We’ve been talking a lot about the bubble lately.

Not that bubble:

So, I couldn’t let this go by. If you want a good example of someone stuck in the bubble, read The Wall Street Journal‘s Evan Newmark, who’s one of the only people on the planet brave enough to defend the AIG bonuses this morning.

I would have let this pass without comment but for Newmark’s drawing equivalence between AIG’s bonus babies and the rest of us:

In the past few years, the greed at AIG wasn’t all that different from the greed on the rest of Wall Street–and it wasn’t all that different from the greed on Main Street either.

Let’s face it. If we look in the mirror, we will see those AIG bonuses staring right back at us.

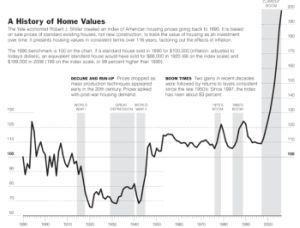

Um, no, actually. Most of us see people who didn’t gamble beyond what folks like Newmark have always told us: Invest your money in stocks and over the long haul you’ll win (oops). Most of us who did buy houses in the other bubble didn’t do it to get rich; we did it because pundits and brokers told us we’d never be able to afford a home if we didn’t do it now. We don’t see people who created financial weapons of mass destruction and lend hundreds of billions of dollars on zero collateral. Maybe our mirrors are a little spotty—most of us have don’t have maids.

But you can see where Newmark’s coming from a mile away—blame the borrowers!

In good times, people get whatever they can. That is how millions of Americans ended up lying on mortgage applications, speculating in real estate and then defaulting on their inflated mortgages. It is greed–and it happens to almost everybody.

Think about your own behavior in the giddy pre-Crash years. Did you bully a raise from your boss when one of your colleagues left? Did you buy a little condo in Miami to cash in on the boom? Did you throw more money into brokerage stocks as they rose higher and higher?

Well, outside the bubble the answers for 99 percent of us are : No, no, and no.

And we didn’t get untold hundreds of millions of dollars in compensation over the years for pushing the financial system off the precipice and walking away scot-free—with another couple of hundred million dollars from taxpayers.

Don’t you get it? These AIG folks are people in positions of enormous power and they have already been paid enormous sums of money. Astronomical sums of taxpayer money have been doled out because of them. Without that bailout, AIG would have gone flat busted in September and they’d be in the back of the line of creditors fighting over scraps. Equating Joseph Cassano, say, with Joe Blow buying a condo in Florida is insane.

It’s nice to see Journal readers ripping this junk to shreds in comments:

Here’s “AgentG”:

If a CDS was sold and the issuer was unable to cover the risk, then this smacks of fraud. The sheer magnitude of the consequences demand that some legal remedy be pursued, even if it means retroactive regulation, clawbacks or other actions by the government. Letting such reckless and ruinous actions stand as legal without consequences for the perpetrators would be a pitiful comment on the rest of us, and would represent the total fecklessness of our political system.

And “Nothing Like You” says it better than I could:

You should not presume, just because you are greedy and reckless, that I am too. I did not invest in speculative real estate in markets that I was not familiar with and that showed signs of over-inflation. I did not buy stocks as they reached all time peaks simply because they had been going up. I have never bullied a raise from my boss. I demonstrate commitment and expertise that warrant promotions and raises based on merit. I have always worked without an employment contract–if I do well, I keep my job; if I fail, I will lose it. This just makes sense. That is the American way.

The idea that doing things that are “certainly reckless and absolutely ruinous” are not wrong, simply because they are not illegal is despicable. All you have really managed to say in your article is that YOU are greedy, reckless, and ruinous, and that you attempt to rationalize that by suggesting that everyone else shares your lack of moral fiber.

In short, you are the problem.

I looked back through the last couple months of Mean Street, to make sure I had a good handle on where this was coming from—and also so you don’t have to. Here are some headlines:

“Obama’s Dow 5000,” February 23

“Mr. Obama, Please Return to Planet Earth,” February 25

“Obama Taxing the ‘Wealthy,’ Killing America,” March 2

“Barack Obama, the Jeff Immelt of U.S. Presidents” (on how foolish it was for Obama to try to call a stock-market bottom), March 4

“Our Hero Calls a Stock Market Bottom,” March 11

Now, I’ve said I’ve not been a fan of Obama’s start on the economy but have tried to dispense with the lunacy that the cratering markets are his fault (he’s almost been in office two months now!), so you know I’m not going to like this line of argument.

But I’d like to point out my favorite part of the “Obama Taxing the ‘Wealthy'” column:

Everyday, these “wealthy” people ask themselves the questions that determine the fate of the economy.

Why donate to the museum or cancer charity this year? Why go to Philadelphia for the three-day weekend? How much longer can we afford to send the kids to private school?

The poor, poor “wealthy” people might have to send their kids to school with the unwashed masses. I’m sorry, I just can’t work up much outrage over that.

I’m somehow more concerned about the poor, poor “poor” people. You know, the 90-year-olds who shoot themselves when the sheriff comes to evict them. The kids who can’t even afford school supplies or a cafeteria lunch, much less $30,000-a-year private-school tuition, because their parents have lost their jobs. The folks who are living in tent cities in places like Sacramento, not in a co-op on the Upper East Side of Manhattan.

Visit msnbc.com for Breaking News, World News, and News about the Economy

The “wealthy,” as Newmark puts it, will be just fine, if less well off (mainly because of the doings of other wealthy people!). It’s the poor and middle class we need to be really worried about.

Obviously.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.