Our Greg Marx wrote about how Politico and Time, bizarrely, posted Rolling Stone‘s blockbuster scoop on General McCrystal and staff’s insubordination before RS itself did.

And I mean, they posted the whole scoop—a full PDF of the story in the magazine. That’s about as clear and cynical an example of copyright infringement as you can find, and Politico and Time ought to consider themselves fortunate if Rolling Stone decides not to go after them for it.

This isn’t the first time this has happened. Rolling Stone kept Matt Taibbi’s explosive Goldman Sachs-vampire-squid piece off the Web for weeks last summer, and lots of bloggers posted the stolen PDF of the story.

It usually makes no sense for publications to give away their expensive-to-make work to people on the Web while trying to sell subscriptions to them at the same time (I also wrote last summer that it made no sense for RS not to have an option to buy the story online). Whatever RS‘s strategy is is complicated when legitimate news organizations like Time and Politico steal your stuff and post the whole thing free for their millions of readers.

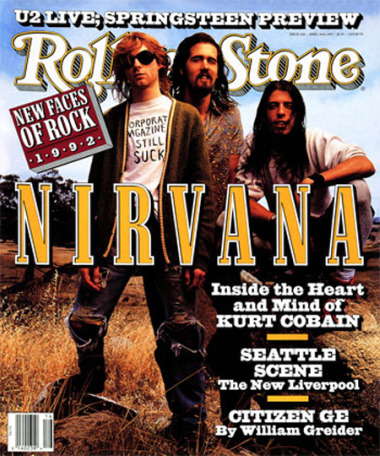

And by the way, Rolling Stone‘s online strategy worked for me. I, overcoming a longtime loathing of its music coverage, subscribed to the magazine last year to read its original reporting, especially Taibbi. Corporate Magazines may Still Suck, but Rolling Stone‘s non-music journalism does not, as Holly Yeager wrote earlier today.

— The Journal goes page one again on the shady stranger-originated life-insurance business. This one examines the woes of a Florida broker.

The practice was legal in many states during the prior decade, though disliked by regulators because it skirted the intent of “insurable interest” laws. Those laws prohibit taking out a policy on someone without having a stake in the person’s well-being. When hedge funds moved into this area around 2004, however, many insurers did little double-checking of the financial information provided on applications and didn’t drill down deeply about buyer’s intentions in taking out the policies; they focused on medical underwriting, and some initially welcomed the influx in business, according to insurance-industry executives.

State authorities have charged that some agents, in their haste to earn fat commissions, stepped over the line, committing fraud to dupe insurers into issuing the multimillion-dollar policies favored by investors. The most common charge: that agents inflated applicants’ wealth to mislead insurers. Insurers typically ask questions about annual income and net worth, in part, to ensure that buyers can afford the premiums.

— Paul Carr finds some hard-hitting journalism from Forbes.com, which he calls “you journalistically bankrupt SEO whores” (SEO stand for search-engine optimization):

Celebrities Who Love The iPad: Miley Cyrus, Justin Bieber and Oprah Winfrey, to name a few.

Business Insider and The Huffington Post might even be too embarrassed to run that one.

If you’re feeling queasy, you might wanna skip this paragraph:

And while the rumors about Beiber dating Cyrus remain unfounded, his fling with the iPad is no myth: Photographers have caught the generously coiffed teen and his iPad on many occasions.

(h/t David Carr)

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.