The Guardian has an excellent and disturbing take on the crash of Nasdaq’s systems on Thursday:

A series of system crashes affecting Google, Amazon, Apple and Microsoft in the past fortnight has brought warnings that governments, banks and big business are over-reliant on computer networks that have become too complex…

Jaron Lanier, the author and inventor of the concept of virtual reality, warned that digital infrastructure was moving beyond human control. He said: “When you try to achieve great scale with automation and the automation exceeds the boundaries of human oversight, there is going to be failure. That goes for governments, for consumer companies, for Google, or a big insurance company. It is infuriating because it is driven by unreasonable greed. In many cases, the systems that tend to fail, fail because of an attempt to make them run automatically with a minimal amount of human oversight.”…

“These outages are absolutely going to continue,” said Neil MacDonald, a fellow at technology research firm Gartner. “There has been an explosion in data across all types of enterprises. The complexity of the systems created to support big data is beyond the understanding of a single person and they also fail in ways that are beyond the comprehension of a single person.”

That’s a good second-day story.

— The Wall Street Journal takes a look at the continuing disaster unfolding at Eddie Lampert’s Sears:

The damage has a number of causes, former Sears executives and employees said. Sears disrupted a key relationship with Whirlpool Corp. WHR -1.87% that had underpinned the business for decades. Key management positions turned over frequently. Decaying stores that kept customers away hurt appliance departments as well. Executives focused on technological gimmicks like giving sales associates iPads that proved more frustrating than useful. Meanwhile, competitors were building up their appliance businesses.

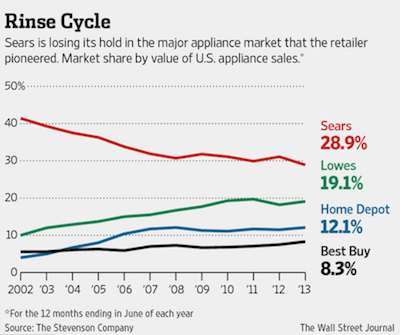

As recently as 2002, Sears sold four of every 10 major appliances in the U.S., far outpacing its rivals. Its closest competitor, Lowe’s, held a 10% market share, and Home Depot held only 4%, according to Stevenson data.

The WSJ pins most of the blame on Sears ending its Kenmore-manufacturing relationship with Whirlpool in favor of LG Electronics, whose new Kenmore appliances “lacked many of the bells and whistles for which the brand was known.”

Maybe so, but that happened in 2009, and the WSJ’s own chart shows that almost all of the decline in market share happened before 2008:

— My old pal Joe Hagan has some excellent reporting for New York on the new regime at The New York Times Company, where he finds contrasting visions of the future at the top and blurred lines on responsibilities. Much of the tension comes from scandal-plagued CEO Mark Thompson’s encroachment on the newsroom.

…The role of “visionary” at the paper, traditionally held by the news chief, was now being ceded to Thompson. And in recent months, say several Times sources, Abramson has chafed at some of Thompson’s moves as he redirects company resources to projects of ambiguous design, including an aggressive video unit run by a former AOL/Huffington Post executive who sits among news editors but reports to the corporate side of the Times…

Thompson is from a press culture where the line between news and business has never been particularly sacred, and he saw himself as a new kind of fusion executive…

In place of the 30 reporters and editors who left last winter, the Times is hiring dozens of videographers to create new content for the paper’s website. And in February, it was Thompson who hired a general manager of video production, Rebecca Howard of AOL and the Huffington Post, to oversee the new video push. Though she was billed as part of a “video-journalism” effort, Howard is a business executive with an office in the editorial suites. When it was announced that the video unit would be reporting to the corporate side of the paper, “Jill was clearly shaken by it,” says a person who was in meetings with her…

Thompson meets regularly with reporters and editors, but he is still a mystery. “There wasn’t a grand plan,” says one reporter who heard him out. “Maybe there isn’t a grand plan. Sell tchotchkes, do this, do that. You could reasonably infer what he’s talking about is chipping away at that wall between business and news.”

You know what? I want to read the NYT. I don’t want to watch it. It’s fine to create new businesses, of course, particularly if they bring in new profits. But taking resources away from the core business is a really bad move.

There’s much more in the piece. Read the whole thing.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.