“Austerians” has started popping up all over, and Barry Ritholtz does a nice job of tracking the origin of the word. As he succinctly explains:

A play on the fiscal reserve of the “Austrian” school of economic thought (Friedrich Hayek or Ludwig von Mises) the phrase Austerians referred to the desire to slash government spending and cut deficits during a time of economic weakness or recession.

Like it or not, it’s a word we need these days.

While Mark Thoma got some credit for coining the term way back in mid-June, Ritholtz traces its use back even further. He says it started with Rob Parenteau, of The Richebacher Letter.

Like Ritholtz said, etymological mystery solved.

–The G-20 summit in Toronto got a lot of coverage from the business press. But amid all the reports of divergent views and eventual compromise, my former colleagues Alan Beattie and Chris Giles at the FT made a good point about what it all means:

What this discordance marked, veterans of the process said, was a weakening of the G20 as a forum that bound its members. Dan Price, partner for global issues at Sidley Austin, a law firm, and G20 representative when George W. Bush was US president, said: “As recovery takes hold at different rates around the world and as domestic political pressures figure more prominently than the threat of a global meltdown, one can expect these declarations to become increasingly general to accommodate the concerns of different countries.”

That’s useful context that helps readers make sense of the weekend meeting.

–The Money Game reports that Paul Krugman is in Europe, talking about the connection between inequality and financial crises. It’s got the slides that go with Krugman’s talk:

His basic thesis: it’s not an accident that the two “big ones” in American history have both occurred just as inequality reached extreme peaks. The two are inextricably linked, as the conditions that prompt extreme inequality prompt those at the lower end to max out on debt and spending to compensate.

With that in mind, check out this analysis from the numbers gurus at the Center on Budget and Policy Priorities:

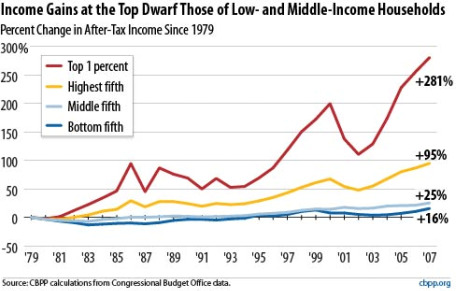

After-tax incomes nearly quadrupled for the top 1 percent of Americans in the last three decades, while barely rising among middle- and lower-income households, according to new data from the Congressional Budget Office.

This chart tells quite a tale:

As the center points out, the new CBO data only go through 2007, so they don’t reflect the recession and the stock market plunge. “These events may have reduced inequality somewhat by shrinking incomes the most at the top, as the bursting of the dot.com bubble did a decade ago. But as the chart shows, that turned out to be just a speed bump for the top 1 percent, whose after-tax incomes soon resumed their climb.”

There’s more analysis of those CBO numbers here, including this: “Taken together with prior research, the new data suggest greater income concentration at the top of the income scale than at any time since 1928.”

Interesting? Yes. Getting enough attention from the press? No.

Holly Yeager is CJR’s Peterson Fellow, covering fiscal and economic policy. She is based in Washington and reachable at holly.yeager@gmail.com.