the tech boom, when the private sector was super-charged, they haven’t come close to that level since the 1970s. The spending cuts Pawlenty is calling for aren’t just deep, they’re historic (and even so, his tax plan is unlikely to produce enough revenue to pay for them). Again, the NYT and Journal stories do the best job of communicating this, though neither really nails it. And the Post, LAT, and Politico don’t even include the 18 percent target in their write-ups.

Is it unfair to expect reporters to nail down this stuff in the first pass, especially when they’re racing to get the story up for a hungry web audience and, as was apparently the case in some of these articles, don’t have for follow-up research and reporting?

Maybe, but it’s not unfair to ask them to do better. At National Journal’s site, Tim Fernholz had a detailed write-up Tuesday afternoon that pointed out the unlikelihood of Pawlenty’s growth target, the scant revenue his tax plan would collect, and the massive cuts his spending cap would require, while not neglecting the intra-party primary positioning that was the subtext for the speech. It’s a great example of what a politically astute reporter who’s taken the time to understand some key policy details—and who believes that his readers care about them—can do, even on an unforgiving deadline. As this campaign soldiers on, here’s hoping we see more work like this in our biggest news outlets.

Greg Marx is an associate editor at CJR. Follow him on Twitter @gregamarx.