Who are the 47 percent, why were Mitt Romney’s comments on them so wrong, and how did Romney come to such a misunderstanding of the country?

First, for background here’s Romney’s quote:

All right, there are forty-seven per cent who are with him, who are dependent upon government, who believe that they are victims, who believe the government has a responsibility to care for them, who believe that they are entitled to health care, to food, to housing, to you-name-it. That that’s an entitlement. And the government should give it to them. And they will vote for this President no matter what … These are people who pay no income tax…. My job is is not to worry about those people. I’ll never convince them they should take personal responsibility and care for their lives.

It’s worth noting, as few in the press have done, that Romney’s comments jibe with the fact that he has campaigned on cutting the earned-income tax credit and child tax credit, which would effectively raise taxes on much of the 47 percent. He’s saying here that Obama’s supporters are essentially welfare queens who pay no taxes, and he’s said before, in so many words, that he would like to tax them.

But as many others have already pointed out, Romney’s statement, uncovered by Mother Jones, isn’t just politically dumb—particularly at a $50,000 plate fundraiser hosted by a private equity guy—it’s a toxic combination of misleading, false, and hypocritical.

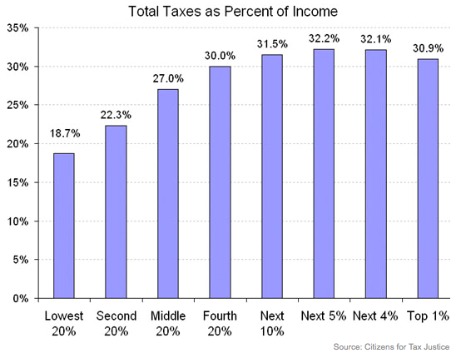

— Misleading because though Romney does say “income tax,” there are lots of other taxes in American life, most of which hit the poor and middle class far harder than the rich. Payroll taxes, excise taxes, sales taxes, and state income taxes all hit the poor, which results in an overall tax system that looks like this:

Just 8 percent of non-elderly households paid no federal income or payroll taxes.

— False because many and maybe even most of the people in that 47 percent vote for Republicans, not Democrats. A good chunk of them are old people on Social Security, almost all of whom worked for decades all the while paying into the social-insurance system. Demographics have swelled that number. Some are young students.

But the vast majority of the rest are people who don’t need a quarter-billionaire to convince them to “take personal responsibility and care for their lives” since they are the working poor and/or lower middle class families, a sizable percentage of whom will vote for Romney.

— Hypocritical because much of the increase in those not paying federal income tax is due to conservative Republican policies like the earned-income tax credit put in place by Ronald Reagan and George W. Bush.

Because Republicans are mostly opposed to significant minimum wage increases, because they almost all oppose bolstering collective bargaining, they’ve decided to subsidize low-wage work with tax credits. The Washington Post‘s Ezra Klein ably deconstructs this:

But now that those tax cuts have passed and many fewer Americans are paying federal income taxes and the rich are paying a much higher percentage of federal income taxes, Republicans are arguing that these Americans they have helped free from income taxes have become a dependent and destabilizing “taker” class who want to hike taxes on the rich in order to purchase more social services for themselves. The antidote, as you can see in both Paul Ryan and Mitt Romney’s policy platforms, is to further cut taxes on “job creators” while cutting the social services that these takers depend on. That way, you roll the takers out of what Ryan calls “the hammock” of government and you unleash the makers to create jobs and opportunities.

So notice what happened here: Republicans have become outraged over the predictable effect of tax cuts they passed and are using that outrage as the justification for an agenda that further cuts taxes on the rich and pays for it by cutting social services for the non-rich.

— Hypocritical because many of those folks not paying federal income taxes actually pay higher federal tax rate, than an insanely rich person like Mitt Romney, who lives off tens of millions of dollars a year in investment income, does. As Klein notes, “when you account for both sides of the payroll tax, they paid 15.3 percent of their income in taxes, which is higher than the 13.9 percent that Romney paid.”

So how does a presidential candidate and former governor come to such a fundamental misreading of a country (whose citizens work longer hours than almost any other industrialized country, by the way)?

Romney’s misconception didn’t come from nowhere. It’s an article of faith on the right fostered by the far-right wing news media’s house of mirrors, especially those of The Wall Street Journal editorial page and Fox News.

A decade ago, the WSJ famously called people who are too poor or too old to pay federal income taxes “Lucky Duckies” a decade ago. Ayn Rand called them “looters” and “parasites”, which Romney’s running mate Paul Ryan softened to “takers” and “makers,” language also used by the WSJ.

Fox News has relentlessly pounded on the “takers” meme, while glorifying the “makers.” As usual, Jon Stewart had the best criticism of this news media house of mirrors more than a year ago.

Part one:

Part two:

If you want to figure out where this gaffe originated, watch them both all the way through.

— Further Reading:

Lucky Duckies waddle onto the WSJ news pages

Zombie Lie Laboratory Creates 62 Percent Tax Rate Plan

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.