The headline of the moment is that US authorities are poised to arrest two JP Morgan officials for allegedly covering up losses in the London Whale trading debacle of last year.

Whether this signals a newfound aggressiveness in white-collar prosecution at the federal level remains to be seen. Here’s hoping.

But beneath the surface, evidence has been quietly piling up to show that the older, really consequential scandal, the Global Financial Crisis, was accompanied by fraud of a systemic nature.

A new Columbia Business School research paper, for instance, is one of the more rigorous examinations testing for the existence of systemic fraud in the mortgage aftermarket. The Economist‘s Free exchange blog wonders whether the paper might be the “smoking gun” that finally proves the misrepresentations about underlying mortgages was a big driver of the crisis.

Actually, at this point, the crisis is starting to look like the mansion in Clue, with smoking guns, candlesticks, daggers, ropes, lead pipes, not to mention nuclear waste, in every room.

But the blandly titled “Asset Quality Misrepresentation by Financial Intermediaries,” by Tomasz Piskorski and James Witkin of Columbia and Amit Seru of the University of Chicago, is the most rigorous fraud study, with extremely conservative methods, that I’ve seen. And it’s pretty damning.

The paper looks at the question of what investment banks told bond buyers—pension funds and other institutions around the world —about the actual mortgages that made up the mortgage bonds they were selling. Specifically, the researchers honed in on two very checkable metrics of loan quality: loan-to-value—how much the property was worth relative to the amount borrowed on it—and whether the property was going to be owner-occupied or bought as an investment to rent out. Obviously, the latter kind is much more likely to default, and mortgages backed by a lot of equity are also less likely to default; the owner can usually just sell it first.

It’s often said that bond buyers had access to relevant information about the quality of mortgages—if only they had bothered to look. But as the Economist points out, they didn’t have access, as the study’s authors did, to Equifax, the credit agency that knew both the borrowers’ total debt burden and their primary address. This is a pretty clever method of crosschecking mortgage data.

To me, the more interesting fraud indicator of the two is how often the presence of second-liens was concealed. As the study’s authors point out (with my emphasis), this kind of misrepresentation, “clearly indicates that the distortion of information occurred within the boundaries of the financial industry, as some institutions obviously knew the presence of other loans on a property, especially if their loans were behind someone else’s.

This study presents its methodology as quite conservative. And while it’s only a working paper and not yet peer-reviewed, it does seem so to me. Among the results (my emphasis):

[M]ore than 27% of loans obtained by non-owner occupants misreported their true purpose and more than 15% of loans with closed-end second liens incorrectly reported no presence of such liens. The propensity of banks to sell loans that misrepresented asset quality increased as the housing market boomed, peaking in 2006.

Overall, more than 9% of loans had one of these misrepresentations in our data. Note, however, that because we look only at two types of misrepresentations, this number likely constitutes a conservative, lower-bound estimate of the fraction of misrepresented loans.

For the sake of discussion, let’s consider that the lower bound. Now look for a second at a discussion of the level at which the fraud might have occurred—borrower, broker, lender, bond seller, or somewhere else? Finding that out is usually a prosecutors’ job.

Still, the (very opportunistic) authors were able to get lender-level data from the bankruptcy of the hard-partying gang at New Century, which, one could say, was one of the “worst” actors. But, really, how to choose among Indy Mac, Countrywide, CitiFinancial, Wells Fargo, Lehman’s EMC, Merrill Lynch’s First Franklin, etc. etc.? Mike Hudson’s book makes a strong case for Roland Arnall’s Ameriquest as a leader in driving the mortgage market off the rails and into the gutter.

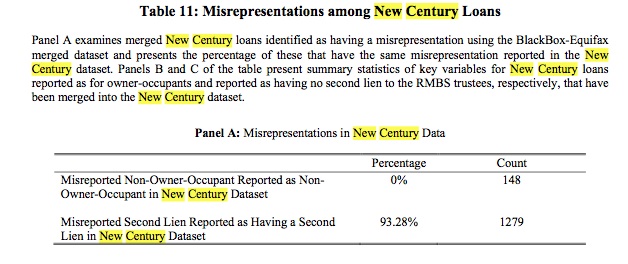

Still, it’s New Century’s records that we’ve got, and they make a strong case that the chain of blame starts, even if it doesn’t obviously end, with the lender. The authors found for instance that of 1,279 loans found to have misrepresented the presence of another lien, 93 percent actually had the correct information in New Century’s own database.

So, when New Century misrepresented a loan, which was often, it almost always knew better. Does this absolve the bond underwriter? Of course not. But it does show what a shark tank the financial industry had become.

Not to belabor this, but it needs to be pointed out that this work in an academic forum meshes perfectly with so much of the data that has been bobbing to the surface since we’ve all moved on from the crisis to cover the Whale, Libor, and various other financial-industry disasters.

The lawsuits brought by Fannie and Freddy’s conservator, the Federal Housing Finance Agency, against Goldman, JP Morgan, Bank of America, and practically every other brand name in finance, are a treasure trove of data similar to the Columbia study.

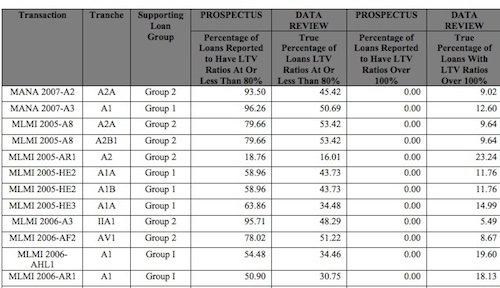

Here are just a few bits of data (among thousands) from a suit against Merrill Lynch that shows that when Merrill told the buyer loan-to-value rates underlying a security was 80 percent or less, there was a good chance it was a misrepresentation, and that as much as 18 percent of the time, there was no equity in the house at all. This is just a scrap of one table in one suit:

As Barry Ritholtz wrote last December, it’s easy to see why plaintiffs are getting traction in the legal war.

Add these to a few of the other important ratios we’ve heard. Richard Bowen, one of Citigroup’s top underwriters, famously warned Robert Rubin (yes, that one) in November 2007 that the bank’s Quality Assurance department was turning up an inordinate number of loans that either “fell outside of policy criteria” or had documents missing.

“QA for recent months indicates that 80% of these files fell into the category.”

Then there’s the 2007 under-appreciated epic study by The Wall Street Journal‘s Rick Brooks and Ruth Simon that found that more than 60 percent of subprime loans in 2006 went to people who actually had prime credit, FICO scores of 620 or higher.

And this obviously just a few bits of the trash continent that has bobbed to the surface since the crisis. Just imagine what will come with more time and study.

The crisis narrative can only go in one direction.

Dean Starkman Dean Starkman runs The Audit, CJR’s business section, and is the author of The Watchdog That Didn’t Bark: The Financial Crisis and the Disappearance of Investigative Journalism (Columbia University Press, January 2014). Follow Dean on Twitter: @deanstarkman.