It’s The New York Times turn to do a nice story on “overdraft protection” practices.

The Journal had one yesterday and the Washington Post did this weekend. Today, Felix Salmon of Reuters picks up the ball and advances it, too.

First, the Times piece. Eric Dash has a snappy take on the issue, rounding up lots of good points and making it clear he’s on your side (emphasis mine):

Even now, after all those bailouts, banks never seem to tire of dipping a little deeper into your wallet. Despite the tough economic times and increased scrutiny from Washington, they are keeping most fees at record highs, and are eking out slight increases on others like overdraft charges — a step they rarely took during past recessions.

I submit that one way to turn around circulation numbers is to report and write more like this. Some might say that’s taking sides, but it’s no journalistic sin to empathize with the public. I’ll bet the antipathy to this gouging is almost unanimous among those who aren’t bank executives (think 99.9 percent of us). Why should the paper’s prose be clinical and detached when writing about something that’s clearly a ripoff? I think readers would love to know their paper is fighting for them. Too often they don’t. Papers make you read between the lines to appreciate what they do.

Digression aside, the Times has some very interesting stuff here. The argument for allowing banks like Citigroup and Bank of America to get so inordinately huge is that they become more “efficient,” lowering costs for consumers. Tell that to their customers getting slapped with overdrafts (emphasis mine):

The nation’s biggest banks — those that received the biggest bailouts from taxpayers, and are once again gaining strength — charge fees that are on average at least 20 percent higher than those at smaller lenders, according to Moebs Services, a economic research firm used by banks and federal regulators.

So your neighborhood bank, which presumably has a higher percentage cost of overhead than GinormaBankCorp, is somehow able to charge a fifth less than said behemoth. Hmm.

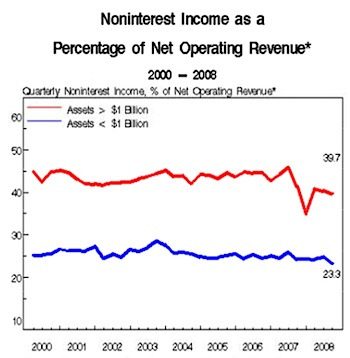

Salmon’s on this, too, finding a report by bank consultant Michael Flores that shows just how much more big banks depend on overdraft charges and the like:

It’s the biggest banks who are the worst offenders here, making much more money off noninterest income (ie fees) than their smaller counterparts.

Here’s his chart:

It gets worse. Salmon quotes Flores:

Active households (defined as the 20.2 million households with bank or credit union accounts who write the majority of NSF items) pay $1,374 in annual NSF fees.

I’m skeptical of that $1,374 number (can it really be that high?) but if it’s even half that, it’s an outrage. As Salmon says:

This is a tax on poverty, it’s substantial, and it ought to be stopped: the 20% of bank customers who pay 80% of the overdraft fees are the banks’ poorest customers.

This is certainly right. And it’s good to reframe these fees for what they really are: exponentially high-interest loans.

Think about it. If you accidentally overdraw your account, Bank of America, say, covers the excess amount of the purchase and charges you $35 for the privilege. They never asked if you wanted them to do that. And as we saw yesterday, some banks make it difficult or impossible to turn off “overdraft protection,” a term that I said ought to be in scare quotes every time it’s used in a news story. It’s Orwellian. This “service” allows overdrafts (most occur via cards these days), it doesn’t protect you from them.

Salmon reports that the median overdraft is $36. If you waited a year to pay that $35 fee, it would basically be a 100% interest loan. Of course, a bank would shut your account down by then. I’d guess most are paid within two weeks, when the next paycheck is deposited. A report (PDF) by East Carolina University professor Mark A. Fusaro put the median annual interest rate paid on overdrafts at 4,547 percent.

While you might dismiss overdrafts as a simple personal-responsibility issue, Fusaro found that 57 percent of account holders in its sample had overdrawn at some point, meaning that most of us are irresponsible.

Salmon calls this a “poverty issue,” which is red meat for a certain kind of commenter (bring it on!). But he’s certainly right. Fusaro found that 20 percent of account holders used overdraft protection for personal loans. Well-off folks aren’t doing that. Basically, these are payday loans that make that loathsome industry’s interest rates look tiny.

Let’s not forget about credit cards. When my wife and I got married, I put her on my bank accounts. She accidentally used my Bank of America credit card instead of my BofA check card and racked up $33 overdraft fees. Now, fine, it’s our mistake and we’re in a better position to take those hits than many. I’ll take my lumps. But I’m old enough to remember when credit cards got refused when you reached your credit limit. Any wonder why they don’t now?

That’s a key answer to this big problem. The default setting on all accounts, including credit cards, ought to be to decline overdrafts (this wouldn’t affect bad checks, of course, which are more problematic). Consumers should have to consciously opt in to “overdraft protection.” That’s fair, right? Defining and regulating “overdraft protection” as “loans” ought to help, too.

Don’t think the banks will go along without a massive fight. This is a $38 billion a year business that’s almost pure profit.

The new press attention to this practice is a welcome development indeed. Keep it up.

UPDATE:

After posting this, I saw the prolific Salmon had added some excellent thoughts on the subject, dropping a little behavioral economics on the laissez-faire crowd. Here’s a taste:

…I wrote that the banks “should be stopped”. In response, Fernando says that “we need to keep holding people responsible” and that “some people just need to manage themselves better”. But here’s the difference: stopping banks is, conceptually, possible. But the $38 billion in annual overdraft fees are clear proof that Fernando’s “people” just aren’t going to magically start managing their finances in an optimal manner.

Empirically speaking, it’s clear that the 20% of checking account holders who pay, on average, $1,374 in annual overdraft fees apiece are precisely the people least able to afford them. They’re probably also the 20% of people who, for whatever reason, find it very difficult to manage their personal finances. Not everybody is as numerate and sophisticated as Vincent Fernando — a lot of people can’t even manage simple addition and subtraction. Is it fair for the highly-sophisticated and numerate executives at international banking giants like Bank of America to take advantage of that financial illiteracy in order to line their own pockets with multi-million-dollar paychecks? Or should people be able to trust their banks implicitly?

Can’t put it any better than that. Go read the whole thing.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.