Of the many and conflicting stories about how The Huffington Post came to be—how it boasts 68 sections, three international editions (with more to come), 1.2 billion monthly page views and 54 million comments in the past year alone, how it came to surpass the traffic of virtually all the nation’s established news organizations and amass content so voluminous that a visit to the website feels like a trip to a mall where the exits are impossible to locate—the earliest and arguably most telling begins with a lunch in March 2003 at which the idea of an online newspaper filled with celebrity bloggers and virally disseminated aggregated content did not come up.

The invitation for the lunch came from Kenneth Lerer. He was 51 and casting about for something new, having recently left his position as executive vice president for communications at AOL. Lerer was a private man who was nonetheless comfortable in the presence of powerful people with whom he had earned a reputation for honing images in disrepair, most famously for the disgraced and subsequently rehabilitated junk bond trader Michael Milken. Lerer had made a good deal of money and a good many friends after having first made a name for himself in the quixotic 1974 New York senate campaign of Ramsey Clark (for which he was hired by the chairman of this magazine, Victor Navasky, who later recruited him for CJR’s Board of Overseers, which has no say in content). Lerer was splitting his time between New York and skiing at his vacation home in Utah when he came across a new book by a young sociologist, Duncan Watts. The book was called Six Degrees. Lerer was so taken by it that he took Watts to lunch.

He brought the book with him and Watts would recall that the copy was dog-eared, the flatteringly telltale sign of a purposeful read. Lerer had a plan and he wanted Watts to help him. He had set himself an ambitious target. He wanted to take on the National Rifle Association.

He told Watts: “I know the answer to this is somewhere in these pages.”

Nine years and one Pulitzer Prize later, what is the phenomenon that lunch set in motion? How is it that The Huffington Post, at turns celebrated as the savior of its parent company and decried as a glitzy thief of journalism produced by others, has come to matter?

Before its purchase by AOL in February 2011, HuffPost was not a property that had produced much in the way of revenue; it had posted a profit only in the year before the sale—the amount has never been disclosed—on a modest $30 million in revenue. Aside from scoops from its estimable Washington bureau, it did little in the way of breaking stories, the industry’s traditional pathway to recognition.

Huffington Post, which had mastered search-engine optimization and was quick to understand and pounce on the rise of social media, had been at once widely followed but not nearly so widely cited. But that is likely to change now that it can boast of a Pulitzer Prize for national reporting—the rebuttal to every critic who dismissed HuffPost as an abasement to all that was journalistically sacred.

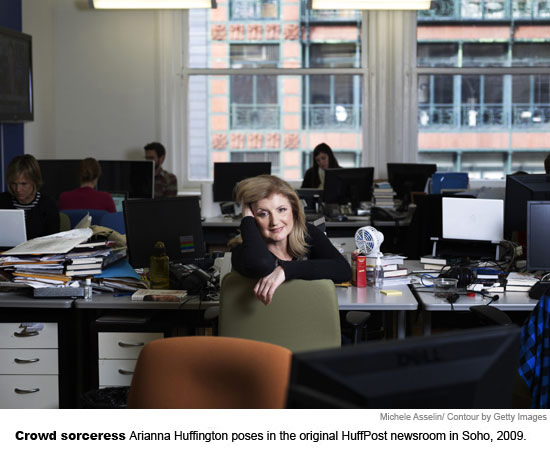

Arianna Huffington liked to boast that the site that bore her name had remained true to its origins. The homepage’s “splash” headline still reflected a left-of-center perspective; it had thousands of bloggers, famous and not, none of them paid; and while there was ever more original content, especially on the politics and business pages, the site was populated overwhelmingly with content that had originated elsewhere, much of it from the wires (in fairness, an approach long practiced by many of the nation’s newspapers). But Huffington Post had evolved into something more than the Web’s beast of traffic, blogging, and aggregation. These days, Arianna Huffington has a regular seat at the politics roundtable, which speaks not only to her own facility on TV but also to the prominence her organization enjoys.

Power can be felt, even if it defies measurement. By the winter of 2012, Huffington Post could lay claim to a widely shared perception of its growing influence—the word Huffington prefers to power, which, she says, sounds “too loaded.” For better or, in the eyes of its critics, worse, Huffington Post had assumed the position of a media institution of consequence.

It was possible to draw all sorts of conclusions from data about “HuffPo,” both flattering and not. Yet two numbers in particular stood out for what they suggested about the nature of the enterprise that Huffington, Jonah Peretti, and the host of that first lunch, Ken Lerer, had built: 40 million and 19,000. The former is the number of unique visitors who came to the site in January. The latter is the number of names in Arianna Huffington’s contact list.

Each represents a network that together constituted something far greater than what each represented by itself—an aspiration: the potential power that comes to those who can build, nurture, and harness a network that is at once vast and loyal.

Emphasis on potential.

1. Connected

Duncan Watts, an Australian who had come to Cornell for graduate school, was 32 and possessed a disposition that could be mistaken for curmudgeonly. The rapid growth of the Web had proven a boom time for social scientists, who could suddenly perform all sorts of research on large samples in very quick time and at relatively little cost. The result was papers and conferences and books that, in Watts’ view, transformed sociologists into engineers. Time and again, people approached Watts with questions for which he could offer only the maddening answer of “it depends.” This did nothing to make sociologists popular. Nor did it stop all sorts of people from coming around, among them Ken Lerer.

Six Degrees examined the nature of what Watts called “small worlds.” The conceit—later to be adopted by fans of Kevin Bacon and playwright John Guare—had come from a 1967 experiment by the social psychologist Stanley Milgram, in which he tracked the number of connections it would take for a letter to reach a certain recipient unknown to the original sender. The answer: six. That conclusion suggested that it was possible for any one person to reach any other person in the world by establishing a network of diminishing familiarity—start with a friend, then a friend of a friend, and so on—until the connection was complete. That premise had fueled the study of what Watts called the “science of networks,” one that dated to the 18th century and which had over time drawn in a host of scientists who seemed to think all things could be measured. And if they could be measured, they might be graphed and charted in a way that revealed patterns that could, in an ideal world, be replicated.

Perhaps the dream of creating vast networks of connected strangers was possible, if only one could identify the proper links. Or, in the parlance of the network world, making weak links into strong ones.

