The New York Times has the story of the week, a superb investigation into why there haven’t been prosecutions on Wall Street. They find a clear pattern of government protecting financial interests over bringing people to justice.

Gretchen Morgenson and Louise Story get several big scoops here, all of which are eye-opening on why there has been no push to hold Wall Street accountable. Let’s take them one by one:

— Tim Geithner, emblem of financial capture, went to then-New York Attorney General Andrew Cuomo in October 2008 and told him, in so many words, to lay off:

According to three people briefed at the time about the meeting, Mr. Geithner expressed concern about the fragility of the financial system.

His worry, according to these people, sprang from a desire to calm markets, a goal that could be complicated by a hard-charging attorney general.

— Phil Angelides and the Financial Crisis Inquiry Commission reined in staffers who wanted to focus directly on Angelo Mozilo and Countrywide:

However, the two (staff members wanting to focus on Countrywide) soon received a startling message: Countrywide was off limits. In a staff meeting, deputies to Phil Angelides, the commission’s chairman, said he had told them Countrywide should not be a target or featured at any hearing, said Mr. Krebs, who said he was briefed on that meeting by Mr. Bondi and Mr. Biegelman shortly after it occurred. His account has been confirmed by two other people with direct knowledge of the situation.

— Bush’s Justice Department prevented the FBI from reallocating resources to focus on financial fraud:

The study identified about two dozen regions where mortgage fraud was believed rampant, and the bureau’s criminal division created a plan to investigate major banks and lenders. Robert S. Mueller III, the director of the F.B.I., approved the plan, which was described in a memo sent in spring 2008 to the bureau’s field offices…

Days after the memo was sent, however, prosecutors at some Justice Department offices began to complain that shifting agents to mortgage cases would hurt other investigations, he recalled. “We got told by the D.O.J. not to shift those resources,” he said. About a week later, he said, he was told to send another memo undoing many of the changes. Some of the extra agents were not deployed.

— Former Attorney General Michael Mukasey has a discrepancy in his testimony to the FCIC:

Michael B. Mukasey, a former federal judge in New York who had been the head of the Justice Department less than a year when Bear Stearns fell, discussed the matter with deputies, three people briefed on the talks said. He decided against a task force and announced his decision in June 2008.

Last year, officials of the Financial Crisis Inquiry Commission interviewed Mr. Mukasey. Asked if he was aware of requests for more resources to be dedicated to mortgage fraud, Mr. Mukasey said he did not recall internal requests.

— The Federal Reserve asked the SEC to go easy on banks that had screwed their clients by sticking them in auction-rate securities.

— The SEC enacted a policy of not heavily fining bailed-out banks—one that not only let them off the hook but slowed down other investigations:

Any one of these, as far as I can tell, is a major story in its own right, and I’d like to see each of them followed and, hopefully, advanced by the rest of the press. Combined, they add up to a damning picture of a government that’s more concerned about financial interests than justice or that has just looked the other way.

And there are lots of other goodies here, like a consumer advocate recalling how former OTS chief John Reich told him Mozilo was his good pal.

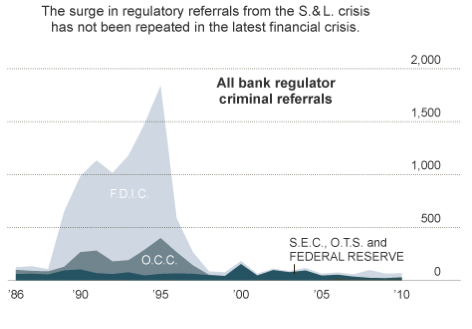

This data is incredible:

The university’s ’Transactional Records Access Clearinghouse indicates that in 1995, bank regulators referred 1,837 cases to the Justice Department. In 2006, that number had fallen to 75. In the four subsequent years, a period encompassing the worst of the crisis, an average of only 72 a year have been referred for criminal prosecution.

While that big number in 1995 was due to the S&L crisis, it’s awfully revealing to see barely a blip from 2007 to 2010.

The Times is also excellent to point out things the Justice Department could prosecute if it wanted to:

Merrill Lynch, for example, understated its risky mortgage holdings by hundreds of billions of dollars. And public comments made by Angelo R. Mozilo, the chief executive of Countrywide Financial, praising his mortgage company’s practices were at odds with derisive statements he made privately in e-mails as he sold shares; the stock subsequently fell sharply as the company’s losses became known.

Executives at Lehman Brothers assured investors in the summer of 2008 that the company’s financial position was sound, even though they appeared to have counted as assets certain holdings pledged by Lehman to other companies, according to a person briefed on that case. At Bear Stearns, the first major Wall Street player to collapse, a private litigant says evidence shows that the firm’s executives may have pocketed revenues that should have gone to investors to offset losses when complex mortgage securities soured.

Add Ameriquest to this list (this is where you really should read Michael Hudson’s excellent book The Monster: How a Gang of Predatory Lenders and Wall Street Bankers Fleeced America–and Spawned a Global Crisis)

I thought I’d gotten jaded the last few years. Not jaded enough, apparently.

Fantastic work by Morgenson, Story, and the Times.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.