The New York Times posted a truly awful story online yesterday headlined “Argentina’s Default Offers a Cautionary Tale for Greece.”

It does, if the cautionary tale is: What are the heck are you waiting for? Are you going to kill your economy and your own citizens so global investors don’t have to take a haircut when you could default like Argentina and start growing again?

Let me outsource the criticism of the New York Times article to… The New York Times:

OK, I guess I don’t quite see how Argentina’s default, of all examples, can be viewed as a cautionary tale for Greece:

That’s Paul Krugman, of course, politely swatting down his colleagues on the news side. I’ll note that the news side must have noted Krugman’s 1:20 p.m. comment because the headline was changed not long after on the Web and by the time it landed in today’s print edition, the emphasis had been totally changed:

A Tale of Default, 10 Years Later.

In Argentina, Strong Growth But Little Access To Credit.

That doesn’t cut it—at all. The big problem with this story is that it’s written from an almost purely financial point of view, rather than a public-interest point of view, and so it gets the whole thing ass backwards. It treats borrowing as an end in itself, rather than as a means to an end, which is economic recovery.

The fact that Argentina’s economy has grown about three times as fast as our own since it defaulted is buried down in the eleventh paragraph as a sort of caveat to the story’s doom-and-gloom warnings of the perils of a default. The Times doesn’t return to anything about how Argentina’s economy has gone gangbusters since defaulting until the 31st paragraph:

And yet — buoyed by its ability to devalue its currency back during the crisis — Argentina’s economy is growing.

Miguel Faraoni, who heads Faraoni y Lo Menzo, a toymaker here, said he could not compete in the 1990s, when Argentine toy production fell to a flood of Chinese products. He considered bankruptcy around 2001 when he was employing only six workers, down from 30 in 1990.

Today he has 40 workers, and Argentina’s toy industry has a 40 percent share of domestic sales, up from 10 percent in 2001. “We are working 24 hours a day to meet domestic demand,” Mr. Faraoni said.

Hey, guys: That’s your lede. An editor really should have caught this.

And this is a true WTF moment:

Greece, with few agricultural exports, cannot expect a similar windfall. But economists say it can benefit from Argentina’s example on debt restructuring — mainly by seeking to avoid repeating it.

First of all, “economists say” is vague enough to be meaningless. More problematically, it’s also vague enough to be false, implying as it does that all or most economists think Greece should avoid restructuring its debt. This is wrong in a couple of ways: Lots of economists think it’s a much better idea for Greece to give haircuts to its lenders rather than kill its economy by imposing austerity and paying them in full. But also, find me an economist who thinks that Greece won’t default on its debt—and soon—and I’ll show you an incompetent and/or captured economist.

Compounding the problem, the Times doesn’t give us any reason why its “economists” think Greece should avoid restructuring its debt. Here are the paragraphs immeditately following that assertion:

The Argentine government waited until 2005, when its economy was already in recovery, to conduct the first of two debt restructurings. Nongovernment foreign investors — the biggest included pension funds from Italy, Japan and the United States — took haircuts costing them two-thirds of their investments.

Notably, the one creditor that was paid back in full — in 2006 — was the International Monetary Fund, to which Argentina owed $9.8 billion dating to the 1990s.

A lesson for Greece is “whereas the commercial creditors are expected to take a haircut, the official creditors like the I.M.F. are not willing to,” said Robert S. Koenigsberger, chief investment officer with Gramercy, an emerging markets investment manager.

This is the Times saying that Greece shouldn’t default because that would mean foreigners and overseas banks would lose a good chunk of their investments. Well, no kiddin’! That’s the whole point. Scott Talbott might get red in the face making that argument.

But the bafflement continues here. The gist of the Times‘s piece is that Greece shouldn’t default because then it won’t be able to borrow more money.

For one thing, a decade later, Argentina has still not been able to re-enter the global credit market.

“A default is not free,” said Jaime Abut, a business consultant in Rosario, a city north of Buenos Aires. “You have to pay the consequences, and for a long time. Argentina is no longer considered a serious country.”

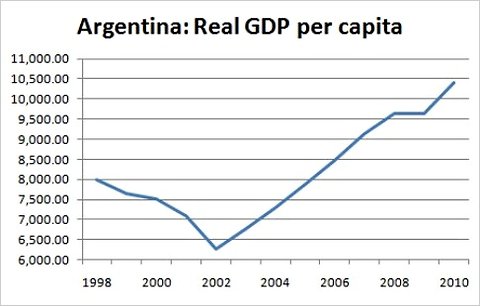

Krugman nails that quote there, asking “shouldn’t that be a Serious country?” Indeed. But why does the Times think Argentina needs to be back in the global credit market? It’s grown at 8 percent a year for eight years without being in the global credit market!

Of course, Greece is a different country than Argentina. It has different circumstances, including membership in the euro, which it would have to quit in order to do the devaluation it needs to recover (it also has a vastly higher debt-to-GDP ratio). But the Times does a remarkably poor job here of showing how the lessons of Argentina’s default might apply to Greece.

From what I can tell the main one is: Go for it.

And while this is an unfortunately sharp departure from the Times‘s normal standards, it’s nice to see that Krugman feels free to take on his own paper. I understand Krugman is untouchable, but it’s still a healthy thing.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.