Mitt Romney’s taxes were all over the news last month when it turned out he paid just 13.9 percent of his $22 million 2010 income in federal taxes.

That turns out to be high compared to some of the tax returns filed by hotel giant Marriott International when Romney served on its board of directors. That 13.9 percent is twice what Marriott paid one year when Romney headed its audit committee, thanks to tax schemes that got the company successfully sued (twice) by the Justice Department.

Bloomberg News’s Jesse Drucker has the scoop here as he continues to dig up tax shelters with colorful names. We’ve seen the Double Irish, the Killer B, the Deadly D, and now Son of BOSS.

Bloomberg paints a picture of overly aggressive tax avoidance while Romney was on the company’s board. Senator John McCain, long before he was Romney’s 2008 opponent, hammered Marriott, calling the tax shelters a “scam.” Two IRS lawsuits resulted in federal court rulings against the company that recovered hundreds of millions of dollars in unpaid taxes. And the company shelters cash in a shell company in Luxembourg, to boot. Here’s a quote on Son of BOSS:

“This is pretty much the poster child for those classic early tax shelters: you use a hyper-technical reading of the tax law to obtain what are, by any standard, unwarranted tax benefits,” said Robert Willens, a tax-accounting analyst in New York who advises investors.

And here’s Bloomberg on another of Marriott’s tax-avoidance plans, one that didn’t get it in trouble with the authorities, though the IRS questioned it at least twice.

In 2001, Marriott bought four synthetic fuel plants to use the credit. Companies could get the benefit by producing fuel after they sprayed coal with various substances, regardless of environmental improvement from the procedure. The process gave rise to a derisive nickname for the subsidy: “Spray and pray.”

Such credits cut Marriott’s tax bill sharply. In 2002, its first year receiving the benefit, Marriott legally claimed $159 million of such credits, cutting its effective tax rate to 6.8 percent.

I went back through the clips to see if there was much reporting on whether this synfuel business had any real environmental benefit or if it was purely for tax purposes. There was less than I would have hoped, but Don Barlett and James Steele did have a 2004 Time cover story on the industry, which it called “The Great Energy Scam.”

Steele later told NPR that:

…we asked several companies that run these plants–and plants is, by the way, a glorified name for these; they’re not very elaborate. We asked several companies, `Let us look at what you’re doing, let us see the process. Nobody would let us on site really for any of these facilities. And nobody would, in many cases, even tell us who their silent partners were.

It’s not hard to imagine why. Here, Time quoted Utah-based Headwaters, one of Marriott’s suppliers talking about how you just needed to spray stuff to change the coal a bit, not improve its environmental performance (though it said it did so), which was the intent of the tax credit:

“The tax code does not require you to show a change in the coal’s performance,” says Headwaters spokesman John Ward, whose company’s processes are in use in 20 synfuel operations in nine states. “For the tax credit, you just need to show there has been a substantial chemical change.”

The IRS later ruled that “synfuel facilities in general did not meet its scientific standards,” in the words of a 2004 Reuters story, but it didn’t revoke past credits.

The AP reported back in early 2008 that Marriott shuttered the synthetic-fuel business because the tax credits expired. Marriott itself said in its fourth quarter 2007 conference call that the synthetic-fuel business earned it $400 million in net income in just six years.

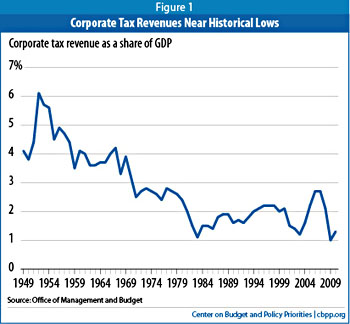

Which is a big reason why its tax bill has been so low. And a big reason, writ large, for why corporate tax bills in general are so low:

So this is a twofer for Bloomberg: Good reporting on a prominent politician’s business past illustrates a bigger issue.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.