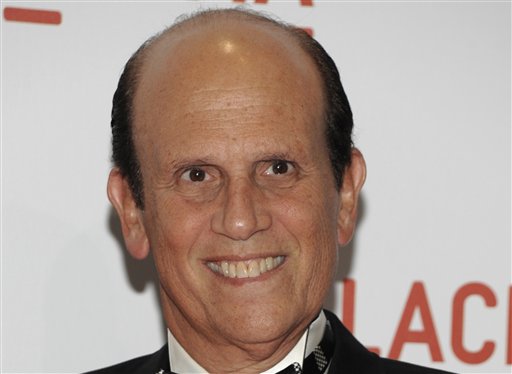

So, who is Michael Milken, anyway?

According to the Washington Post he’s “a financier with numerous philanthropic ventures in health and education,” who just donated $50 million to George Washington University’s public health school.

But whatever happened to this Michael Milken?

That’s the Wall Street kingpin, father of the junk-bond industry, stepfather to the leveraged buyout/private equity business, whom the feds charged with 98 counts of fraud, racketeering, and insider trading in 1989.

Milken pleaded guilty to six counts of securities fraud, paid $600 million in fines, was sentenced to 10 years in federal prison, and spent 26 months behind bars. He was also banned for life from the securities industry, which means he hasn’t been a financier for about a quarter century. What he did for a living at soon-to-be-bankrupt Drexel Burnham Lambert was helping fund a marauding leveraged-buyout industry later held in such low regard that it had to rebrand itself as “private equity” and playing a key role in the financialization of the economy

But it’s true, he has “numerous philanthropic ventures in health and education.” Right, and Imelda Marcos is a politician whose shoes garnered their own museum.

I asked the WaPo why it left off an obviously salient part of Milken’s past and will update when/if I hear back.

Six hundred million dollars may not sound like much in the wake of the most recent Wall Street legal morass , but it’s $1.1 billion in today’s dollars. Put it this way, that’s twice what Goldman Sachs paid to put its CDO fraud behind it and it’s about 23 times what Angelo Mozilo had to pay to settle fraud allegations against him.

Even after that giant fine, Milken remained a centimillionaire many times over, and is worth $2.5 billion today, according to Forbes.

It’s hardly the first time this past has been airbrushed. In 2011, Mother Jones caught the Los Angeles Times and the Associated Press neglecting to mention Lowell Milken’s past in a story about his contribution to UCLA. Milken was banned for life from the securities industry for his role at Drexel Burnham Lambert. Such decorum is unwarranted, to say the least.

The Post‘s big miss came less than a week after The Wall Street Journal editorial page ran a fallacious op-ed from Milken that identified him only as “chairman of the Milken Institute.” In it, Milken blamed the government for the housing bubble and financial crisis—an argument that has been discredited and debunked ad nauseum—and doesn’t mention a word about Wall Street, which was the key actor in the mess:

Housing’s 2008 collapse led to the U.S. Treasury takeover of Fannie’s and Freddie’s obligations even as the Federal Housing Administration increased its guarantees to more than $1 trillion and the Federal Reserve stepped up purchases of mortgage-backed securities. Federal debt surged.

Americans will eventually have to pay for that through some combination of inflation, higher taxes, higher interest rates or reduced benefits and services

Wall Street’s securitized loans were vastly more likely (more than four times more) to get into trouble than Fannie and Freddie’s.

And this is one of the worst bank apologies yet (emphasis mine):

The Consumer Financial Protection Bureau now wants to tip the scale even more against lenders by asserting the legal theory of “disparate impact.” Consumers can sue if the volume of loans to any racial group or aggrieved class differs substantially from loans to other groups. No intent to discriminate is required, and it’s illegal for a mortgage application to ask the borrower’s race. Financial institutions trying to avoid making bad loans by implementing prudent underwriting practices can inadvertently get in trouble. A bank forced to pay a fine one year because it irresponsibly made “predatory” loans to people with bad credit can be fined the next year for not making similar loans.

Somebody’s been reading too much Peter Wallison. Unfortunately, it’s just not true .

It ought not be surprising that you shouldn’t take the word of one of the most notorious Wall Street figures of his age. But that’s exactly why journalists shouldn’t deep-six who Michael Milken was, no matter what he’s done since.

ADDING: Milken also makes a whopping fact error in the blockquote above. He says, “it’s illegal for a mortgage application to ask the borrower’s race”, but it’s illegal not to ask that question under the Home Mortgage Disclosure Act.

(pictures via the Associated Press)

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.