Watts’s book was filled with images and drawings that could be confounding—how many threads are necessary for connecting a mass of buttons in a way that created a button network?—yet tantalizing, especially, it seemed, for someone trying to find a way to take on one of the nation’s most powerful lobbies.

Still, networks were eternally undermined by the inevitable force of randomness. It was one thing, say, to go to a baseball game and hear the stirrings of rhythmic clapping that then cascade around the ballpark so that quickly everyone is clapping in unison. A powerful thing to behold—so much so that an inning later, you yourself might want to start the whole stadium clapping. Maybe the person to your left joins in, and maybe five or six others do, too. Until the clapping dies. In Watts’s view, networks were a wonderful phenomenon to observe, but all but impossible to replicate. Why did everyone in the ballpark feel the desire to join in the clapping in the sixth inning but not in the seventh? What was different? Could you somehow recreate the precise conditions that made that ephemeral but resoundingly successful sixth-inning network happen?

Watts doubted it. There were simply too many variables at work. Still, you could, in theory, try something: Start to clap, see if anyone joins in, stop if they don’t, wait for a new set of conditions to arise—another player to bat, a runner reaches second base? Or third? In other words, experiment, and measure the results as they occur, all the while adjusting, tweaking—try clapping louder, say, then faster, maybe adding a chant—but do so having accepted the likelihood that animates work for all scientists: failure.

Ken Lerer listened, and he was not deterred. Networks did, in fact, occur—vast networks through which previously disconnected people suddenly found themselves joined together, perhaps to share an idea, a song, a sentiment, a cause. Why not then try to create a network that could challenge the vast and powerful and sustaining network of the NRA?

“I know the answers,” Watts told him. “I am confident they are not there.” Then, having deflated Lerer, Watts threw him a lifeline: “Maybe my friend Jonah can help you.”

Jonah Peretti was 29 and had already earned a reputation as something of a wise guy. He had been a technology teacher at a New Orleans private school when he was admitted to a graduate program at MIT. His plan was to study ways networks might foster communication among teachers, but got sidetracked midway through his master’s thesis. In 2000, Nike was inviting customers to create footwear with personalized wording. The company had been criticized widely for selling sneakers made by desperately poor people in impoverished countries. Peretti, tall, skinny and bespectacled, submitted his request: He wanted his sneakers emblazoned with the word SWEATSHOP. Nike declined. At which point, Peretti did a clever thing: he e-mailed.

Nike replied. Back and forth they went: Peretti pressing his request; Nike, grasping at excuses, going so far as to refuse on the grounds that “sweatshop” was slang and therefore not permissible. Peretti, citing Webster’s, insisted it was not. He ended the exchange with a final request: “Could you please send me a color snapshot of the ten-year-old Vietnamese girl who makes my shoes?” What happened next represents one of those moments in which the tectonic media plates experienced a subtle but profound shift: Peretti offered the e-mail trail to Harper’s. The magazine declined. So, on January 17, 2001, Peretti forwarded the e-mails to 10 friends. Those friends, in turn, forwarded the e-mails to other friends and before long, a lot people who had never heard of Jonah Peretti—some of them in Australia—were sending around his e-mail conversations with Nike.

Less than two weeks after he first forwarded the e-mails, the San Jose Mercury News published a story about the exchange. Salon soon followed. Then Time, The Village Voice, and The Independent and The Guardian in London. Years later, Peretti would recall the sensation of watching something he had originated spread so widely that it would culminate in his appearance on the Today Show with a chagrined representative of Nike. “Every person who’s made something that’s gone viral remembers the experience with glee and disbelief,” he says. “Part of it feels powerful and part of it feels like magic—I just did this little thing and a big thing happened.”

To his credit, Peretti completed his thesis on teacher communication, but his mind was elsewhere, looking for ways to replicate the sensation he had experienced with Nike. He left Cambridge and moved to New York, where he started a laboratory for what he called “contagious media.” At Eyebeam Art & Technology Center, Peretti, together with like-minded friends including his sister, Chelsea, an aspiring stand-up comic, produced what would come to be regarded as early independent benchmarks of virality: blackpeopleloveus.com—in which white people try to ingratiate themselves with black friends in a manner so compellingly offensive that it earned a piece in The New York Times; and the “breakup hotline,” a telephone number and accompanying website for women attempting to rid themselves of unwanted suitors. “I was trying to have an impact on culture,” Peretti says.

Where Watts believed in “embracing” randomness, Peretti nodded to it but had seen that he possessed a talent for improving the odds of a viral launch. Watts would later say, “Basically, he’s a prankster.”

Which was why he thought Peretti and Lerer should meet.

Stopthenra.com did not, in the end, stop the NRA. The goal was to ensure that the Clinton-era assault-weapon ban would not expire in September 2004. And though the ban did end—Congress simply avoided voting on it—Lerer would remain pleased with the effort. (Later that year he donated the site to the Jim Brady gun-control campaign.) For Peretti, the experience provided important lessons. He had learned through the Nike saga how essential a role mainstream media played in adding legitimacy to a viral meme, a lesson underscored by Lerer’s PR skill. But there was something more, a point that Watts had raised early in his book.

The problem with Stop the NRA was that it spoke to an audience that was, in Watts’s words, already “clustered.” That audience was akin to a group of friends or colleagues who already knew one another. As an example of “clustering,” Watts cited a science-fiction trilogy by Isaac Asimov, in which Earth is a land of atomized steel caves, as opposed to Solaria, where all communication is virtual. On Earth, everyone whom everyone knows is known intimately, but they do not know anyone else. On Solaria, the connections are vast, but weak.

It is almost too convenient to read that passage and, given the state of the news business in 2003, not think of newspapers as the equivalent of all those steel caves, sealed off and closely bound. In the two generations since the great migration of readers from the cities to the suburbs, the prevailing wisdom in newsrooms was that readers, having abandoned the outward view of the street for the inward view of the backyard, cared only about what was taking place in closest proximity. To work in a newsroom with a strong suburban readership was to be told, time and again, that the metric for success was market penetration, and that looking outward beyond geographical limits of the circulation area was a kind of journalistic heresy. Meanwhile, a whole new way of disseminating information was exploding—sending stories and news into those heretofore seemingly impregnable caves, and ending the monopolies on content. Readers may have still wanted their newspapers, but they no longer needed them as they once had.

