The mythology of Treasury Secretary Hank Paulson got a helping hand recently from a spate of magazine cover stories unwilling to fundamentally criticize the man they present as our last best hope. The Great Man Theory may be out of favor in history departments, but not, alas, in the pages of the business press.

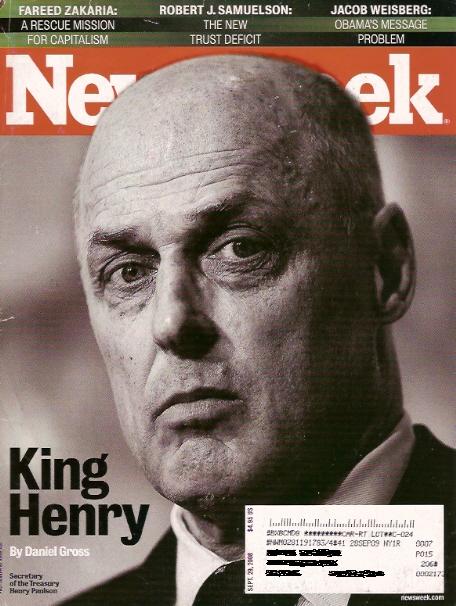

Exhibit A:

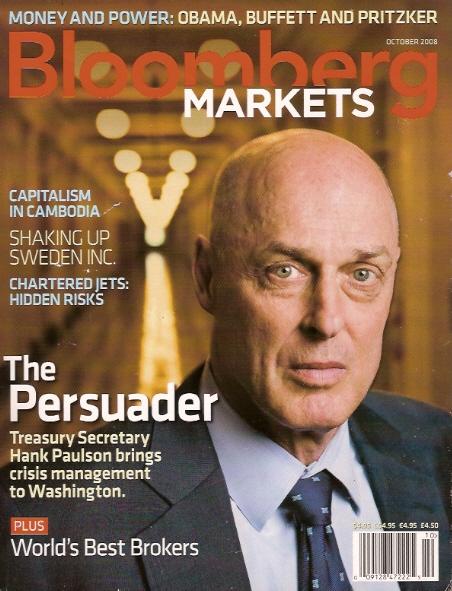

Exhibit B:

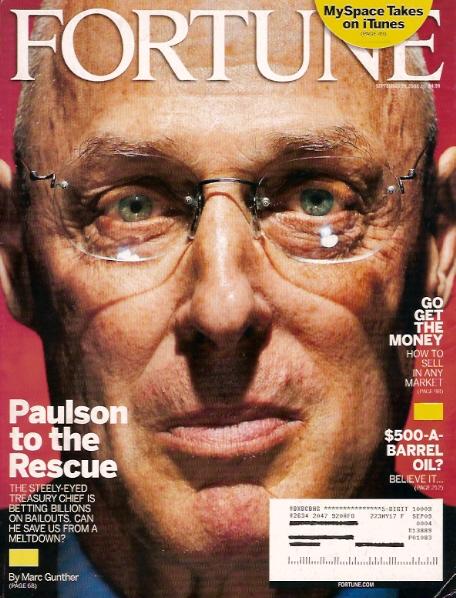

Exhibit C:

Furthermore, the timing of the stories, which came out during deliberations over the bailout plan—although two of the pieces apparently went to press too early to mention it—meant that they served as nice publicity for Paulson’s rescue bid. After all, how could we seriously doubt the judgment of that “steely-eyed treasury chief” staring from the cover of Fortune?

Or the dashing young football player poised to “tackle the mortgage mess” inside Newsweek:

Or the relaxed—notice the hands in pockets—but resolute former investment banker in the October Bloomberg Markets:

Each of these stories has a slightly different take on Paulson’s leadership style, but at base their takes are the same: This man may have critics, but woe to anyone who doubts his skills.

To support their claim to Paulson’s fitness for what has become a rather extraordinary job, the articles pointedly note that the man developed those skills at that bastion of finance Goldman Sachs—where Paulson enjoyed considerable success before choosing to dedicate his life to public service.

Bloomberg:

At the Treasury, Paulson is drawing in large part on the skills he honed during his 32 years in investment banking. Paulson’s signature style is to confront issues early, hold private meetings and build a consensus before announcing a deal, so that he’ll get the necessary backing, according to members of Congress and government staff who’ve worked with him.

