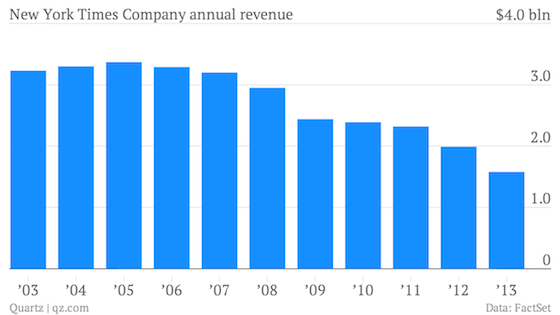

Quartz posts this graphic of New York Times Company revenues going back to 2003, asking “Can the New York Times’s online readership offset its prolonged ad slump?”

The Times has very real problems, thank you very much, but they’re not this bad. This is a good example of a chart that’s technically accurate, but really misleading, and a warning about using datasets out of context.

The problem here is that the Times Company has been shedding assets over the last two years and is not the same company it was even four months ago. It sold its regional papers in 2011, About.com in 2012, and The Boston Globe and Worcester Telegram & Gazette last year.

In their last full years under the NYT, the New England papers had about $394 million in sales, About.com had $111 million, and the regional papers had $277 million. That’s $782 million in sales the Times Company has unloaded since 2011.

While the revenue (and expenses) disappeared, the Times got half a billion dollars or so in exchange and used it to shore up its balance sheet. It converted flows to stocks.

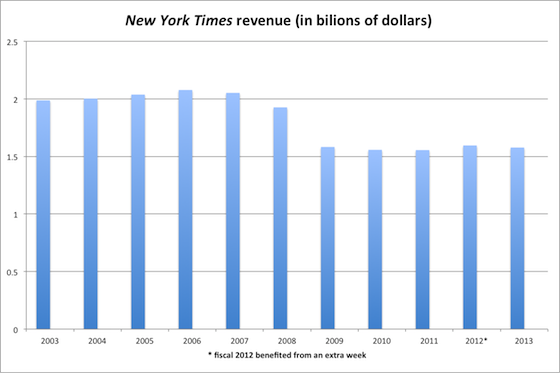

Here’s what the Times’s numbers actually look like on an apples-to-apples basis (and not adjusted for inflation):

What’s most striking about this chart is how flat the paper’s revenue has been since the recession. That’s entirely thanks to the paywall, which has offset the paper’s ad losses for three years now.

The Wall Street Journal messed up the NYT’s numbers too. The fiscal year 2012 had 53 weeks for some companies, with the last one tacked on to the fourth quarter. A quarter typically has 13 weeks, but the fourth quarter 2012 had 14.

So if you want to truly compare how a company did in the fourth quarter of 2013 to the prior year, you have to back out 2012’s extra week. This is not a small matter. One extra week means nearly 8 percent more days to take in revenue.

The WSJ, though, reports the NYT’s unadjusted numbers without noting the extra week that distorted them.

On a conference call with analysts, Times Co. executives blamed a 6.5% decline in online-ad revenue on a “glut” of Web ad inventory and increased use by marketers of so-called programmatic automated ad-buying systems, which have led to price declines.

The decline, excluding the extra week in 2012, was 0.2 percent.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.