The big papers go page one today, as they should, with reports on newly released transcriptions from 2006 Federal Reserve meetings—devastating documents of the failure of top economic policymakers to understand what was happening in the economy.

The New York Times‘s Binyamin Appelbaum spent much of yesterday providing an entertaining live feed of his reading of the transcripts. This morning he turns the tweets into an excellent page-one story. The Washington Post leads with the Greenspan angle, for some reason, quoting a nauseating Tim Geithner paean to the onetime Maestro. The Wall Street Journal‘s story reads like access journalism, a mild treatment of an embarrassing disclosure.

It’s worth remembering that Appelbaum, just months after the Fed’s meetings, was at the Charlotte Observer showing how disastrous the housing crash would be, fraud and all.

It’s of course true that it was impossible to know exactly how a housing crash would play out, but it was clear that it was going to be a big problem. The NYT‘s lede zeroes in on the nearsightedness of the Fed. These were basically captains of the Titanic, oblivious to the possibility of disaster:

As the housing bubble entered its waning hours in 2006, top Federal Reserve officials marveled at the desperate antics of home builders seeking to lure buyers.

The officials laughed about the cars that builders were offering as signing bonuses, and about efforts to make empty homes look occupied. They joked about one builder who said that inventory was “rising through the roof.”

But the officials, meeting every six weeks to discuss the health of the nation’s economy, gave little credence to the possibility that the faltering housing market would weigh on the broader economy, according to transcripts that the Fed released Thursday. Instead they continued to tell one another throughout 2006 that the greatest danger was inflation — the possibility that the economy would grow too fast.

The Times says Chairman Ben Bernanke expressed the most reservations about the optimism on housing, the economy, and the financial system—although these look more like hedges on Bernanke’s part than real concerns. The Post and Journal point to Fed Governor Susan Bies, as the “Cassandra” and “most attuned to the brewing trouble,” but that in itself is revealing if you read the Times. It alone quotes her saying this:

“I really believe that the drop in housing is actually on net going to make liquidity available for other sectors rather than being a drain going forward, and that will also get the growth rate more positive,” Ms. Bies told colleagues at the committee’s June meeting.

But Tim Geithner looks particularly ridiculous in these stories. I like the subtle wit on display here in the Times:

Mr. Geithner suggested that Mr. Greenspan’s greatness still was not fully appreciated, an opinion now held by a much smaller number of people.

The Journal quotes him saying this:

“Our recent financial-market data don’t, in my view, provide a convincing case for a substantial increase in the probability of a much weaker path for growth going forward,” Mr. Geithner said at a meeting in December 2006.

And the Times quotes him saying “We think the fundamentals of the expansion going forward still look good” at the same meeting.

Which points to something that stands out here: the utter lack of consequences most of these people have faced for their failures. Obama made Geithner his Treasury Secretary, and the president begged him to stay on last year when he thought about leaving. Obama re-nominated Bernanke to chair the Fed. He nominated Yellen to be vice-chair of the Fed. Bies is on the board of Bank of America. Greenspan is semi-disgraced, but still writes op-eds for the Financial Times.

These are the people running country’s financial and economic policy. Where are the people who got it right?

The Journal quotes an economist defending the Fed and leaves it unchallenged:

On Thursday, after the transcripts were released, some analysts expressed sympathy for the Fed. Pierpont Securities chief economist Stephen Stanley said the Fed’s view at the time “was a pretty consensus view” among analysts.

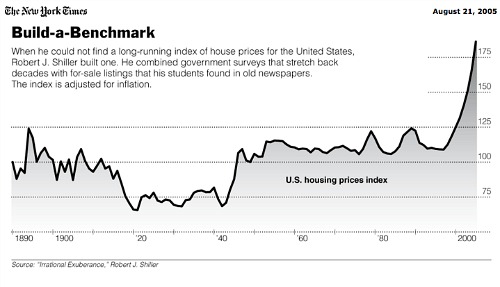

Note the “pretty” qualifier there. That’s because there were loads of people yelling about a housing bubble for years. Yale’s Robert Shiller and Princeton’s (and the Times‘s) Paul Krugman to name just two that even Fed governors couldn’t ignore. Here’s a Shiller chart that ran in the Times in August 2005. Apparently, the Fed and consensus economists couldn’t see the problem here:

You really had to be out to lunch not to know there was a massive housing bubble going on. Bubbles always end in crashes and for such a huge portion of the economy, it was bound to be damaging.

The Times gets at the fundamental problem with the Fed board in this paragraph:

The transcripts of the 2006 meetings, released after a standard five-year delay, clearly show some of the nation’s pre-eminent economic minds did not fully understand the basic mechanics of the economy that they were charged with shepherding. The problem was not a lack of information; it was a lack of comprehension, born in part of their deep confidence in economic forecasting models that turned out to be broken.

It’s true that the board was hearing reports that should have raised serious questions and didn’t, but it’s also true Fed’s economists were giving the board wildly false information at the same time, as the Post reports from the June 2006 transcripts:

A Fed economist reported that “we have not seen — and don’t expect — a broad deterioration in mortgage credit quality.”

One wonders what lofty ranks said unnamed Fed economist occupies now.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.