Audit pal Felix Salmon has an important piece on the Republicans’ debt-ceiling insanity, writing that “the default has already begun”—as has the irreparable damage:

The harm done to the global financial system by a Treasury debt default would not be caused by cash losses to bond investors. If you needed that interest payment, you could always just sell your Treasury bill instead, for an amount extremely close to the total principal and interest due. Rather, the harm done would be a function of the way in which the Treasury market is the risk-free vaseline which greases the entire financial system. If Treasury payments can’t be trusted entirely, then not only do all risk instruments need to be repriced, but so does the most basic counterparty risk of all. The US government, in one form or another, is a counterparty to every single financial player in the world. Its payments have to be certain, or else the whole house of cards risks collapsing — starting with the multi-trillion-dollar interest-rate derivatives market, and moving rapidly from there.

And here’s the problem: we’re already well past the point at which that certainty has been called into question. Fidelity, for instance, has no US debt coming due in October or early November, and neither does Reich & Tang:

And Citigroup and State Street are telling clients they don’t want T-bonds maturing in mid-to-late October as collateral, as the Journal reports.

Felix:

While debt default is undoubtedly the worst of all possible worlds, then, the bonkers level of Washington dysfunction on display right now is nearly as bad. Every day that goes past is a day where trust and faith in the US government is evaporating — and once it has evaporated, it will never return. The Republicans in the House have already managed to inflict significant, lasting damage to the US and the global economy — even if they were to pass a completely clean bill tomorrow morning, which they won’t. The default has already started, and is already causing real harm. The only question is how much worse it’s going to get.

— The New Republic‘s Noreen Malone marvels at the sheer nerve of Republican Senator Ted Cruz, who’s as responsible as anyone for the government shutdown, taking to the National Mall with fellow demagogue Sarah Palin to rail against the government shutdown. Cruz had the nerve to ask, “Why is the federal government spending money to erect barricades to keep veterans out of this memorial?”

Malone:

2) The memorial is closed because the government is shut down. That’s why veterans — and everyone — can’t get it.

3) Barricades don’t really cost money to erect in this day and age. The Park Police, particularly in D.C., probably have lots of those laying around and stuck them up before the shutdown began, kind of like a “gone fishing” sign for the collapse of democratic process. It’s not as if they welded them by hand with the molten tears of people forced to sign up for Obamacare. If the government did “spend money” on them, it’s in the past tense. It’s not an ongoing activity. Also, it probably cost like … maybe a hundred bucks, total?

4) The Park Police are, in fact, monitoring the memorial, but it’s mostly to keep the protesters (protesting its closure) under control. The Park Police are not being paid for this (even though protesters chanted “You work for us”), because they’ve been furloughed. Thanks largely to the intractable Ted Cruz.

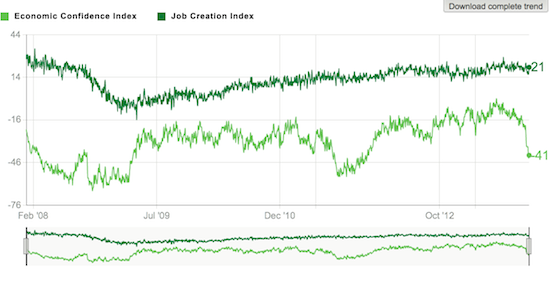

— The economist Justin Wolfers points to the Gallup poll of consumer confidence, which shows it collapsing as the shutdown/debt ceiling fiasco drags on:

Thanks, Republican Party.

I’m really surprised that the markets haven’t freaked out yet, even though consumers have been for weeks.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.