The Audit sometimes gets interesting mail from readers, and from time to time we’ll be posting some of it in an Audit Mailbag.

A “Debits and Credits” item critiquing a Wall Street Journal story on borrowers in foreclosure vandalizing homes drew sharp and mixed response.

Our piece took issue, among other things, with the newspaper’s reliance on a public-relations firm’s survey to support an assertion that a large number of foreclosures involved borrowers doing substantial damage to their homes. We compared the Journal‘s piece unfavorably with a New York Times story that documented the rise of a foreclosures industry and evidence of abuses in the bankruptcy system. We said the Times, in relying on an academic study to support some of its findings, was on firmer footing than was the Journal with its public-relations survey.

An editor from Michigan disagreed:

Even if the WSJ article is “flimsy” as you say, you would have been better off trying to determine what is meant by “damaged.” You cite some egregious examples, but many responding to the survey might have cited simple things as broken light fixtures, knobs off doors, doors off hinges, etc., as their damage. These are things that people live with all the time, but to repair them for a sale does cost a “substantial” amount of money.

You do the same thing in this article that you are accusing the WSJ of doing, which is criticizing without looking at any background, or providing readers with any facts at all. You assume that because this survey has corporate clients, it is corrupt, or that the info is automatically tainted. Certainly, the WSJ should have pointed this out, but what are the “questionable fees” applied to accounts in the Times story? Who says they are questionable? A college professor?

Finally, somehow you make this tragedy out to have sides, the “borrowers’ side”, the “lenders’ side.” This isn’t about journalists taking sides.

If we all are doing responsible journalism, we will point out all the problems, from the greedy lenders to the irresponsible people who knew they couldn’t afford the house they were buying, to the regulators allowing $0-down homes with adjustable rate mortgages, to evicted people who do do damage to property.

While we’re at it, we should look into the securitization of real estate mortgages—which, by the way, isn’t going away—and fix the risk problem there. We should look at the people who kept draining their equity with refinance after refinance, taking the money out for vacations, cars, to pay down other debt, without regard to where the market was heading.

In every big and small town in America, there are all these stories. Let’s cut out the class-warfare rhetoric and just provide good journalism.

Ralph E. Wirtz

Managing Editor,

Midland Daily News

Midland, Michigan

Ryan Chittum, who writes “Opening Bell,” our weekday-morning roundup of the business press, heard from a reader who says the Journal, in a story about home prices luring buyers back into the market, misused a housing stat. We’ll have a few things to say about that.

Hey Ryan,

There was an even bigger snafu with the WSJ and National Association of Realtors piece today on page one.

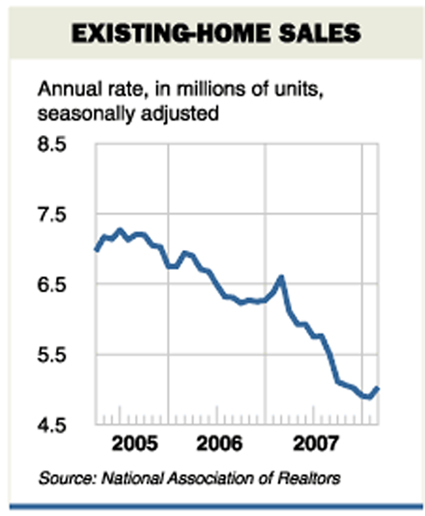

“On Monday, new data suggested that pressures like these are starting to drive prices low enough to attract some buyers back into the market. Sales of previously occupied homes jumped 2.9 percent in February from the month before, the National Association of Realtors said, the first increase since July.”

There are a couple of problems with that statement:

1) The year-over-year data for February 2008 existing home sales were down 23.8 percent from February 2007 levels. That data point never found its way into this article at all. I cannot recall a more blatant misreporting of fact in a front-page WSJ article, ever.

2) I noted that was not what the data stated at all: “Changes from January to February are measuring seasonal differences, not actual improvements in house sales.”

Imagine what it would be like if you reported retail sales from December to January this way: Headlines would misleadingly state: “Retail sales plummet 65%!” That is why with highly seasonal data series, the preferred methodology is to report year-over-year data—not month-to-month variations.

Have a look at what the existing home sales, non-seasonally adjusted, look like.

Every February for the past 4 years has seen a sizable increase over January.

The NAR is notorious for spinning their data. I am sorry to inform the WSJ that their reporters got snookered.

All told, this one aspect of an otherwise fine article was not up to the WSJ‘s usual standards.

Barry Ritholtz,

CEO; Director of Equity Research,

Fusion IQ

The Big Picture

New York, New York

An author of the story, James R. Hagerty, didn’t have a comment. To us, though, the reader’s judgment seems useful but a little harsh. In fact, the NAR does seasonally adjust its numbers. Plus a Journal sidebar and chart did include the year-to-year change.

NAR stats are generally accepted, for better or worse, as is the trade group’s method of adjusting them.

But, yes, it probably would have been good to include the long view in the main story.

The reader asserts that the January-to-February bump happens every February and is therefore meaningless. The Journal found the stat meaningful, a judgment that seems within its editorial perogative. After all, the February bump happened.

And here is some fan mail for Ryan:

Ryan,

Thanks for the sharp, tight roundup this morning on the headlines about the economy.

I’m writing a story about inflation here in the heartland, where there is still some doubt about how bad it is.

You help me do my job better.

Jere Downs

staff writer, Business

Louisville Courier-Journal

Louisville, Kentucky

Elinore Longobardi’s piece on the demise of the local business section drew a lot of mail, including this:

Dean Starkman Dean Starkman runs The Audit, CJR’s business section, and is the author of The Watchdog That Didn’t Bark: The Financial Crisis and the Disappearance of Investigative Journalism (Columbia University Press, January 2014). Follow Dean on Twitter: @deanstarkman.We just published our last Sunday Business section and we’ve folded our stand-alone weekly Business section inside Local two days a week. Who knows what’s next? So far we haven’t lost any jobs—though open positions aren’t being filled

Needless to say, this CJR story made the rounds fast here.

Linda Rawls

staff writer, Business

The Palm Beach Post

West Palm Beach, Florida