The alternative to the steel caves, to the “clusters,” was the ephemeral network of Solaria. But where, in the here and now, did that network exist? How could it be harnessed? Peretti, whose stock in trade was the dissemination of pieces of disconnected content, believed he had an answer: He called it the Bored At Work Network. All across the world, he believed, men and women sat at their desks, staring at computer screens, bored senseless. How better to provide a momentary relief from the tedium than to disseminate something so engagingly simple that recipients would take a moment to forward it to friends—Rule No. 1 of the Peretti School of Viral Content: It must be explainable in a sentence.

What was forwarded, of course, reflected something about the sender, which, as Watts pointed out, was why few ever send pornography—not cool. And while a good deal of these bits of content had all the permanence of footprints in sand, every so often the Bored At Work Network would light up, and weak links were instantly transformed into strong ones. A vast network sprang to life.

“It’s hard to reproduce,” Peretti would later say. “It’s hard to understand.” But when it happened, its power was palpable.

Which was why Lerer remained undeterred. the 2004 presidential campaign had begun, and for Democrats there was the growing sense that President Bush, saddled by the increasingly unpopular war in Iraq, could be defeated. Peretti was still experimenting with contagious projects and teaching at NYU’s Interactive Telecommunications Program (ITP) when Lerer called with an idea: He wanted Peretti to fly to Los Angeles to meet Arianna Huffington.

Lerer had met her that year, at a dinner on the Upper East Side. His wife had declined the invitation and Lerer went reluctantly, only to find himself succumbing to the charm that had worked so well for so long on so many people. Lerer thought it might be a good idea for Huffington to meet his young collaborator. At that moment, Peretti represented that small sliver of American society who had no idea who Lerer was talking about.

In the fall of 2004, Arianna Huffington was well along in yet another iteration of what her many critics and perhaps even some of her many friends might call the Saga of Arianna.

Very long story short: Huffington, née Stassinopoulos, child of a Greek newspaper owner of inconsistent success, escapes a relatively friendless adolescence in Athens for England, where in short order she joins and becomes a featured member of the Cambridge debating Union and thereby a) discovers the power of words b) meets lots of people and, as a result, c) starts to appear on television d) writes a best-selling book on feminism and e) meets and falls in love with the cultural critic Bernard Levin who, she jokes in what becomes a familiar refrain is twice her age and half her size. She is 5’10”. She breaks off with Levin after seven years; she wants children, he does not. She writes two more books (the second a biography of Maria Callas that results in a plagiarism suit that ends in a settlement with an author that she would later consider a friend) and relocates to New York, where, with the help of such social luminaries as Ann Getty and Barbara Walters becomes so ubiquitous a fixture on the Upper East Side party circuit that in 1983 she is anointed with a profile in New York magazine: “The Rise and Rise of Arianna Stassinopoulos.” Three years later, she marries, seemingly well, the Texas gas and oil heir Michael Huffington, a Republican whose political career she helps guide through his election to Congress in 1992. Then comes Huffington’s unsuccessful 1994 run for the Senate, during which the glowing picture of Arianna as the eager young woman about town devolves into a portrait so calculating that she calls to mind Angela Lansbury in The Manchurian Candidate. The marriage ends in 1997—Michael Huffington later reveals that he is bisexual—leaving Arianna with a house in Brentwood she shares with her sister and two daughters, and with a lingering reputation as a woman of somewhat curious opinions on alternative lifestyles and healthy living (she is a fiend about sleep), fueled by her association with one John-Roger, the leader of the cultlike Movement of Spiritual Inner Awareness. Arianna, contributor to the National Review, evolves into a “progressive.” She runs for governor. She gets less than 1 percent of the vote. She returns to writing books—there will be 13 in all—as well as a blog, Ariannaonline, when one morning in the fall of 2004, Jonah Peretti, who had flown in the night before and who had spent the night in the guestroom, comes into the dining room at 7 a.m. to discover that he is her second breakfast meeting of the day.

Laurie David, then-wife of the dyspeptic Larry, soon joins them, and Peretti is whisked along on a private jet for a flight to Sacramento for a rally in support of the Senate candidacy of Phil Angelides. In the course of a few hours, Peretti would watch with wonderment as Arianna Huffington eased herself from setting to setting, all the while making the person she was talking with feel like the most interesting and important person in the world, hanging on every word, never shifting her attention to check one of three BlackBerries. “I loved being a gatherer,” Huffington would later say. “I don’t really think you can make gathering mistakes.”

Peretti saw this talent through a different prism. “Arianna,” he says, “can make weak ties into strong ties.”

He returned to New York to discover that Lerer was already a few steps ahead of him. He wanted to talk about the venture the three of them would embark upon. “I remember him saying things like, ‘We don’t want to build a big website,’” Peretti would recall. “‘We want to build an influential site.’”

2. Sticky

Precisely what occurred at the Huffington home in Brentwood a few weeks later, after George W. Bush’s defeat of John Kerry in 2004, is open to both debate and litigation. The nature of the dispute has to do with who exactly came up with the idea for what would become Huffington Post. All sorts of well-connected people—all connected to Arianna—had all sorts of ideas about how people of fame and influence on the left could make that influence felt. Among the 30 or so people invited—Larry David, Norman Lear, Meg Ryan, David Geffen—was one conservative outlier, Matt Drudge’s associate, the late Andrew Breitbart, who would later tell Wired that the site was his idea all along. Two other participants, Democratic consultants Peter Daou and James Boyce, would insist that the idea was theirs, and would six years later sue Huffington and Lerer. The case is pending.

Still, the sense of those assembled was that the left needed an answer to the power of Matt Drudge—the secretive, right-leaning loner who had become the political world’s primary purveyor of content and opinion—and that perhaps Arianna’s many friends could help. People offered suggestions about how this might work. Lerer, as was his habit, said almost nothing; he had long cultivated the reputation of a canny strategist by being a good listener who waited until everyone else had their say before offering a trenchant opinion. Yet there was one constant in the comments: how to make best use of the growing fascination with blogging.

