Michael Hiltzik of the Los Angeles Times has a must-read column about agnotology, the study of the “cultural production of ignorance,” which is one of the biggest (non-journalism business) problems facing journalists today:

But then there’s ignorance custom-designed to manipulate the public. “The myth of the ‘information society’ is that we’re drowning in knowledge,” he says. “But it’s easier to propagate ignorance.”

That’s especially so when issues are so complicated that it’s easier to present them as the topics for discussion in which both sides are granted equal time.

Big Tobacco’s public relations campaign against the anti-smoking movement, for example, was aimed at “manufacturing a ‘debate,’ convincing the mass media that responsible journalists had an obligation to present ‘both sides’ of it,” reported Naomi Oreskes and Erik Conway in their 2010 book, “Merchants of Doubt.”

The industry correctly perceived that no journalist would ever get fired for giving the two sides equal weight, even when that balance wasn’t warranted by the facts.

It’s he-said-she said arbitrage, though the obfuscators can largely go around the press now.

— Audit Chief Dean Starkman takes to The New Republic for a long piece on why “No, Americans Are Not All To Blame for the Financial Crisis.”

Here’s a snippet:

Lately, a flying squadron of scholars and lawyers, taking up where journalism left off, has dug further into federal housing data to uncover new mind-melting patterns. One of them, Jacob Faber, a Ph.D. candidate at New York University, last year came up with what may be the second-most astonishing fact about the crisis era: In 2006, the year of the locust, some households earning more than $200,000 annually were more likely to be put in subprime than others earning just $32,000. For those unlucky borrowers, income–the best measure of ability to repay–was not the variable that determined the quality of the loan they received.

Short version: That’s not how a fair market works. But it’s what happened. And the real reason those $200,000-plus borrowers found themselves in subprime leads us to the darkest origins of the lending practices that wrecked the economy–as well as of the troubling way we’ve misallocated accountability…

Let’s return to Jacob Faber and his finding about those high-earning families finding themselves with subprime loans. Of course it was African American households earning more than $200,000 who were more likely to wind up in subprime than white households earning $32,000. Go ahead and roll that around for a minute.

For more on this, read Dean’s new book (particularly chapters 6 through 9), The Watchdog That Didn’t Bark: The Financial Crisis and the Disappearance of Investigative Journalism.

— Advertising Age reports that The Wall Street Journal has launched its first native ads despite Editor Gerard Baker’s contention last year that they were a “Faustian bargain.”

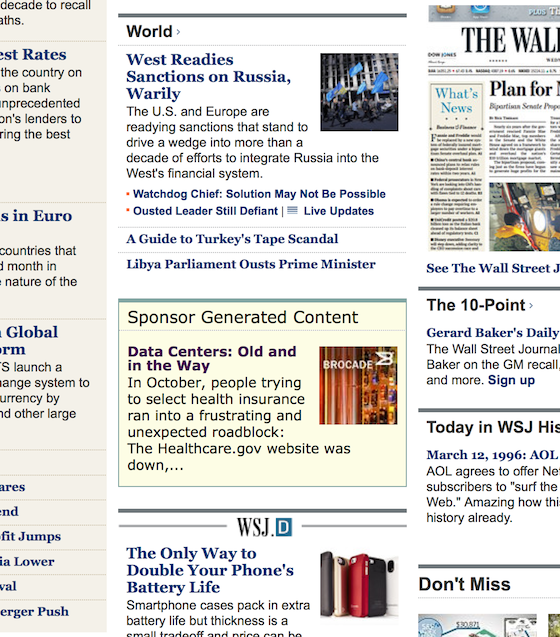

Here’s what it looks like below the fold on the WSJ.com home page:

And here’s what the ad itself looks like:

Ad Age:

Mr. Baker was in Asia last week and unavailable for an interview. In a statement, he stressed that the native ads were clearly and thoroughly labeled. “I am confident that our readers will appreciate what is sponsor-generated content and what is content from our global news staff,” he said.

Trevor Fellows, head of global media sales at The Wall Street Journal, said actually blurring ad-edit lines would be “absolutely a Faustian bargain” but that readers won’t be confused in this case.

I agree. The Journal, like the Times has done native ads the right way. There’s no confusing this and the paper’s own copy.

Again, though, that raises the existential question about native ads: If you make the ads look too native, it’s deceptive. If you ake it look too non-native, nobody will want to read it.

Unless you somehow just can’t resist a headline like “Data Centers: Old and in the Way.”

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.