One of the business press’s institutional biases is the bullish. It sells magazines, provides happy newshole for advertiser to pitch alongside, and pleases your executive sources.

So it warms my cold, 90-percent-in-cash heart to see a super-negative column like Brett Arend’s today in The Wall Street Journal. You don’t see a whole lot of these guys in the major press.

I’m not sure that asking “Could Wall Street be about to crash again?”, as Arends does in the lede, is the wisest thing to do. No need to use the C-word.

But he provides a good synopsis of why things are bleak—and not just for the market.

Most important is deflation, which Arends says is already here, and which we’ve been worried about here for a couple of years. Maybe it’s not officially here, but it’s awfully darn close:

Consumer prices have fallen for three months in a row. And, most ominously, it’s affecting wages too. The Bureau of Labor Statistics reports that, last quarter, workers earned 0.7% less in real terms per hour than they did a year ago. No wonder the Fed is worried. In deflation, wages, company revenues, and the value of your home and your investments may shrink in dollar terms. But your debts stay the same size. That makes deflation a vicious trap, especially if people owe way too much money.

Deflation would be coming at the exact wrong time because the economy is still overloaded with debt, which becomes harder to pay down. Arends is on that, too:

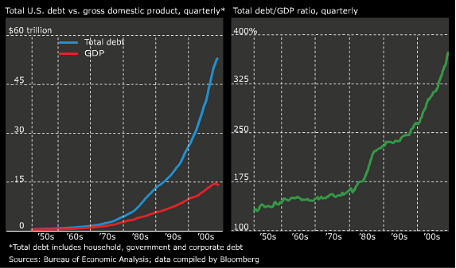

According to the Federal Reserve, total U.S. debt—even excluding the financial sector—is basically twice what it was 10 years ago: $35 trillion compared to $18 trillion. Households have barely made a dent in their debt burden; it’s fallen a mere 3% from last year’s all-time peak, leaving it twice the level of a decade ago.

It would have been better probably to put that in context with a GDP number, which is something on the order of 350 percent. In other words, the government and the private sector (the vast majority is the private sector’s) owe 4.5 times what the entire economy produces in a whole year. That’s more than doubled since the start of the Reagan era. See this spooky Bloomberg chart from a year ago:

For investors, the bad thing is that stocks have already priced in an increased pace of earnings gains. Arends says they’re trading at 20 times cyclically-adjusted earnings, which is 25 percent above the historic level. Stocks are no longer cheap, like they may have been at Dow 6,700 a year and a half ago.

Unfortunately for the US of A, the stock market has arguably now been our most important indicator of economic well being for some time. The market’s rebound from its bottom in March 2009 has been a critical factor in the delay and dilution of reforms and economic restructuring that’s sorely needed.

The fact that 17 percent of Americans can’t find jobs or have given up looking or can’t find full-time work isn’t enough to light a fire under the tail ends in Washington. But let the stock market plunge a few thousand points and watch the place snap to—and the business press go on a war footing.

Betcha.

In other words, a crash or sharp decline might not be such bad news for much of the country.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.