The phenomenon had with remarkable speed spawned a culture whose chief practitioners celebrated the end of the traditional way information flowed: top to bottom. No longer, the blogging champions claimed, would the power to disseminate ideas and information reside with the legacy news organizations. The Web had made everyone a publisher—even, it was repeated endlessly, the fellow who stayed in his pajamas all day.

Back in New York, Peretti reasoned that to try to replicate Drudge by being like Drudge would do no good. Those competitors who had tried—Drudge Retort, BuzzFlash—had gained little traction. “You could be 50 percent better but it wouldn’t matter,” he later said. “No one would need it.” Drudge already owned the franchise on what Peretti called “stickiness”—the capacity to have readers return, time and again.

While Drudge was sticky, so too were the bloggers, many of whom presented ideas that could be shared and, as a result, created communities among like-minded people, clusters. Clusters, while tightly knit, tended to grow slowly. Peretti wanted to grow fast.

He had already seen how effectively he could spread content. But the networks he created did not last. Arianna Huffington’s networks did. He had watched her move between networks she had created—no one, he believed, worked harder at it—all the while connecting people in a way that made them feel a part of something. It was not merely making weak ties into strong ones: “She makes her weak ties feel like strong ties.” And that, he recognized, “creates a large network of all kinds of people who feel close to you. That’s really important for power.”

To succeed, he concluded, the site that was to become Huffington Post would have to be both viral and sticky. People would have to feel a connection that brought them back. They would also need to have things they could share with other people. And what better way to take fullest advantage of the blogging boom than to have famous people do it? The blogging world might well hate it, but “they wouldn’t be able not to look,” he later said. “Even the haters would come every day.”

If the site was to be a blog, it had to look like a blog, and for that he would need to build it with blogging software. He chose Moveable Type and set about building a prototype. It was up to Lerer to raise the seed money—$1 million. And it was up to Huffington to find the bloggers. She wanted Arthur Schlesinger; he was a friend. So was Larry David. And John Cusack. And Harry Shearer.

Who wasn’t?

3. Contagious

Eyebeam’s “Contagious Media Showdown” began on Saturday, May 7, 2005, with a series of workshops and the launch of a contest, whose winners would be judged, fittingly, not on the aesthetics of their viral creations but on the metrics: hits, page views, unique visits, unique users, bandwidth, etc.

Submissions included Cryingwhileeating.com, thebrainfreeze.com, fartingsaucers.com, and the eventual winner, forgetmenotpanties—615,562 unique visitors! Jonah Peretti was the kickoff speaker. Four years had passed since he had hit the send button on his Nike campaign, and in that time, he had helped spawn a phenomenon that had developed a culture all its own and was moving beyond its underground roots. MSNBC, Slate, and the Los Angeles Times covered the event with the sort of tender wonder associated with seeing a child’s first drawing.

Huffington Post’s debut came two days later, and the reaction to it was decidedly less enthusiastic. The site was not handsome. But to its founders that was beside the point. Peretti, who like Huffington and Lerer was unencumbered by journalistic sensibilities, understood that all that really mattered was ease of use. Except for the “splash” headline and the tile architecture that the site would soon adopt, the HuffPost of May 2005 looked like a stripped-down version of today’s.

The launch featured an introductory blog by Huffington herself, along with blogs by, yes, Arthur Schlesinger, Larry David, and a much-maligned co-bylined post by Julia Louis-Dreyfus and her husband, Brad Hall, on gay marriage. The knives were out: “I’m predicting it’ll be at least as successful as Arianna’s last campaign for governor, and you can quote me on that,” wrote Ned Rice in National Review Online. “The problem with blogs like The Huffington Post is that they divert our attention from real and serious journalism,” wrote Cal Thomas of Tribune Media Services, which had been carrying ariannaonline.com. But no one could rival the delighted venom of Nikki Finke in LA Weekly: “Judging from Monday’s horrific debut of the humongously pre-hyped celebrity blog the Huffington Post, the Madonna of the mediapolitic world has undergone one reinvention too many.” Finke went on to hit where it seemed likely to hurt most, suggesting that Arianna’s Hollywood friends wanted little to do with the venture.

In truth, there was little need to scrounge for copy; all sorts of people were willing to have a turn once they realized how easy it was to send along their musings. There was little in the way of editing, save for some cosmetic tending to prose, and the admonition, especially to the writers among them, to “be bloggier.”

By May 2006, Time had anointed Huffington one of the world’s 100 most influential people—along with Matt Drudge. Lerer had raised another $5 million and the site, depending on who was doing the counting, had between 760,000 and 1.3 million monthly unique visitors. Huffington announced the hiring of Melinda Henneberger, a former reporter for the The New York Times and Newsweek, in an effort to create original content generated by a salaried employee. Huffington seemed to be inviting everyone she encountered to blog, including the doctor who had tended to her broken foot. Money was coming in; in June, the JWT advertising agency bought all the site’s advertising space for a single week to promote such clients as JetBlue, Levi’s, and Ford, at a cost reportedly in the low six figures. Newsweek included Arianna on its cover for its story on women and power.

And yet there remained something unseemly about the whole enterprise, especially to journalists, a sense that in making its own rules Huffington Post had violated a few too many. Its newsgathering was done by others, even if the commentary was original. The bloggers were not paid—a fact that did not stop people from joining in—me included. I wrote 14 blog posts for Huffington Post for one reason only: I had a book coming out, and it was clear that if I wanted to reach potential buyers, Huffington Post provided an ever-widening platform. Many writers without marquee names were submitting pieces and not only seeing them posted, but sometimes surpassing the posts of the famous contributors.

Being able to see their names, or better still, their bylines—with tiny, pinky-nail photos—meant that these unpaid contributors had joined the phenomenon Huffington talked of and celebrated above all others: the Conversation. And in providing all these people with a forum, Huffington Post had succeeded in extending and strengthening the reach of its ever wider, and stickier, network.

That fall, HuffPost traffic surpassed that of The Philadelphia Inquirer’s website, though it still lagged behind that of the big players: CNN, Yahoo, the Times, and its self-appointed nemesis, Drudge. The site, which had started with fewer than 10 employees—most in New York, with Huffington and Roy Sekoff in Los Angeles—began to hire, slowly. Among the newcomers was a former student of Peretti’s, Paul Berry. Peretti was getting restless—he was planning to start his own laboratory, a company to be called BuzzFeed—and he needed someone who could transform the already impressive traffic numbers into the metrics worthy of the contagious phenomenon he had helped spawn.

