Sure enough, the Justice Department charged former Credit Suisse CDO executive Kareem Serageldin with fraud for allegedly artificially inflating CDO values. Two of his underlings pleaded guilty and say Serageldin orchestrated the scheme.

The NYT:

The government’s case against the former Credit Suisse traders depicts a brazen scheme to artificially increase the price of bonds on their books to create fictitious profits just as the housing market was seizing up.

In one instance, the team, facing an inquiry from Credit Suisse’s internal controls group in August 2007, tried to justify their mortgage bond portfolio’s inflated value by seeking “independent” marks from other banks’ trading desks, according to the government.

After learning that the marks at Deutsche Bank and Barclays Capital were substantially lower than their own marks, they looked elsewhere.

Mr. Siddiqui, the junior trader, subsequently secured sham “independent” marks from a friend who worked at a small investment bank.

— Bloomberg News’s Carol Hymowitz makes a good catch, noting that while 58 percent of Facebook’s users are women, 0 percent of its board members are:

The disconnect puts the social-media company at odds with others in the industry that have at least one female director, including LinkedIn Corp. and Google Inc., and from most big public companies in the U.S. Just 11.3 percent of the Fortune 500 had male-only boards last year, according to Catalyst, a New York-based nonprofit that researches women and business issues.

There’s usually ten or twelve people on a board, and we’ve still got fifty-six major companies that can’t find a single spot for a woman, much less multiple spots?

A Catalyst survey of Fortune 500 companies found that those with three or more female directors outperformed those with fewer between 2005 and 2009, achieving on average 43 percent better return on equity. As Facebook prepares to raise $5 billion in an initial public offering, the composition of its board shows its business strategy is faulty, said Susan Stautberg, co-founder of New York-based Women Corporate Directors, which promotes female board membership.

“It doesn’t make sense for a company that claims to be so forward looking to not have any women directors,” she said. “If they just have an old boy’s network in the boardroom, they won’t have access to diverse ideas and strategies.”

Facebook, at least, does have a woman in a prominent executive position: COO Sheryl Sandberg.

Meantime, this Bloomberg headline oversells the story on how much Facebook CEO Mark Zuckerberg will be worth once company goes public:

Zuckerberg Tops Google Founders With $28.4 Billion Facebook Haul

He hasn’t gotten the haul yet, and that’s the high end of the IPO range, as Bloomberg points out in the lede. At the low end, his haul would be $21.3 billion (on paper). The headline implies the valuation is already set. It’s not.

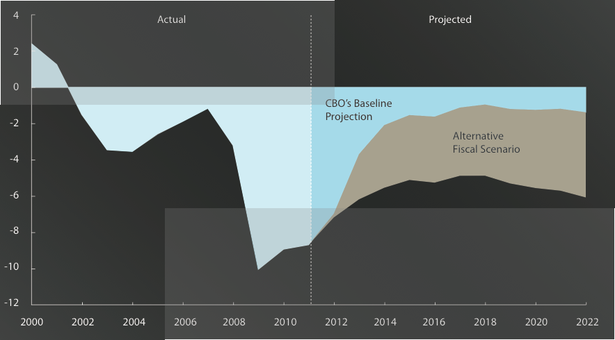

— The Atlantic‘s Derek Thompson cobbles together the most important charts from a new Congressional Budget Office report on the economic outlook for the next decade.

This one shows what would happened if Congress followed current law:

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.The CBO’s “baseline projection” sounds like a sober prediction. It’s not. It’s a fantasy. For example, the baseline projects that the Bush tax cuts are will expire next year (not!). For a dose of reality, the CBO also calculates spending and taxing under an “alternative scenario.” This is the scenario to pay attention to. It anticipates that Congress will delay both tax increases and spending cuts currently scheduled in the law — a very reasonable assumption.

What if Congress sat on its hands and let current law rule? The deficit would fall by 60 percent to $500 billion in 2013, and it would stabilize by the middle of the decade. But nobody wants that to happen. Conservatives don’t want to raise taxes, and liberals don’t want to soak up stimulus by $500 billion in one year. So we’ll keep having high deficits through the decade.