Much of the press coverage I’ve seen in the wake of Twitter’s eye-watering IPO has been responsibly skeptical or, at the very least, contextual.

We’re still smarting from 1999, when media hype helped inflate the original tech bubble. I’ve seen lots of cautionary stories about bubble indicators: stock valuations, IPO activity, and the return of mom and pop (read: the dumb money) to the stock markets.

Sometimes these tales are too cautionary. The New Yorker‘s John Cassidy, in pointing out Twitter’s exorbitant valuation, tells readers that Exxon Mobil “trades at a multiple of one times earnings–yes, one times earnings,” an assertion that’s off by a factor of 12. Of all profitable publicly traded companies worth more than $1 billion, none has a P/E less than 2.2.

But it’s particularly worth noting when press coverage effectively buys into the hype.

Take this Mashable post, which consists of a clickbait headline, a misleading chart, and zero context or analysis. It’s headlined, “Can You Get Rich by Investing $1,000 During an Internet IPO?” which is a giant red flag to anyone who remembers the late 1990s (editors: this does not include many of your writers).

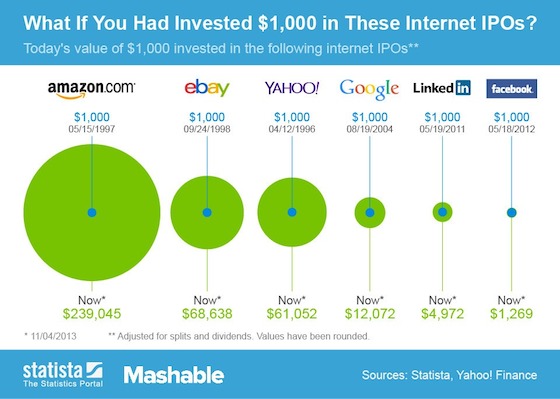

Here’s the chart:

Take all your cash and dump it into IPOs, people! Get rich quick—it’s the American way.

The first problem here is that “you” can’t really invest in IPOs. Those are mostly reserved for the super-connected. You, as a retail investor, typically can only buy after the IPO launches, which means you miss out on most of the “pop.”

So if you bought Amazon one second after it began trading back on May 15, 1997, you bought it at $29.15 a share, while those in on the IPO got them for $18. In other words, your $1,000 bought 34.3 shares while Frank Quattrone’s pals got 55.6 shares for the same $1,000.

That $239,045 Mashable and Statista say you’d have from your Amazon.com wager turns out to be $143,300 in the real world. Had you bought $1,000 of eBay when it opened, you’d have $23,000, not $68,638. With LinkedIn, you’d have $2,500, not $4,972. Good gains all, but not as good as the chart leads you to believe.

That’s actually not the biggest problem with the piece. The whopper is that Mashable and Statista cherry-pick the winners and ignores the losers. So, you have Amazon, Google, eBay, and Yahoo, but no Webvan, Pets.com, Globe.com, or DrKoop.com.

What if you had invested $1,000 in the latter four IPOs? You’d have a whole lotta nothin’. Also, their method assumes that you would buy at the open and hold it through thick and thin. I’ll bet you there are very few original shares that haven’t traded. I bought $1,000 worth of Apple in the summer of 2002. Unfortunately for my theoretical 70-bagger, I had to sell it a couple months later to pay a broker’s fee. Darn you, New York City real estate!

Possibly just as bad as Mashable/Statista is this Time.com article headlined, “After Twitter: 5 Potentially Blockbuster IPOs Coming Next.” Here’s the lede:

Twitter’s IPO has come and gone, bringing immediate riches to some of the company’s employees and anyone lucky enough to get in on the $26 IPO price (the stock jumped 73 percent on its first day). But Wall Street’s IPO mania is hardly over.

The first of the five potentially blockbuster IPOs”: A textbook company that loses $1 for every $3.50 in revenue. Time.com breezily dispenses with that:

The company posted a net loss of $50 million in the first nine months of this year, on revenue of $178 million. However, it’s headed by former Yahoo! Chief Operating Officer Dan Rosensweig, giving the company some clout in the tech world.

Oh, Dan Rosensweig. Of Yahoo? They’re golden.

Then we get Zulily, which is basically Groupon for mommy bloggers, and which Time tells us will go public this week with a P/E of roughly 10,000. Time doesn’t actually put it like that, of course. Here’s what it says instead:

The shopping site, which specializes in products for mothers and their children, more than doubled its sales in the first nine months of the year to $439 million and posted a small profit of $155,000 in that time frame… The company’s stock will price between $16 and $18, giving it a valuation of as much as $2.2 billion.

Next, Box, which “isn’t profitable but boasts some high-profile customers.” And Square, which loses money and is already valued at about 25 to 30 times net revenue on the private market.

Alibaba is the only one on the list that makes good money. Which it will have to to justify a $100 billion valuation.

These valuations are in many cases ridiculous and people in Silicon Valley know it. The greater fool theory is fine by me when it’s VC types getting hosed. But the bag’s about to be handed to mom and pop.

Let’s be a lot more skeptical for their sake.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.