4. Disruptive

By the time he arrived at Huffington Post in 2007, it was as if all of Paul Berry’s life experience had prepared him to become the site’s lord of traffic. He was 30 years old, recently married, and possessed an air of infectious enthusiasm. He spoke in a loud voice. He laughed often, and loudly. Peretti had seen possibilities in him as a graduate student at NYU’s ITP, and invited him to be part of the Contagious Media project at Eyebeam. By then, Berry had long abandoned his youthful dream of writing fiction—he studied Latin American literature as an undergrad—and had found work of moderate fulfillment as a coder and Web developer.

He had spent part of his childhood in Mexico City, where his father, Tim, worked for UPI before settling in Silicon Valley. Tim, who taught Paul to code when he was eight, eventually founded his own company, which sold downloadable business software—at least until the dotcom crash of 2000. Paul headed to Mexico, where he found work as a $25-an-hour developer, all the while feeling painfully removed from the ferment and excitement of the great digital disruption unfolding at home. “I needed to be close to the change of history,” he recalled. “It’s like there’s an earthquake happening and the land is splitting and there’s this gaping hole. It’s that obvious.”

He returned to New York, where his skills led to work at a real-estate finance firm. But the work did not excite him. Berry enrolled at NYU’s ITP, where he’d taken a class as an undergrad, studying with Clay Shirky, the media theorist. To the school’s chagrin, he kept his job and maintained a full class load.

Two weeks before teachers were to submit grades, Berry unveiled Teachers On the Run, a site where ITP students could rate and comment on their professors. It became an in-house sensation, especially after one woman posted an anonymous comment criticizing a professor for staring at her breasts. “Everybody was just in a frenzy,” he recalled. Here, after all, was an unnamed student leveling a troubling accusation against a professor in a public forum. Was this slanderous? Was it a grudge? Was it wrong to post? Berry did not think so, especially after more women added their comments, supporting the charge. The school’s administration wanted it shut down, though Shirky stuck up for him. Berry had witnessed, as Peretti had with his Nike campaign, the power an idea could muster if it found its audience.

Teachers on the Run was a crude experiment, especially compared to Berry’s project a year later for Peretti’s class: Dog Island. Unlike Teachers on the Run, Dog Island was a hoax, a make-believe resort where dog owners could send their pets, for a respite, or forever. Berry chose a rough look for his first draft. But the sense of the class was that he had not succeeded in making Dog Island feel like canine paradise; it needed to be slicker. In Peretti’s class, Berry learned there was a process to creating content with viral capability: iteration. “In Jonah’s approach to viral, there is a structure,” Berry says. “You get close to chaos in how you develop. But there’s a structure of feedback from key people.”

That structure, he was beginning to learn, meant developing an idea, presenting it to an audience, and, depending on their reactions, tweaking, adjusting, even overhauling. “It’s insanely rare that on the first try you have it right.” Dog Island did find its audience. There were dog lovers who came to hate it, assuming that sending small pets to Dog Island spelled their doom. Berry did not dissuade them, suggesting that, alas, from time to time big dogs did kill little dogs, because that was the natural order of things.

“Dog Island was the most fun, because I’m a traffic junkie,” he recalls. “There is a thrill when someone tells you about something you’ve done without knowing you’ve done it.” Something so compelling, alluring, amusing, and so beyond the need for explanation, he adds, “they have to share it.”

Berry had discovered a way to make a living by becoming a creative player in the great disruption. In the culture of “scrappiness,” failure was part of the joy of the work, as he and Peretti found at HuffPost: “Let’s have an idea on Monday. Instead of having a lot of meetings about that idea, let’s just fucking do that idea. By Wednesday, we will have realized the flaw in the idea and we’ll have iterated it, so by Friday, it’s totally different, and it’s either executed or almost done.”

And measured. Everything had to be measured. “Traffic,” he says, “was the measure of success. It showed if we could be a real business.”

But what, exactly, was that business? By 2007, Huffington Post had taken $10 million in investment. This figure was considered modest by venture-capital standards, but it did suggest, none too subtly, the nature of the enterprise: Raise money, raise the profile, raise more money, and then, when the moment and price were right, look for an exit. That could not happen without revenue, and the revenue would not come without traffic. And traffic, much to his delight, was Paul Berry’s to chase.

In the years to come, much would be made—not all of it kindly—of HuffPost’s success in search engine optimization, or, as its critics insisted, figuring out how to stay a step ahead of the Google search algorithm. “All you had to do was study,” Berry now says. “All you had to do was have compassion for Google’s rules.” And while that may sound too disingenuous by half, there is truth to it. Berry did study, and then he did what he and Peretti had always done: They iterated. Berry launched blogs, stories aggregated from elsewhere, photo slide shows, lists—and measured each of those launches in real time, adjusting, pushing as he went. When he and his small New York staff logged off at the end of yet another interminable day, he handed things over to the team of programmers and coders in Ukraine and South America, thereby ensuring that the work, and the measuring, never stopped. With Peretti ever more involved with BuzzFeed, with Huffington in Brentwood, and with Lerer concerning himself primarily with the business, the growing HuffPost newsroom effectively became Berry’s to run.

The space, a loft on lower Broadway above Dean & DeLuca, was a big room with long rows of desks. It was a workplace that approximated the experience of Lord of the Flies. In the absence of grown-ups, or any tradition as to how things were supposed to happen, bright and eager people in their 20s spent a lot time of yelling at one another, all the while competing to see who could drive the most traffic until the end of yet another 12-hour day, when they would head outside and drink together. “There was a feeling that we were making up the rules as we went along,” says one of them. “Most of us had so little work experience that we didn’t know it wasn’t normal.” The absence of criticism represented praise.

