David Cay Johnston has a fantastic piece out on “9 Things The Rich Don’t Want You To Know About Taxes” running in a bunch of alt-weeklies this week.

He thoroughly debunks the canard that the rich pay vastly more taxes proportionally than everybody else and he shows how the system has been rigged over the last three decades in favor of the wealthy. The truth is that while the federal income tax is progressive, other significant taxes, like payroll contributions, are regressive. And look at state and local taxes (emphasis mine):

When it comes to state and local taxes, the poor bear a heavier burden than the rich in every state except Vermont, the Institute on Taxation and Economic Policy calculated from official data. In Alabama, for example, the burden on the poor is more than twice that of the top 1 percent. The one-fifth of Alabama families making less than $13,000 pay almost 11 percent of their income in state and local taxes, compared with less than 4 percent for those who make $229,000 or more.

Johnston also notes that the richest 400 taxpayers in the U.S. paid an average 16.6 percent federal tax rate in the last year. That’s less than half the marginal top rate of 35 percent. Do you know how much money you have to make to be in the top 400 earners in a rich country like the U.S.? Try $138 million in 2007, the last year for which we have IRS data—and that’s adjusted gross income. That 16.6 percent is far less than the average taxpayer pays:

Compare that to the vast majority of Americans, whose share of their income going to federal taxes increased from 13.1 percent in 1961 to 22.5 percent in 2007.

Why do the richest of the rich pay less tax than the rest of us? A major reason is that our tax code taxes capital income (on investments held at least a year) at less than half the rate it taxes labor income. And the very wealthy naturally have much more capital and capital gains than your average taxpayer does.

Which brings us to John Paulson, the hedge fund manager who Johnston points out didn’t have to pay any “current income tax” on the $9 billion he’s reaped in the last two years (much of which has come from taking a huge cut of the capital gains he got with other people’s money, incuding pension funds). How’s that?

What the news media missed is that hedge-fund managers don’t even pay 15 percent. At least, not currently. So long as they leave their money, known as “carried interest,” in the hedge fund, their taxes are deferred. They only pay taxes when they cash out, which could be decades from now for younger managers. How do these hedge-fund managers get money in the meantime? By borrowing against the carried interest, often at absurdly low rates—currently about 2 percent.

Lots of other people live tax-free, too. I have Donald Trump’s tax records for four years early in his career. He paid no taxes for two of those years. Big real-estate investors enjoy tax-free living under a 1993 law President Clinton signed. It lets “professional” real-estate investors use paper losses like depreciation on their buildings against any cash income, even if they end up with negative incomes like Trump.

Frank and Jamie McCourt, who own the Los Angeles Dodgers, have not paid any income taxes since at least 2004, their divorce case revealed. Yet they spent $45 million one year alone. How? They just borrowed against Dodger ticket revenue and other assets. To the IRS, they look like paupers.

But the very rich also have the best tax lawyers working on sheltering their income and the best lobbyists working the halls of Congress. That’s why, say, private-equity and hedge-fund managers’ get to treat their fee earnings as long-term capital gains rather than income. (UPDATE: I transposed income and long-term capital gains in the original version of this post)

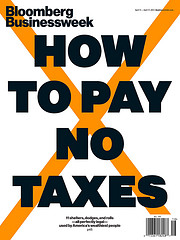

And it’s why Bloomberg’s Jesse Drucker has the cover story in Bloomberg BusinessWeek on “Eleven shelters, dodges, and rolls—all perfectly legal—used by America’s wealthiest people.”

It’s a good look at how billionaires get out of paying taxes. Drucker, an old Wall Street Journal colleague of mine, gives us this excellent context on the richest 400, pointing out that their federal tax burden fell by nearly half from 1995 to 2007:

For the 400 U.S. taxpayers with the highest adjusted gross income, the effective federal income tax rate—what they actually pay—fell from almost 30 percent in 1995 to just under 17 percent in 2007, according to the IRS. And for the approximately 1.4 million people who make up the top 1 percent of taxpayers, the effective federal income tax rate dropped from 29 percent to 23 percent in 2008.

He also points to the McCourt anecdote:

Several of those techniques involve some variation of complicated borrowings that never get repaid, netting the beneficiaries hundreds of millions in tax-free cash. From 2003 to 2008, for example, Los Angeles Dodgers owner and real estate developer Frank H. McCourt Jr. paid no federal or state regular income taxes, as stated in court records dug up by the Los Angeles Times. Developers such as McCourt, according to a declaration in his divorce proceeding, “typically fund their lifestyle through lines of credit and loan proceeds secured by their assets while paying little or no personal income taxes.”

Swell guys. Real estate developers, of all people, depend on taxpayers and government—sometimes through direct subsidies—to make their investments go. Taxpayers usually foot the bill for the infrastructure that makes developers’ projects feasible.

Drucker runs through several different techniques the wealthiest use to avoid taxes, including the “‘No-Sale’ Sale,” the “IRA Monte Carlo,” and the “Estate Tax Eliminator.” It’s an excellent compilation of tax tactics that ought to be scrutinized.

Meantime, Johnston also emphasizes the income inequality that’s run amok in the last thirty years. At the same time taxes on the rich have tumbled, their gross income has skyrocketed. Meantime, median wages have been flat over that time and actually declined in the last decade.

It’s worth remarking that it’s nice to have these two stories out at the same time. Johnston’s piece is running on the covers of alt-weeklies across the country. Drucker’s is on the cover of a major business mag at your nearest mainstream newsstand.

Combined, they hammer the point home that the system is rigged in favor of the wealthiest at everyone else’s expense.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.