The New York Times runs a pretty amusing story on Tim Geithner’s Goldman past—you know, the one he never had.

Just as the Geithner aide’s humor fell flat, likewise newspaper corrections, Mr. Geithner’s objections to TV news interviewers and his staff’s work to spread the boss’s résumé have failed to dispel the belief that Mr. Geithner is a former Wall Street banker, or more specifically, a Goldman guy.

That perception over the last 20 months has united liberal and conservative critics but reflects a broader antagonism against the government bailouts for which Mr. Geithner has been a frontline architect.

Gee, I can’t imagine why people think Geithner worked at Goldman (a former Audit funder) or on Wall Street.

It would have been good to spell some of that out.

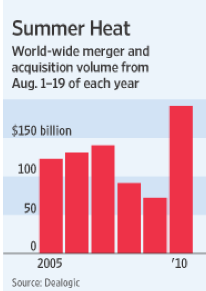

— The Wall Street Journal runs a chart above the fold on A1 trying to back up its story that deals are again on the march:

Yeah, I don’t think so. It’s a chart of “World-wide merger and acquisition volume from Aug. 1-19 of each year.” That’s so narrow and arbitrary a timeframe as to be totally meaningless.

Want proof that it doesn’t matter? This year is the highest year in the chart by far, but 2010 is nowhere near the crazed dealmaking of 2006 and 2007.

This is just charting noise, and the WSJ of all places ought to know that.

— Reuters editor-at-large Chrystia Freeland has a dead-on piece at The Huffington Post on multinational corporatism and the economy.

Here’s the good news about China’s emergence as the world’s second largest economy — US business has figured it out. And here’s the bad news — while US companies can go global, most US citizens can’t. The result, in this age of globalization, is a growing tension between the interests of America’s business leaders and the interests of much of its middle class. Indeed, the most important fault-line in American politics may not be between Democrats and Republicans, it is between those businesses and business people who are succeeding in the global economy and those who are not…

… the equally important truth is that the twin revolutions of globalization and technological change are disproportionately benefiting the global super-class and the middle class in emerging markets like China and India — while leaving much of America behind. America’s business leaders need to figure out how to help America’s middle class join the global economic party — or face a populist backlash which will make Barack Obama look like Milton Friedman.

More, please. This was all too brief.

(By the way, read Freeland’s excellent piece on “The Rise of Private News” in the current issue of CJR)

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.