Felix Salmon reports on an awful new fee Citigroup has cooked up to milk its customers.

The bank will charge you $414 in the first year and $39 a year thereafter to withdraw money from your account biweekly to pay your mortgage, which helps you pay down your note with an extra payment a year. Only, as Felix points out, CitiMortgage will only pay it down once a month, so it’s essentially charging you to borrow your money interest-free:

Which means that for roughly half the year, Citibank is sitting on an amount of money equal to half your mortgage payment. That money has left your account: it’s not yours any more, and Citi can do with it as it pleases. And Citi gets the float from all that money until it gets around to sending it off to pay off the mortgage.

Basically, Citi is getting a big advantage from you making half your mortgage payment two weeks early — and then it has the chutzpah to charge you hundreds of dollars for the privilege. They even charge you $1.50 per extra transaction, as though that costs them any money at all. (It doesn’t.)

I’d like to think almost nobody will get suckered into signing up for this thing, but I’m sure they will.

— We were all waiting for Bloomberg View to weigh in with a voice-of-God editorial on Obama’s appointments to the Consumer Financial Protection Bureau and the National Labor Relations Board.

The president, for once, moved aggressively and Bloomberg is unhappy with that because it’s partisan or something. It thinks that this will make Republicans so unhappy that it will hurt “government function.” Guess what it thinks should happen:

Instead of playing gotcha, setting back progress on Dodd- Frank regulations and possibly upsetting the system of checks and balances, Obama and Republican leaders should agree on a set of recess appointment rules. Here’s one idea to get the ball rolling: In exchange for confirming Cordray, Obama and Senate Democrats would open talks on making the consumer bureau subject to the congressional appropriations process. That way, Obama could have his chief consumer watchdog, and Congress could make sure its role is not being usurped.

Keep dreaming, Bloomberg.

— The Washington Post‘s Ezra Klein asked people for their favorite charts of the year.

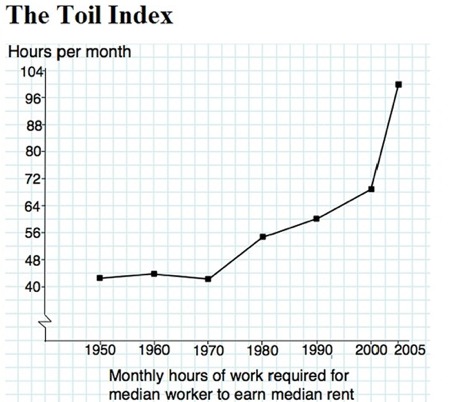

The one that caught my eye is by the economist Robert Frank, who whipped up what he calls the Toil Index to show how many hours the median family must work to pay median rent near an average school, and how sharply that has increased over the last few decades:

He explained it in The New York Times:

From 1950 to 1970, when incomes were growing at about the same rate for families up and down the income ladder, the toil index actually declined slightly. But since 1970 — a period during which income inequality has grown — the toil index has risen sharply.

The increase in two-earner households explains only part of it. The climb in the toil index was also driven by the easy credit that fueled the housing bubble, as well as by an expenditure cascade in housing caused by growing income disparities.

I’d love to see a big take on this phenomenon.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.