Bloomberg BusinessWeek is a lot edgier than its predecessor, at least where design is concerned. Sometimes it’s too edgy, like when it takes two minutes to read some headline intentionally designed to be barely legible.

You can particularly see this walk-up-to-the-line philosophy in its covers, which over the last year or so have pushed the line on what’s okay for a respected mass market magazine.

There was the airplanes-having-sex cover, which was amusing:

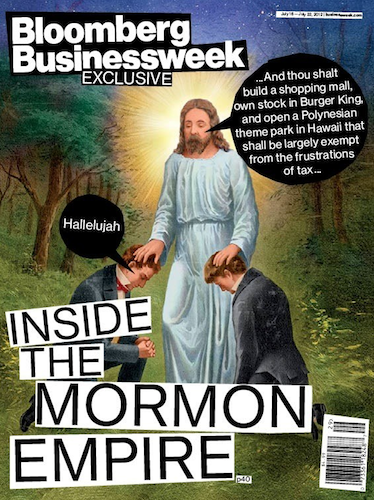

Then there was the Mormon business empire cover depicting John the Baptist telling Joseph Smith to pursue filthy lucre:

Lots of Mormons thought that crossed over into sacrilege. But it’s certainly defensible considering that, as BW’s good reporting showed, the church does indeed run itself like a tax-favored holding company. My problem with that cover was that “Hallelujah” is mostly an evangelical exclamation, not an LDS one, which seemed to signal the ever popular out-of-touch secular-media thing.

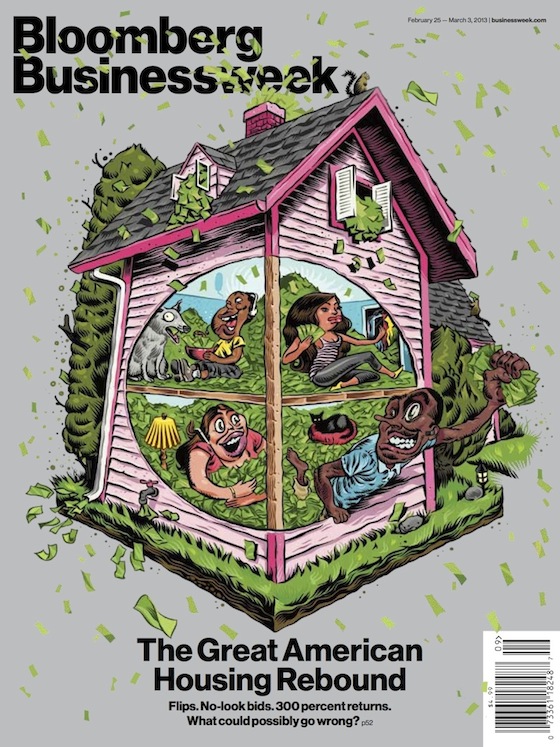

But this week’s BizWeek cover, for a story on the return of bubble behavior to the housing market, is clearly a mistake:

The cover stands out for its cast of black and Hispanic caricatures with exaggerated features reminiscent of early 20th century race cartoons. Also, because there are only people of color in it, grabbing greedily for cash. It’s hard to imagine how this one made it through the editorial process.

Compounding the first-glance problem with the image is the fact that race has been a key backdrop to the subprime crisis.

The narrative of the crash on the right has been the blame-minority-borrowers line, sometimes via dog whistle, often via bullhorn.

It’s a narrative that has, not coincidentally, dovetailed with “Obamaphone” baloney, the ACORN pseudo-scandal, and Southern politicians calling the first black president “food-stamp president,” and is meant to take the focus off the ultimate culprits: mortgage lenders with no scruples and the Wall Street banks who financed them.

In fact, though, the record is clear: minorities were disproportionately targeted by predatory lending, which has always gone hand in hand with subprime. Even when they qualified for prime loans that similar-circumstance whites got, they were pushed into higher-interest subprimes.

In other words, minority borrowers were disproportionately victimized in the bubble. But BusinessWeek here has them on the cover bathing in housing-ATM cash, implying that they’re going to create another bubble.

That’s not okay.

UPDATE: I have a bit more on this story here.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.