People came and went, and when they left, their jobs were filled by someone who might be given a half day of training on Moveable Type and cropping photos before being thrown in the deep end. “There wasn’t a lot of guidance on how things were supposed to go,” says another former employee, who, like others, asked not to be identified for fear of offending the former employer. Berry was a most approachable boss, especially if someone had an idea about something new that might entice visitors; no one could recall his ever asking for a memo, or saying no. That slide show might work, give me 20 minutes. There were new hires who understood, seemingly without explanation, that lists were always done best in odd numbers, because a top 10 list felt like, well, a Top 10 list. Some were not so happy, though, especially those who had come in the naïve hope of creating original works of journalism. They tended to leave, which was just as well, because those who stayed came to see that while a succession of editors took turns addressing the staff about news and content, the speaker who mattered was Berry. He spoke in his animated way about SEO and headlines, why nouns were better search terms than verbs—Michael Jackson Death, not Michael Jackson Dies. The ethos of the HuffPost newsroom was winning the Google search. “That,” says a former employee, “was the thrill.”

Not the origination of the content, but the dissemination. Huffington Post, they understood, was not an enterprise whose core purpose was the creation of works of journalism—as significant or mundane as that can be. It was in the content business, which created all sorts of possibilities of what it could gather and, with a new headline and assorted tags, send back out, HuffPost’s logo affixed. Content would come to mean original reporting by Sam Stein or Ryan Grim from Washington, as well as Alec Baldwin’s blog, Robert Reich’s rants about the forsaking of the American worker, a “Best Retro Bathing Suits” slide show, “Why Women Gladly Date Ugly Men,” David Wood’s Pulitzer Prize-winning 10-part series on wounded veterans, “Nine Year Old Girl’s Twin Found Inside Her Stomach,” campaign dispatches from the Off The Bus citizen journalists, “Angelina and Brad Wow at Cannes,” and “Multitasking Wilts Your Results and Relationships”—as well as Nico Pitney’s blogging on the violence after the disputed 2009 Iranian presidential elections and the 111,000 comments it generated. Because comment was content, too. Comment was like blogging, but at scale. Thousands of comments began to pile up alongside the posts that had generated the commentary. It was as if the posts and blogs were spawning subsidiary posts, the contagious media world’s version of a virtuous circle.

Traffic-counting metrics were at once impossibly complex and elegantly simple: If it’s moving, push it; if it’s not, change it or bury it. There were also surprises that the nimble HuffPost could leap upon, giving it wins over its competitors. On the afternoon that Heath Ledger died in 2008, for instance, the folks at HuffPost discovered that people were entering not his given first name as a search term, but the more familiar-sounding “Keith.” The name Keith was added to the tags, and all that Keith-generated traffic belonged to HuffPost.

Still, there was one caveat to the traffic hunt of which Berry was keenly aware: “The brand still mattered to us.” Which meant that there was a limit to the number of best-starlet-nipple slide shows the site could, or should, run. The blogs could not be HuffPost’s sole purveyor of depth. Nor could the business continue to grow if it was perceived to be yet another political site. Even as traffic climbed in 2007, there was a sense that HuffPost might face a dramatic drop after the presidential election, then still a year and a half away. Looking ahead, Peretti installed traffic-measurement widgets—and discovered that fully half of the site’s traffic came from non-political stories. So in the spring of 2007, HuffPost launched new verticals for media, business, entertainment, and, reflecting Arianna’s mission to spread the virtues of health and spirituality, Living Now.

The 2008 presidential election was indeed a bonanza for politics sites, HuffPost especially. Four years after the re-election of George W. Bush, a Democrat would be elected president and Huffington Post had almost doubled Drudge’s traffic, eclipsing The Wall Street Journal and Los Angeles Times. By September 2008, the site had become the traffic leader among its competitors, with 4.5 million monthly unique visitors—an increase of 474 percent over the previous September.

A few weeks after the election, Huffington Post announced that it had secured another $25 million in funding, this time from Oak Investment Partners, whose president, Fredric Harman, joined the HuffPost board. That brought total investment to $37 million, which had analysts estimating HuffPost’s worth at over $100 million. The money, announced the company’s new ceo, Eric Hippeau, would go toward acquisitions and hiring. Within a year, the company added local verticals in several American cities, launched the 23/6 comedy site—with its 2 million monthly uniques—and, perhaps most significant, entered into a news-sharing partnership with Facebook, to be called HuffPost Social News.

Yet there was still enduring criticism of the way HuffPost went about its work, especially from those whose stories were aggregated on HuffPost; over time, those pieces appeared at ever greater length on the site, diminishing the likelihood that readers would follow a link back to the source. Google News was, in comparison, a generous aggregator; it was essentially a headline and first-graph operation. Archrival Drudge consisted entirely of links back to the source. HuffPost, on the other hand, was far greedier about holding onto its readers. While it never stopped supplying links, it made them just a little harder to find. It seemed the sharing was to be one-sided.

No wonder there was gloating in media accounts of the 2010 demise of HuffPost’s self-congratulatory, yearlong foray into investigative reporting—one that Arianna had proclaimed was launched to “save” that honored, expensive, journalistic form. The Investigative Fund’s executive editor, Larry Roberts, whom HuffPost had snagged from The Washington Post, left after less than a year, and HuffPost’s attempts to have the enterprise incorporated as a nonprofit ran into a legal thicket, given that HuffPost itself was a decidedly for-profit venture that, as Gawker took great pleasure in pointing out, was the chief beneficiary of the dispatches the unit produced. The Investigative Unit, along with its funding, ended up being absorbed by its partner, the Center for Public Integrity.

And yet, despite the occasional misstep, the story of Huffington Post began to assume a relentless familiarity: month after month, year after year, the metrics moved in only one enviable, and northerly, direction. More and more verticals appeared—Style, Technology, Green, Sports, College, Books. HuffPost readers, comScore reported in 2008, were younger than those of Politico and Drudge. And when, in the fall of 2009, HuffPost’s 10 million monthly unique visits hurtled it past The Washington Post’s traffic, Hippeau took note, in an interview with paidContent.com.

“We are now,” he said, “in the big leagues.”

Exclusive CJR interview: Arianna Huffington on what makes a good “gatherer.”

5. Voracious

A week shy of the first anniversary of their February 2011 union, Arianna Huffington and Tim Armstrong arrived at an already crowded television studio at AOL’s lower Manhattan offices for yet another display of their capacity to command attention.

