James Pethokoukis of the American Enterprise Institute responds to my criticism of his misleading post on “why income inequality is a myth.”

At least Pethokoukis has walked it back a bit. A week ago, he wrote that inequality (and the fact that it has risen) doesn’t really exist:

5 reasons why income inequality is a myth — and Occupy Wall Street is wrong

Now inequality does exist, it’s just exaggerated:

Sorry, liberal media, income inequality really is way overblown

Which is progress, I suppose. You can at least make an argument that inequality has been overblown by the fact-based press or whatever. That’s an unfalsifiable opinion, however wrongheaded. What you can’t do is make an argument that it doesn’t exist or that it hasn’t grown dramatically over the last few decades. That’s as false as they come.

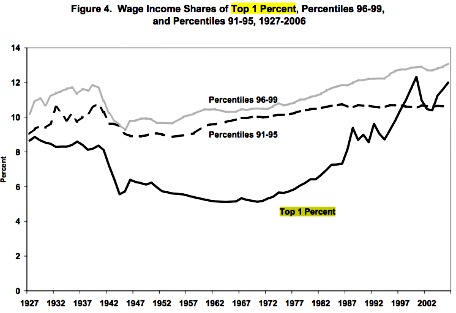

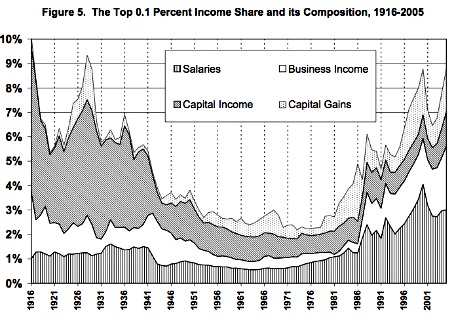

Pethokoukis quoted the economist Robert Gordon in his original post to show how “income gains were shared fairly equally,” which wasn’t true, as Gordon himself said in the first sentence of his paper and in its charts:

The New Republic‘s Matt O’Brien called up Gordon and confirmed his real view:

“The evidence on the long-term increase of inequality within the bottom 99 percent is ambiguous and complex, but what stands out like a searchlight is the unprecedented and increasing inequality between the bottom 99 percent and the top 1 percent,” Gordon told me.

Today Pethokoukis quotes Gordon again (emphasis is Pethokoukis’s):

This paper shows that the rise in American inequality has been exaggerated in at least three senses. First, the conventional measure showing a large gap between growth of median real household income and of productivity greatly overstates the increase compared to a conceptually consistent alternative gap concept, which increases at only one‐tenth the rate of the conventional gap between 1979 and 2007. … Second, the increase of inequality is not a steady ongoing process; after widening most rapidly between 1981 and 1993, the growth of inequality reversed itself and became negative during 2000‐2007.

My dispute wasn’t with Gordon’s research (I’m no economist) but with Pethokoukis’s relaying of it. It’s worth noting that even this Gordon paper specifically notes 2005 research of his finding that between 1966 and 2001 “only the top 10 percent of the income distribution had a gain in real income equal to growth in labor productivity.”

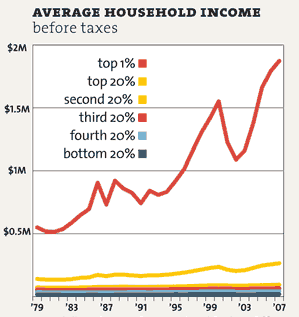

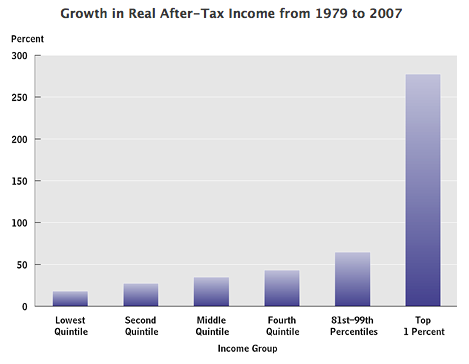

Even then, it’s unclear how productivity measures show that income inequality is overblown. This may be stating the obvious, but the best way to look at income inequality is to look at income (wealth inequality is even more dramatic largely because the poor have little to save). Again, the CBO:

Kevin Drum: posts this chart:

And writes:

Income inequality is mostly a phenomenon of the top 1%. This is absolutely true. The top 10% have done well over the past 30 years and the top 20% have done OK. Nothing spectacular though. The real action has been elsewhere: an enormous movement of income from the bottom 80% to the top 1% (see table at right). I’m not sure why Pethokoukis thinks this is evidence against the growth of income inequality, though. In fact, it’s evidence that it’s even worse than you think.

Here’s Pethokoukis’s second point in today’s post:

Chittum really likes studies from the union-backed EPI. But when I looked at the issue of middle-class stagnation, I went with analysis from the Federal Reserve, more likely free of political influence. And here is what a Minneapolis Fed researcher found:

Pot kettle black coming from the American Enterprise Institute, but we’ll go with it. Maybe union-backed think-tank studies are inherently less reliable about income inequality than ones from banker-run regional Feds (it’s worth noting that no fact or methodology is disputed, but bias is asserted)

Again, I’m not an economist. But Jared Bernstein is (at the liberal Center on Budget and Policy Priorities), and O’Brien quotes him disputing the Federal Reserve studies:

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.To make his case, Pethokoukis cites a pair of studies from the Federal Reserve Bank of Minneapolis that “nobody took seriously at the time, and they shouldn’t do so now,” according to Bernstein. These papers purported to show that real median incomes had increased more than was commonly believed by employing an alternate, lower price index to calculate after-inflation incomes. Bernstein told me it was a classic case of “plugging things in to get the result you want.”