The unemployment crisis has dragged on and on, but reporting about its real-life effects just hasn’t kept up. Hopefully the business press will look at the Pew Research Center’s impressive—and alarming—new report on the recession. It’s a great guide to some of the many stories still to be told.

I’m talking about stories that go beyond the top line numbers, like the 9.7% unemployment rate—which some forecasters say could go up to 9.8 % when the Labor Department releases new data on Friday. As The Wall Street Journal reported in its early look at the Pew study, that simple number just doesn’t get to the full story:

Out of the 13 recessions the U.S. has endured since the Great Depression of 1929-33, “none has presented a more punishing combination of length, breadth and depth than this one,” write the report’s authors. Unemployment data “don’t fully convey the scope of the employment crisis that has unfolded during the recession.”

The Pew report, “How the Great Recession Has Changed Life in America: Balance Sheet at 30 Months,” is ambitious. It’s based on two sources: a late May telephone survey of 2,967 adults across the country, and a Pew analysis of government economic and demographic data. And its findings are grim. As the authors write, “the Great Recession has led to a downsizing of Americans’ expectations about their retirements and their children’s future; a new frugality in their spending and borrowing habits; and a concern that it could take several years, at a minimum, for their house values and family finances to recover.”

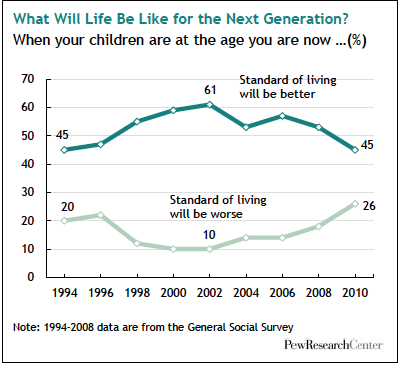

There’s a lot here, including an important topic that, we’ve noted before, has received far too little attention: the disproportionate ways that blacks and Hispanics have been hit by the recession. There’s also good information on the ways people are adjusting their spending, and their retirement expectations. Check out this distressing graph, which starkly illustrates Americans’ deepening skepticism about the standard of living for future generations:

I’d love to read about how that shifting view about the future is effecting how people live their lives today.

The Journal did well to focus on a few stats that really illustrate how much that top line unemployment number doesn’t tell us about what’s really going on:

But not even those who have kept their jobs have avoided hard times. Nearly three in 10 working adults say they have had their hours reduced. Almost a quarter suffered a pay cut, while 12% were forced to take unpaid leave and 11% had to switch to part-time from full-time work.

Among workers 50 to 64 years old, 27% reported that their salaries were reduced, compared with 22% of workers 30 to 49 and 20% of those 65 or older. Among those 50 to 61 years of age, 60% predicted they would delay retirement because of the downturn.

More than a quarter, or 26%, of those who are currently working had at least one stint of unemployment in the past 30 months.

And a quarter of those who are working again say they had to accept part-time work after losing a full-time job.

Keep that in mind the next time you hear that unemployment number.

The Washington Post also previewed the report, and looked at how people are coping:

Four in 10 adults say they have tapped savings and retirement accounts to make ends meet. Others have sought help from friends and family. Almost a quarter say they have borrowed money from someone. And one in 10 — including 24 percent of workers from 18 to 29 years old — say they moved back in with their parents to weather the economic storm.

Wow. Nearly a quarter of 18- to 29-year-old workers moving back in with their parents. Is there a sitcom about that yet?

The Post also pulled out an interesting bit of data about what life, and the economy, might look like when the recession finally ends:

The new, more frugal lifestyles may outlast the recession and its immediate aftermath, the survey indicated. Nearly half of respondents say they plan to save more; nearly a third say they plan to spend less and 30 percent say they plan to borrow less.

As we’ve said before, the unemployment story is a hard one to tell. The New York Times has done great work on the beat, looking where others aren’t and finding human stories to really get at what’s going on.

But this is a story that clearly isn’t going away anytime soon. It’s fundamentally shifting how Americans live their lives, and what they think about their futures, and it’s a story that others need to start telling. Well done to Pew for offering a great resource on how to get going.

— Further Reading:

Deploying Journalism on Unemployment

Holly Yeager is CJR’s Peterson Fellow, covering fiscal and economic policy. She is based in Washington and reachable at holly.yeager@gmail.com.