A few weeks ago, I wrote that the press had become a bit too sanguine about all of the “green shoots” talk going around. The biggest concern is that we’re in something like the eye of a storm. The subprime tsunami has seemed to peak, but there’s another monster wave of foreclosures coming, this one driven by resets of adjustable-rate mortgages, especially so-called option ARMs.

So I’d like to tip the Audit’s green eyeshade to a couple of stories that point out this exact phenomenon.

First, Bloomberg News wrote last week about the option ARM overhang, noting that it’s not going to peak until more than two years from now, in August 2011.

Option ARMs are particularly dangerous because they backload the debt, allowing buyers to pay much lower payment in the early years of the note than if it were amortized like a standard thirty-year mortgage. In the case of negative amortization notes, borrowers don’t even have to cover the interest on the note in the early years, meaning the size of the note actually increases as the months and years go by.

For instance:

Shirley Breitmaier’s mortgage payment started out at $98 when she refinanced her three-bedroom home in Galt, California, in 2007. The 73-year-old widow may see it jump to $3,500 a month in two years.

But even the loony lenders of 2005, 2006, and, yes, 2007 knew the principal had to be paid at some point—although they told borrowers that prices would be higher when the reset came, so if they couldn’t afford it, they could just sell it and cash in. These “resets” are looming now.

More evidence that the state of California is just screwed:

California accounted for 58 percent of option ARMs, according to a report by T2 Partners LLC, citing data from Amherst Securities and Loan Performance.

On the glass-half-full tip: Save your cash and you’ll be able to get a sweet deal on a place there in a year or two. Somebody’s going to get rich doing it. But I digress.

The woman in the anecdote above? She’s likely to lose her home of forty-five years, refinanced on the advice of some shady mortgage broker:

Paul Financial LLC originated the loan and it was sold to GMAC, (Mortgage Modification Center head Cameron) Pannabecker said.

“This loan is a perfect example front to back, bottom to top, of everything that has gone wrong over the last five to seven years,” Pannabecker said. “The consumer had a product pushed on them that they had no hope of understanding.”

Bloomberg reports that $750 billion of these timebombs were created between 2004 and 2008.

Yesterday, McClatchy chimed in, asking in its headline whether option ARMS are “Worse than supbrime.”

It has a $230 billion figure for outstanding option ARMs now. I’m not sure why that number is so different from Bloomberg’s except that many of the option ARMs created in the first half of Bloomberg’s five-year span probably were sold to the greater fool or refinanced before home prices crashed.

I think one of these stories has a source numbers problem because the two have wide discrepancies in the number of outstanding option ARMs out there. Bloomberg says a million will reset in the next four years. McClatchy says there are about 564,000 total option ARMs in existence. Somebody’s wrong here.

One way or another, it’s a lot of houses.

This is great info on why we’ve gotten a bit of a reprieve this spring:

Option ARMs have triggers that reset to a new interest rate based on either a set timeframe or when debt exceeds some cap above the loan’s value. The spring drop in interest rates allowed many borrowers to escape a day of reckoning because the lower rates prevented a triggering of that cap.

That just postponed the problem, however, because most option ARMs have five-year automatic trigger dates.

McClatchy also notes that at the peak, option ARMs accounted for one of every seven home loans.

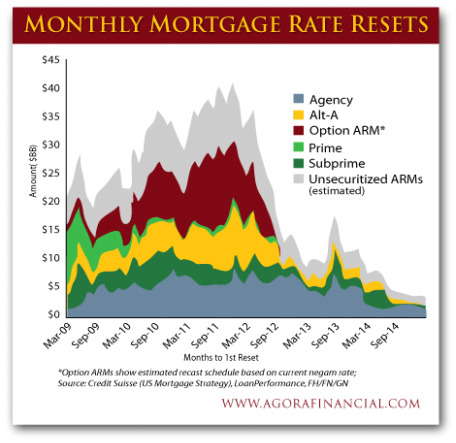

But option ARMs aren’t the only problem here. Traditionally amortizing ARMs have yet to reach the peak of their resets, too. Look at that great Credit Suisse chart again. It looks like resets will peak somewhere near the start of 2012.

The questions there are what will interest rates be then and how many will be adjusting up from artificially low teaser rates. If interest rates are significantly higher (and they’ve bounced off their lows recently)—look out. I just don’t know the answer to how much higher regular ARMs will reset, but I don’t think I’m going out on a limb to say the increases will be significant.

I dig that McClatchy namechecks good journalism by another publication, in this case a story by Audit favorite Mara Der Hovanesian:

In a prescient cover story on Sept. 11, 2006, Business Week magazine labeled option ARMs “nightmare mortgages” and warned that it “might be the riskiest and most complicated home loan product ever created.”

And this is excellent context:

Subprime mortgages caught the nation by surprise because of their short two-year resets to higher interest rates. Option ARMs reset over a longer horizon and thus are a slowly unfolding nightmare.

And it’s also great that McClatchy points out that we don’t know where this garbage is now:

Most were sold into a secondary market, where they were pooled with other mortgages and sold to investors as bonds or securities. The number of these loans is quantifiable, but banks aren’t required to disclose how many such loans they wrote. It’s unclear how many option ARMs remain on banks’ books and weren’t sold to investors.

Let’s close with this quote from McClatchy:

“They’re probably going to default at a rate that makes subprime look like a walk in the park,” warned Rick Sharga, senior vice president for RealtyTrac, a foreclosure research firm in Irvine, Calif.

Good efforts by both. “Green shoots” aside, it’s pretty obvious that the economy isn’t going to recover until the housing market bottoms out. Good luck with that.

This ride ain’t over yet. It’s good to warn the passengers.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.