The Wall Street Journal has a nice piece on advertisers’ doubts about Facebook.

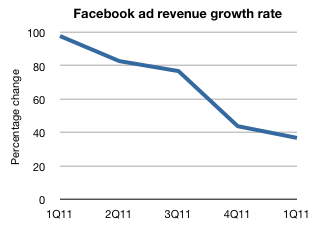

As I noted a few months ago, Facebook brings in just penny a day of revenue for each of its users and its rate of ad growth was slowing considerably. It continued to slow in the first quarter:

The Journal reports that Facebook would have to grow revenue at 41 percent a year for five years to justify the $100 billion valuation it was bandying around (ADDING: at Google’s current earnings multiple). Good luck with that.

With it’s vaunted data horde, which is supposedly where Facebook’s value comes from (most of the value really comes from the mass of eyeballs it accumulates), these are the ads Facebook is currently serving me on my home page there:

How Facebook’s state-of-the-art algorithms figured me for a gout sufferer, I don’t know. I’m also not in the market for boarding schools, much less coed ones, nor a racket like the University of Phoenix. The only reason I noticed these ads is because I went looking for them, which is also a big problem.

The most interesting part of the Journal‘s story is its graphic on how many ads Facebook has to show to get a million bucks worth of revenue. It compares that to the ad revenue brought in by other media.

The New York Times gets about as much for ten full-page color ads as Facebook gets for 125 million impressions for a “sponsored story.” American Idol gets as much revenue with one minute of ads. Of course, those are millions of impressions too. Each Times ad, for instance, is seen by a million people or more, so you’re talking at least 10 million impressions for a million dollars. That works out fairly neatly with the whole “dollars for dimes” digital ad tradeoff, though the Times‘s demographics are presumably more valuable than Facebook’s.

But the sponsored stories the Journal is talking about bring $8 a CPM (thousand impressions) for Facebook, much more than the junk sideline ads I screen-capped above, which are much more common. Facebook’s average CPM is just 30 cents in five rich countries, including the U.S. At that rate, they need about 3.4 billion impressions to make a million bucks.

Facebook can make disastrously low CPMs work because it commands one-fifth of all pageviews in the U.S. But to justify its valuation, and with the universe of potential new users shrinking, it’s going to have to to raise CPMs fairly dramatically.

Since I started writing this post, Facebook has said it expects its IPO to price at a valuation between $77 billion and $96 billion. Fortune’s Scott Cendrowski writes that one research firm says the low end implies a 30 percent compound annual growth rate over ten years, which is almost surely not going to happen.

At the high end, Facebook would be trading at ninety-six times earnings, a Tech Wreck-type number implying torrid and sustained future growth. Apple is, incredibly for the biggest stock in the world, growing faster than Facebook. But it currently trades at just fourteen times earnings.

It’s possible that Facebook still has some low-hanging fruit that it’s not collecting. After all, it’s not exactly bombarding users with ads, and a banner ad across the top of the page would surely be worth a mint. And the scope of the platform it has built is incredible and could in the future be monetized in ways no one has thought of yet.

But as the Journal notes, as of now, advertisers don’t really know what they’re getting out of Facebook. Here’s Kia’s marketing guy:

For now, “being on Facebook sends a message,” said Mr. Sprague. “Consumers they say ‘Facebook is working with Kia, I like Facebook ergo I like Kia.’ That’s what we are hoping for.”

I could be wrong, but I don’t think that’s how it works. And it’s not how Facebook will be able to squeeze higher rates out of folks like Mr. Sprague.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.