The ostensible reason was the formal announcement of the latest in a series of ventures undertaken by the Huffington Post Media Group, now a property of Armstrong’s AOL: 12 hours a day, five days a week of live video streaming. The press corps nibbled on lamb crostini with rosemary aioli while several staff Huffington had poached from the Times joined her in working the room.

The gathering was called to order. Armstrong spoke first. He recalled the first time he had met Huffington, in November of 2010, and how that led, many months later, to halftime at the 2011 Super Bowl, when AOL announced that it had agreed to pay $315 million in what was widely regarded as a desperate move to salvage its declining fortunes by buying Huffington Post and handing control of its editorial operation to Huffington herself. “We believe that content is king,” he said. “We also believe that brand is king.”

With that he yielded the floor to Arianna Huffington.

Huffington Post, she said, had evolved from “a fast-moving train to a supersonic jet.” One hundred and seventy journalists had been hired since the purchase—even as AOL laid off close to 2,500 people and shut down its own journalistic ventures, among them Politics Daily.* Even now, she continued, 20 reporters and six editors were at work on what promised to be a 75-part series on the hard times facing the middle class, a potentially dispiriting portrait that would mercifully be offset by HuffPost’s “Good News” vertical—”Man recovers wallet after 35 years!”

The video rolled. An actor playing a host brought a reporter from the On Celebrity vertical into a discussion about divorce, while ads rolled across the bottom of the screen and make-believe viewers were invited to join in the discussion via Skype. “We’re not creating a new brand,” said Roy Sekoff, now the project’s director. “We’re just doing what Huffington Post already does.”

To underscore the point, Huffington offered an example: Imagine a host interviewing Beyoncé. An editor from the newsroom breaks in with word of Defense Secretary Leon Panetta announcing a timetable for withdrawal of American troops from Afghanistan. Perhaps, Huffington suggested, the host might want to ask Beyoncé her thoughts about this news.

“Everything in our universe,” she said, “will be featured here.”

Tim Armstrong looked on and smiled and let Huffington do the talking, which made good sense, given that this was now her show. And lest there be any confusion, four large photographs hung in the hallway just outside of the studio: Arianna with Suze Orman and Arianna with Jamie Oliver and Arianna with a group of happy young people and Arianna with Mark Ruffalo and, then, Tim Armstrong.

Armstrong had come to AOL in 2009 after making his name overseeing sales and advertising at Google. He was 43, tall and handsome, the sort of man whom central casting might send over if the part screamed: successful. But at AOL he had inherited a company that, to put it bluntly—and many did—had no discernible reason to exist. AOL had once dominated the online landscape. But that was in the late 1990s, light years away in digital time. Its original core business, dial-up Internet service, was evaporating, even as it moved to transform itself into a content business. Armstrong seemed just the man to accomplish a turnaround; he was also a major investor in Patch, a network of local-news websites that AOL bought after his arrival.

Still, the decline of AOL provided a harsh lesson about corporate lifespans in the digital world. Nineteen years after its IPO and 11 after its $350 billion market-value merger with Time Warner, AOL was losing 19,000 customers a week.

So eager was AOL to boost its content-driven traffic that in late 2010 it devised a strategy, The AOL Way. Management set markers: Monthly story production rate was to rise from 33,000 to 55,000, video from 4 percent of the content to 70 percent. All staffers were to write between five and 10 stories a day. To help them make those numbers, AOL produced a 60-page handbook filled with graphs, content flow charts, and such exhortations as “Each article should be profitable and generate at least 7k PVs/story.” Editors were to “Identify High-Demand Topics”; guidelines were provided to “breaking, seasonal, and evergreen.” Editors were commanded to calculate a story’s “profitability consideration.” “Site leaders” were expected to have on hand no less than eight packages that could produce $1 million in revenue. One employee anonymously told Business Insider, which broke the story, “AOL is the most fucked-up, bullshit company on earth.”

The AOL Way was, with apologies to Maimondes, “a guide for the perplexed.” The problem was that AOL was neither a legacy news organization, which produced content that people would, in fact, want to read and share, nor did it have the DNA of, say, a Huffington Post.

The Huffington Post, however, was said to be looking for a buyer.

When Armstrong met Arianna Huffington, Huffington would later say, they hit it off so famously that by the end of that first meeting, they were finishing each other’s sentences. Two months later, AOL announced the purchase, $295 million of it in cash. Notably absent from the agreement was a non-compete clause. Ken Lerer left and started his own venture capital firm, Lerer Ventures, which Eric Hippeau soon joined. Peretti left for BuzzFeed. Berry would leave several months later and take up residence across a spacious room from Lerer Ventures—one floor below the original Huffington Post newsroom. HuffPost resided in the sleek lower Broadway office of AOL. Of the three founders of the Huffington Post, only Arianna Huffington remained. In a sense, she was just getting started.

She had moved back to New York from Los Angeles in 2010, and had quickly established her presence in the newsroom, to the confusion and occasional chagrin of all those young people who had grown accustomed to a workplace with no discernible adults. HuffPost was by then making big-name hires—Howard Fineman came from Newsweek that September. Peter Goodman and Tim O’Brien were hired from the Times. The HuffPost Washington bureau, which had begun as a one-person operation and which had celebrated the first time President Obama called on Sam Stein at a press conference, had grown to 26 reporters who, in a city where power is defined by whether calls get returned, now fielded complaints from the offices of both Harry Reid and Mitch McConnell.

By 2012, Huffington Post had grown so big that its critics—and even some of its fans—were beginning to suggest that, if anything, it had gotten too big, bloated with so many stories in so many verticals that it was leaving itself vulnerable to such new and more nimble content dissemination ventures. Not incidentally, Jonah Peretti’s BuzzFeed claimed 25 million monthly unique visitors in January. HuffPost was also, arguably, encumbered by a parent company that, despite, a late 2011 uptick in advertising revenue—and the reward of a boost in its stock price—had still ended the year with a 3-percent drop in fourth-quarter revenue.

