The Huffington Post reports that Elizabeth Magner, a federal judge in Louisiana, hit Wells Fargo with $3.1 million in punitive damages for gouging a New Orleans man for $24,000 in illegal fees on his mortgage, and then putting the full weight of its legal resources on him to discourage a lawsuit (emphasis mine)

In the most recent opinion, Magner describes Wells Fargo’s litigation tactics, which involved filing dozens of briefs, motions and other filings that slowed down the proceedings to a snail’s pace, as “particularly vexing.” The tactics suggest that any other borrower who might wish to contest a fee or charge would find a legal challenge to the bank simply too burdensome.

And yet, Magner writes, it is only through litigation that the abuses can be uncovered. Calling Wells Fargo’s conduct “clandestine,” Magner wrote that the bank refused to communicate with Jones even as it was misdirecting payments for improper purposes.

“Only through litigation was this practice discovered,” Magner writes. “Wells Fargo admitted to the same practices for all other loans in bankruptcy or default. As a result, it is unlikely that most debtors will be able to discern problems with their accounts without extensive discovery.”

I hope somebody with subpoena power is reading that.

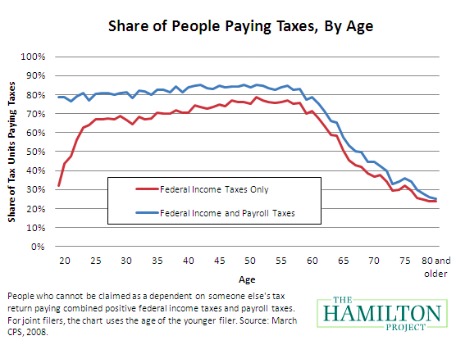

— You’ve heard the canard about how only a little more than half of the population pays (federal income) taxes, which is meant to show how half of us are lazy welfare queens or something. Never mind that almost everybody pays other major forms of taxation: state, local, payroll, gas tax, etc.

But this Hamilton Project chart shows another way that stat is misleading: Most of the people who don’t pay federal income taxes are actually old and retired or young and in college

But during middle age, almost all workers face a tax burden. When looking at those in middle-age, 84 percent faced a net payroll and income tax bill in 2007. This general theme also holds true for low-income households: even households that receive the child-related EITC generally only receive it temporarily, usually when their children are young. On net, even these families face a positive tax bill over time (Dowd and Horowitz 2008).

Furthermore, rising unemployment during the Great Recession has meant that the proportion of American families paying no federal taxes is unusually large today. Unemployed workers without incomes naturally don’t face tax liabilities. But as they find jobs and rejoin the labor force, they will once again contribute to the federal system. Indeed, some of the trends we see today are less illustrative of an unfair tax advantage for the poor; rather, the trends indicate the existence of a group of unfortunate families who have found themselves affected by hard times. And young people today have been particularly hard hit: many are unemployed or weathering the storm in graduate schools, meaning that they are, thus, not paying taxes. When looking more specifically at middle-aged workers with jobs, 96 percent paid federal income or payroll taxes.

— The Wall Street Journal reports on what kind of private information you’re giving up in exchange for those Facebook apps that ask questions like “Is your friend’s butt cute?” (the WSJ finds that developer liked to learn about you and your friends’ sexual preferences until the paper started asking questions).

Most interesting is that at least some of these apps know they’re likely to be flashes in the pan at best and are looking to warehouse your personal information and that of your friends to cash in:

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.By virtue of its size and user base of 800-million-plus people, Facebook is at the heart of the personal data economy. Popular apps can quickly go “viral” there and gain millions of users—but can also flame out just as quickly. This explains why some apps seek to cash in by gathering as much data as possible and hoping to find ways to make money from it.

Brendan Wallace, co-founder of a Facebook app called “Identified” that provides career networking, said his company aims to build up a repository of data. He is unsure how he will use the information but said, “data is what anyone wants access to.” “Identified,” which isn’t in the top 100 apps, obtains from each of its users birthday, city, education and work history, and also the same set of information from its users’ friends.