William D. Cohan roughs up newly former SEC Chief Mary Schapiro and former Fed Vice Chairman Alan Blinder in a Bloomberg View column criticizing them for blurring the lines between government service and self-interested profit. Right on, as far as that goes.

But this part from Nassim Nicholas Taleb is just wrong:

Blinder is a particularly interesting case study of how Promontory works its magic. According to the Promontory website, Blinder is a co-founder of something called Promontory Interfinancial Network, which when you cut through the gobbledygook says it helps smaller financial institutions get some of the same benefits of size enjoyed by our “too big to fail” banks. One of the products Promontory Interfinancial offers customers is Insured Cash Sweep, which according to a fancy video allows someone with more than $250,000 in cash on deposit in a bank — the limit of what the Federal Deposit Insurance Corporation will insure — to get federal insurance for any amount.

What the company does is allow someone to hand over, say, $1 million, which is then broken up for him into four $250,000 pieces and farmed out to separate financial institutions so that, voila, each $250,000 is FDIC-insured. The depositor notices no difference on a daily basis — he can still get his money whenever he wants, unless the money is in a savings account, where access is limited to six times a month — but, like magic, $1 million is federally insured instead of just $250,000. ..

“It would allow the super-rich to scam taxpayers by getting free government sponsored insurance,” Taleb wrote. “Yes, scam taxpayers. Legally. With the help of former civil servants who have an insider edge.”

It’s not a scam to put deposits in multiple banks to insure more than $250,000. The FDIC is explicit about its legitimacy, saying, “The standard deposit insurance amount is $250,000 per depositor, per insured bank” and:

The FDIC insures deposits that a person holds in one insured bank separately from any deposits that the person owns in another separately chartered insured bank. For example, if a person has a certificate of deposit at Bank A and has a certificate of deposit at Bank B, the accounts would each be insured separately up to $250,000.

— This New Statesman review of techno-skeptic books by Evgeny Morozov and Jaron Lanier is well worth a read. Aditya Chakrabortty asks “What happens when engineers run the world?”

He notes a Cambridge study on why so many Islamic terrorists are engineers:

While that accounted for the preponderance of degree-holding jihadis, it did not explain the dominance of engineering. For that, the social scientists turned to what they called the “engineering mindset”. “Engineering is a subject in which individuals with a dislike for ambiguity might feel comfortable,” they wrote. According to a US survey, engineers were “less adept at dealing with the confusing causality of the social and political realms and . . . inclined to think that societies should operate in an orderly way akin to well-functioning machines”.

Had the sociologists panned their lens across from the Middle East to the west coast of the US, they would have found that same mindset not confined to the political margins but flourishing in the commercial mainstream. If this age belongs to any profession, it surely belongs to the engineer – not in the term’s historical sense of builders of dams and railways but in its new sense of makers of technology and software…

… you have a world in which books emerge with titles such as What Would Google Do?and in which the untimely death of the chief executive of a consumer electronics company, Apple’s Steve Jobs, prompts the kind of mass grief that greeted the assassination of John Lennon. A world in which engineers – and the culture described by Gambetta and Hertog – reign supreme.

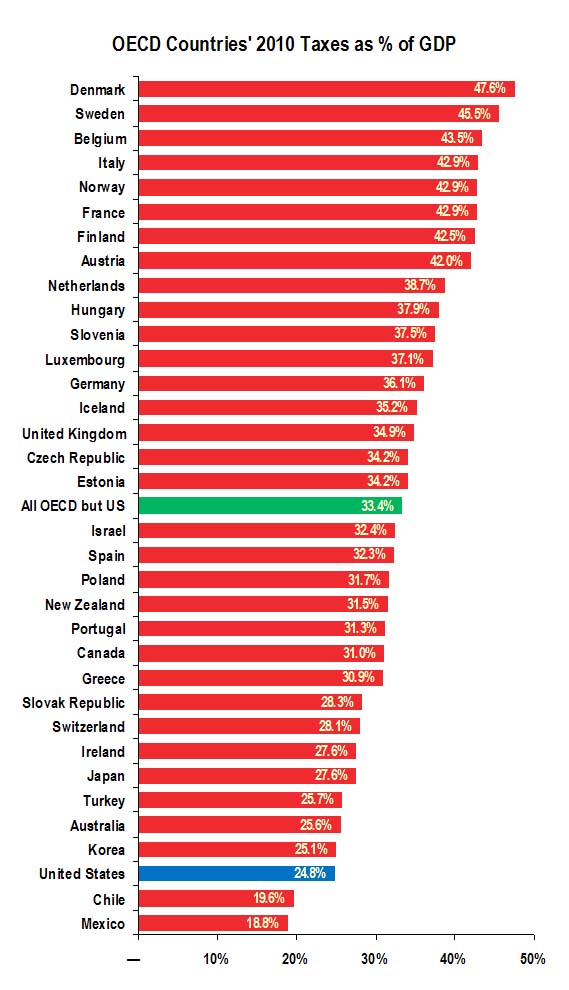

— For everybody who thinks taxes are too high in the U.S., look abroad. The latest OECD report shows how low they are here compared to all the other 33 OECD countries besides Mexico and Chile. Here’s a Citizens for Tax Justice chart:

Totaling up federal, state, and local taxes puts total U.S. taxation in 2010 at 25 percent of GDP, 8.5 percentage points lower than the OECD average. Germany’s rate is more than 11 percentage points higher and Denmark, with the highest taxes, nearly doubles the U.S., at 48 percent.

CTJ doesn’t note that U.S. spending is much closer to OECD levels than taxes.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.