Yet one metric spoke louder than any other about just what it was that Tim Armstrong concluded he was getting when he bought HuffPost: comment. In February, Ryan Grim, the Washington bureau chief, reported on a Houston gathering at which several wealthy men gathered to pool $100 million to stop the president’s re-election. As good as the scoop was, the response was even more telling: 21,000 comments. It was not unusual for HuffPost stories to generate comment measured in five digits. If, as essayist Paul Ford wrote, the fundamental question animating the Web is “Why wasn’t I consulted?” then Huffington Post could be fairly credited with succeeding at making a great many people feel that, in fact, they were being consulted, and better still, that HuffPost was grateful for their thoughts.

A quarter million comments land in HuffPost’s assorted in-boxes every day. The initial sorting—weeding out spam and offensive “trolls”—is done technologically; in 2010, HuffPost bought Adaptive Semantics, which had created software for evaluating the “emotional” nature of content, the better to ferret out the most vituperative screeds. But once that screening is done, the work of deciding what to post is left, intentionally, to people who work at HuffPost, as well as to the site’s most frequent commenters. In 2010, HuffPost decided to reward its most engaged readers with three “badges” that signify the extent of that engagement: “networkers,” who draw fans and followers; “superusers,” who share often on Facebook and Twitter and who also comment frequently; and “moderators” who, in recognition of their keen eye and absorption of the site’s ethos, are trusted with deleting comments they judge inappropriate.

Taken together, the badgeholders serve as voluntary traffic wardens for what truly makes Huffington Post so valuable to a company like AOL: Not brand. Not content. But access to the HuffPost network. It is not just the visit and page-view numbers, because those metrics, envied as they are, inevitably include a vast number of fly-bys, one-time visitors, the long tail of the Bored At Work network. But comments suggest loyalty, and loyalty—or engagement, to use the buzzy ad-world term—means an audience that advertisers can, in the ephemeral world of the Web, come close to counting on.

HuffPost, in a sense, has recreated on a grand scale what might be called the Arianna Experience, one that she first learned at Cambridge and which, in the decades since, she has developed into a network of thousands of people of varying degrees of familiarity who are nonetheless connected by virtue of their connection to Arianna. She herself can be somewhat disingenuous about this talent—her mentor as a “gatherer,” she likes to say, was her late mother, who would invite all sorts of people to sit at her table, and who always made sure they were fed. When she reminisces about the Cambridge Union, it is not merely the conversation Arianna speaks of, but rather the experience of a young woman with a Greek accent making a name for herself in that most hidebound British institution by cultivating the power of her words. With words came friends, and with friends came an ever-wider circle of acquaintances, and it did not much matter what they thought or where they lived, because Arianna was not one to “cluster” her associations. Everyone was potentially welcome because—who knew?—some day, they might be worth calling. When Howard Fineman first met her in 1995, she was married to Michael Huffington and hosting salons in their Washington home, where she gathered such one-time kindred spirits as William Bennett, the conservative author and critic, to talk about non-governmental answers to social issues. She and Fineman did not lose touch. He is now HuffPost’s editorial director.

“I’ve never had a bad gathering,” she says. “Some of them may have been more boring, less fascinating. But not bad.” When she is invited to speak in public, she asks that the house lights be turned up so that she can see the faces in the audience. “If you speak, you know when you have the audience, and you know when you lose them,” she says. “I want to see peoples’ eyes. I want to connect to them. I want to speak to what I sense they want to hear next.”

Tim Armstrong paid a good deal of money in the hope that HuffPost’s network might become his, too. And if that is to happen, his fortunes lie, in large measure, with people like Justin Isaf and Travis Donovan who (with apologies to all those who spend their days producing journalism for HuffPost) are part of the larger army of young men and women charged with the work that is at the core of the enterprise: cultivating, feeding, tending, and stroking the network.

“People will do anything for recognition,” says Isaf, who is 28 and a community manager. “When [we] say you’re good enough to be recognized by the whole world, that goes a long way. They become loyal to your brand.”

Donovan, 25, a senior verticals editor whose arms are ornately tattooed, was a social worker before coming to HuffPost, working to integrate a group home of disabled adults into their community. “It’s the exact same thing on social,” he says. “We want to change the landscape of media. News is inherently supposed to be social. It’s supposed to be something you want to talk with your friends about.”

“Once [we] get into someone’s network, we spread within that group,” says Isaf. “They share it. And we spread within it.”

“It’s not that we want to be the cool dinner party,” Donovan adds. “We want to be the table itself.”

An intriguing aspiration, not only for Huffington Post but for every enterprise, existing or still being imagined, that sees in the story of HuffPost’s rise a series of replicable steps that assure success. This sort of thinking troubles Duncan Watts. In the end, some things just happen. There is a confluence of events that could not be envisioned, that came together in precisely the right way and at the right time and which, in hindsight, could not have been predicted. “I know that they didn’t know they were going to succeed,” Watts says of the HuffPost founders. It was not just their complementary skills and temperaments. It was also the moment—the blogging phenomenon, the bitterness of the left after 2004, the coming of Web 2.0 and the excitement of the 2008 election, the rise of the Bored at Work Network, the evolving ease of technology—all of it, all at once. The rhythmic clapping in the sixth inning that, as Watts would put it, cannot necessarily be replicated in the seventh.

“The larger point of this is that we think deterministically,” he says. “If you think about the major religions, they’re deterministic—creator, plan, faith, destiny, causality. Journalists are prone to this. They tell stories. And stories are confining. There is a tendency to kind of tell a story that makes it seem as if everything had to happen the way it did.”

The Huffington Post was supposed to be the left’s answer to Drudge. At least that is how the story was framed. HuffPost borrowed from Drudge. And from the bloggers. And from Blackpeopleloveus.com and the Contagious Media Lab and Stop the NRA and Ariannaonline. Then it set about doing what comes so naturally in the digital world, and which the legacy journalistic world still struggles to master: It iterated. It did not try to eliminate the possibility of failure. It did something different. It embraced it.

* The original version of this piece reported that AOL’s Daily Finance was shut down, along with Politics Daily, after AOL and Huffington Post merged. But Daily Finance was not shuttered, and we regret the error.

Michael Shapiro , founder of The Big Roundtable, is the author of six previous nonfiction books. His work has appeared in such publications as The New Yorker, The New York Times Magazine, Esquire, GQ, and Columbia Journalism Review. He is a professor at Columbia Journalism School.