The Los Angeles Times has a good and disturbing look at how the LA housing market is already showing signs of entering a new bubble:

Out of all homes sold in March, 91% of the company’s deals involved a bidding war. And about 10% were investors flipping a property at a profit after buying it just a short time before. Some agents representing buyers have called Redfin agents offering to double their commissions to ensure clients win bidding wars, Kelman said. And, increasingly, deals are being financed with smaller down payments — meaning buyers are able to take on more debt…

Banks had been relying on a wave of refinancing business. But as that slows, they are setting their sights on new home buyers by loosening their underwriting standards and accepting lower down payments.

Some lenders have even begun offering piggyback loans — which enable buyers to take multiple mortgages to avoid putting any money down, Cecala said…

That is how the American economy works now,” he said. “It seems as if we just go from one bubble to the next.”

The LAT misses, though, by not giving readers numbers on how much housing prices have rebounded since the bottom of the market. And this story calls out for a much longer take.

— You don’t see terms like “corporate avarice” and “corporate pay masters” don’t appear too often in the op-ed pages of The Wall Street Journal–much less in columns arguing that the minimum wage is far too low.

So credit where credit is due to the WSJ for running a Ralph Nader op-ed that opposes nearly everything its editorial board stands for:

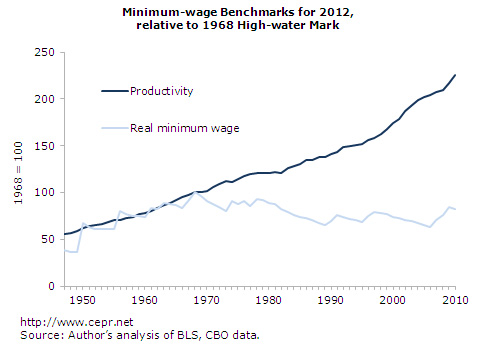

It is long past time for minimum-wage workers to receive a raise. Had the federal minimum wage just kept pace with inflation since 1968, it would stand today at $10.67 per hour, not $7.25…

At a Senate Labor Committee hearing last month, Sen. Elizabeth Warren (D., Mass.) noted that had the minimum wage increased in proportion to worker productivity since 1960, it would stand today at $22 per hour…

Do members of Congress want to serve the interests of their corporate pay masters? Or do they want to support a hard-pressed working class of 30 million Americans whose depreciating wages result in deprivations and tragedies? It’s time for our country to catch up to 1968 wages.

Here’s a Center for Economic and Policy Research chart showing the disconnection of the minimum wage from productivity growth:

— James B. Stewart reports that at least 41 publicly traded companies had directors who lost shareholder elections last year but were kept on their boards anyway:

“It’s appalling,” Nell Minow, a co-founder of GMI Ratings, which rates companies based on risk to shareholders, including corporate governance issues, told me this week. “It’s the No. 1 issue in corporate governance.” She noted that the reason such a thing was possible was that many companies operate under a “plurality” voting system, in which directors run unopposed and just one vote is enough to be elected. And even companies that require a majority vote may decline to accept a director’s resignation.

That an electoral system unworthy of Soviet-era sham democracies is flourishing today in corporate America is largely thanks to the management- and director-friendly policies of Delaware, where more than half of United States companies are incorporated and where the corporate franchise tax contributes disproportionately to the state’s revenue. State law controls board governance, and Delaware has long tolerated plurality voting. The Delaware Supreme Court has also affirmed the power of boards to reject the resignations of directors who fail to gain a majority of votes…

Defenders of plurality voting have typically argued that majority voting or elections that would be binding might be destabilizing or disrupt continuity. But “that’s simply to say that democracy is destabilizing,” Ms. Minow said. “Continuity is exactly what shareholders voting against directors do not want. That’s why they’re withholding their votes.”

Delaware is our very own Cayman Islands, and it gets entirely too little press coverage.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.