The reaction from internet evangelists over the Stop Online Privacy Act and the Protect IP Act has bordered on hysteria. Witness Wikipedia shutting down for twenty-four hours so we can all “Imagine a World Without Free Knowledge.”

The Financial Times‘s John Gapper takes a level-headed look at all this and finds it overdone and, notably, self-serving:

… Silicon Valley damages itself with its persistent scaremongering over efforts to crack down on piracy. By refusing to engage in a serious effort to prevent it – instead equating copyright enforcement with censorship, or with “breaking the internet” – it undermines its credibility.

The Digital Millennium Copyright Act of 1998, which it now holds up as a model, was awfully dangerous back then; music companies were stupid to “sue their customers”; governments that halt internet access to persistent file-sharers are breaching their human rights. And now the Stop Online Piracy Act (Sopa) merits a blackout by websites that it isn’t meant to affect…

The blackouts were a dramatic gesture but curbing piracy does not “destroy the internet as we know it”. It would be wiser for Silicon Valley to cut the histrionics and help to fashion a decent law.

Read the whole thing.

— Agence France Presse looks at how newspapers in Japan are faring: Just fine, thanks, something it credits in part to their connection to their communities. A paper in Fukushima, for instance, put out hand-written newspapers after the earthquake and tsunami there last year.

The numbers are amazing in an early-adopter country:

According to the World Association of Newspapers, Japan has the second-highest newspaper penetration of any country, with readership of paid dailies at 92 percent of the population, behind only Iceland.

Japan has the planet’s three biggest-selling daily newspapers, it added, led by the Yomiuri Shimbun.

The Yomiuri claims a monumental circulation of 13.5 million copies a day including its evening edition, and at 9.98 million, its morning edition alone sells more copies than all of Britain’s national dailies put together.

— I wanted to flag this TheStreet.com piece from last week on the private antitrust lawsuits credit-card companies and banks are facing:

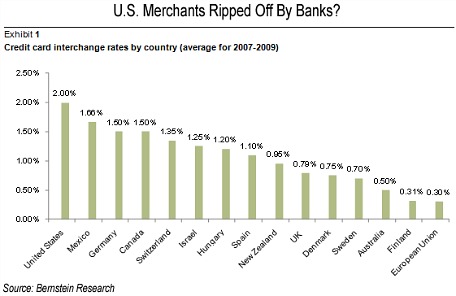

Estimates of the potential cost of a settlement of the antitrust case vary dramatically–from a few billion dollars into the hundreds of billions. At least as worrisome to the financial companies, according to Deutsche Bank research, is the risk that a settlement or judge’s ruling could take the 2% “interchange” fees banks and card companies charge retailers on credit card transactions to as low as .5%, That would equal the rate in Australia, but still be higher than the .3% charged in the European Union, according to a report by Sanford Bernstein analyst Rod Bourgeois.

The impact of such a change would be several times as costly as the Durbin Amendment, which caps fees banks can charge on debit cards and is one of the new rules most hated by the big banks.

Lest you think the stakes are overstated or that the plaintiffs are grasping at straws, look at this chart: