The torrid growth in digital-only subscribers to The New York Times slowed sharply in the first quarter. Worse, advertising fell so sharply that the paper’s overall revenue declined slightly.

But it’s worth correcting some misimpressions about what those numbers really mean.

Quartz’s Zach Seward, for instance, writes a post headlined “The New York Times paywall has hit a growth wall,” but that’s not really true.

Six percent growth in digital subscribers is not hitting a wall nor is 8 percent circulation revenue growth. This line, while probably wrong, is at least unfalsifiable: “The current offerings may have taken the company as far as it can go.” That also will likely turn out to be too pessimistic, as I’ll argue below.

But it’s true that the torrid growth of The New York Times‘s paywall finally slowed seriously in the first quarter. The question, which is not at all answered, is whether this is a blip or the beginning of a trend. We’ll have a better idea when the second-quarter earnings come out in July. We’ll know for sure by next January or so.

Point is, it’s perilous to hinge your estimates on a single quarter, as I’ve shown myself with the NYT paywall. Check out this post from October 2011, when digital subscriptions slowed dramatically:

It seems clear the Times isn’t going to have half a million paying digital subscribers this time next year.

It ended up with 566,000.

So let’s unpack what we know (I’ll only talk about The New York Times in this post, not The Boston Globe, since NYTCo is selling it, and the Globe doesn’t yet follow paywall best practices).

The Times‘s 6 percent digital-subs growth from January to March was the slowest growth since the company launched its metered paywall two years ago. Much of this is due to the law of large numbers: As a subscriber base gets bigger, it becomes increasingly hard to grow it.

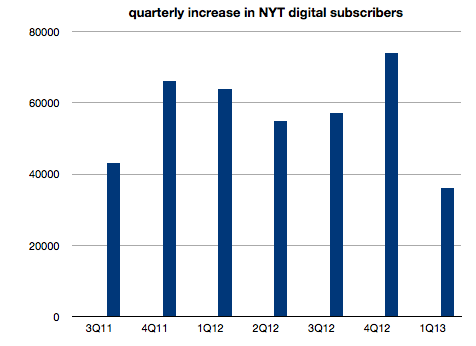

And the base had gotten very large indeed, with 640,000 digital subscribers by the end of last year. That number is now 676,000, and the 36,000 net new subs are the least added in any quarter yet, though it’s worth remembering that the second full quarter of the paywall back in 2011 wasn’t much better, with 43,000:

It’s also worth flagging that the year-over-year increase was a whopping 45 percent. But it will surely be very difficult for the NYT meter, as currently constituted, to snag the 60,000-subscriber growth it averaged in previous post-launch quarters.

Still, if you’d have said two years ago that the NYT would still be adding digital-only subscribers at 36,000 a quarter, the Times would have been thrilled. It’s not a small number, and it means incremental annualized revenue of about $6 million to $7 million.

(By the way, it’s worth noting that a not insignificant chunk of the paywall impact doesn’t show up in the subscriber numbers since the paper has intentionally steered readers to subscribe to the Sunday print paper. A Sunday subscription gets you free nytimes.com access, and delivery was actually up slightly in the first quarter).

As we have always said, direct digital subscription revenue are just one component of a reader-focused paywall strategy. You can’t expect to slow print circulation losses and charge more for the paper when readers can get all your content online for free.

Some, like the Orange County Register, have taken that idea to the extreme. It moved recently to an all-access, no meter plan that charges $30 a month whether you read it online, in print, or both. That disincentivizes readers from even ditching the paper for a cheaper digital subscription. I write about some of the problems with that in the next issue of the magazine, which will be on newsstands (kidding! Subscribe here) next week.

The Times‘s reader-focused strategy, even with digital-only subscriber growth slowing, still posted an 8 percent revenue gain from a year ago. That’s $16 million in new revenue. Less than half of that comes directly from digital-only subscribers. The rest comes from increased pricing power and online-only readers subscribing to the Sunday paper.

The problem is not circulation. It is, as always, advertising. Ad revenue declined in the quarter by $20 million, an 11 percent plunge. The strong circulation gains weren’t enough to offset that and overall revenue declined 1 percent. With the backdrop of the last seven years, though, keeping revenue to a 1 percent decline is nothing to scoff at.

Circulation is now 54 percent of the Times‘s revenue and climbing. Ads are just 40 percent and falling fast. Two years ago, as the paper launched its paywall, ads were at 49 percent and circulation at 45 percent.

My bet is that the Times, far from hitting a wall, will see slow to moderate growth in digital-only subscriptions for a long time to come. Even if it didn’t tweak its model, 676,000 is far fewer than the number it will have in five or ten years.

Look at The Wall Street Journal, for instance. Back in 1998, two years after it launched its paywall, sequential subscriber growth fell to about 4 percent in the fourth quarter. It took the Journal, which has the most successful paywall of them all, till late 2002—more than six years—to get to 676,000 subscribers. Hundreds of thousands of those weren’t digital-only since the paper charged print readers a lower fee to read online. A little more than a decade after that, the Journal has 1.3 million subscribers (including Barron’s). That happened even as it jacked up the cost of a WSJ.com digital-only subscription from $49 a year to $264 currently.

Now the NYT is exploring new products, including a cheaper subscription plan and a more-expensive one that will include some sort of access to events. If I were looking to charge for specialized content, as the NYT says it is, target No. 1 would be the paper’s DealBook business site. Business journalism is just easier to charge for: Its readers have more money, many of them have expense accounts, and they make money off your information. A/B test that, NYT.

The risk with any cheaper plan is that the paper will cannibalize its subscribers paying $15 a month. There will inevitably be some cannibalization. The key is whether the growth of new-to-the-NYT low-dough subscribers will offset those losses. The Times will have to test this carefully also to make sure they do.

Be careful about over-interpreting results from one quarter. While much of the commentary has been negative, the NYT’s net income was down because of bad comps from the first quarter of 2012, when it unloaded some assets. But it’s operating profit was actually up 81 percent in the quarter (19 percent if you exclude accelerated depreciation from last year). The market sent shares up 5 percent on the earnings report, adding about $70 million to its market cap. Part of that is likely due to the announcement of the paywall expansion, but that’s just a natural extension of the company’s reader-focused strategy.

Meantime, CEO Mark Thompson said on a conference call with investors Thursday that the second quarter is looking better for ads. Let’s hope so. The paywall is pulling its weight, but the Times has to dramatically slow ad losses, while building new revenue streams to supplement reader revenue.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.