We note that this observation doesn’t seem to have played out. At least not in recent weeks. From what we’ve read, not everyone who has worked with Paulson on the bailout would recognize this particular version of the Treasury secretary. Early intervention? No. Consensus? No. Necessary backing? Not at first.

And, in fact, these cover stories don’t even quite agree among themselves as to who Paulson is.

Fortune even points out that Paulson was “slow to acknowledge” economic trouble, although it softens the criticism by noting his “can-do spirit.” That spirit, we learn, “is valuable when tackling daunting problems, but is less helpful in spotting trouble on the horizon.” And since the piece is, after all, titled “Paulson to the Rescue” (or in the online version, “The Power of Paulson”), we shouldn’t be surprised that Fortune focuses more of Paulson’s can-do spirit than his limitations.

Newsweek, which calls Paulson “King Henry” on its cover, doesn’t so much present Paulson the smooth negotiator as it does Paulson the competent (if not always popular) man of action:

…Paulson has rankled some in Washington by conducting business like a Wall Street Master of the Universe: the marathon late nights and weekend meetings with a small group of people, followed by an unveiling of the result as a fait accompli.

But, and here is the key point, rankling or no rankling, Paulson is up to the task of saving us from disaster. Newsweek goes on to tell us:

In many ways, Paulson was the ideal person to deal with this mess. A 32-year veteran of Goldman, he helped take the venerable (and venerated) company public and served as CEO from 1998 to 2006, an era in which the firm prospered.

It was also an era in which Goldman helped bring on the credit crisis, but these cover stories are hardly the only ones to leave that important detail out.

In fact, this 2006 BusinessWeek cover story—which came out as Paulson first took off for Washington—does a better job of raising the right issues. Although this earlier cover story doesn’t foresee the current collapse, it does put Paulson in some context:

Think of Paulson as Mr. Risk. He’s one of the key architects of a more daring Wall Street, where securities firms are taking greater and greater chances in their pursuit of profits.

This is a smart point. And the current pieces should have made it.

But the fundamental problem with these pieces is deeper than a missed observation or clashing versions of the same person. The underlying problem is that they are a species of the Great Man theory that is all too prominent in the business press. In these stories, Paulson is not just the institutional face of the credit crisis, he’s a kind of stand in for that crisis. Rather than scrutiny of the system, of which Paulson is undoubtedly a key part, it’s Paulson front and center.

And so, as with any “great man”, his story needs bits of background that illustrate the formation of his current character. Each piece falls in line with this model.

Newsweek even starts to lay out the mythological groundwork in the first paragraph with Paulson “the former college-football star” who is “carrying the weight of the troubled markets on his shoulders.” Thank you, Atlas.

Bloomberg, going back to the beginning, writes:

Henry M. Paulson Jr. developed a taste for hard work and a love of nature while growing up in Barrington, Illinois, a semirural community of 10,000 about 35 miles from Chicago with large areas of wetlands and forest preserves. Paulson still owns a farm there with his wife, Wendy, whom he married 39 years ago in September. His father was a wholesale jeweler who raised Paulson to be a Christian Scientist and to become an Eagle Scout. At Dartmouth College in Hanover, New Hampshire, Paulson earned a degree in English and was a member of Phi Beta Kappa. He also was an all-Ivy League football player and a member of the Green Key Society, an honorary service group.

A profile should have biographical detail, of course, but look at the ones chosen. They support the picture of a man who was in Wall Street but not quite of it, who has strong ties to his family and the natural world, and who is dedicated to cultivating body and mind.

Fortune in particular plays up this view of Paulson, not only with the stock biographical details, but also is more explicit about what they say about the man:

Did you know that Hank Paulson was an Eagle Scout? Paulson, 62, grew up in Barrington Hills, a Chicago suburb, and he still comes across as a straight-shooting, down-to-earth Midwesterner, an image he does nothing to dispel. (Look for his cheap sports watch the next time he is on TV.) A Christian Scientist, he doesn’t smoke or drink, and he’s more likely to spend a Saturday night grilling hamburgers with friends at home than holding forth at a Georgetown salon.

This kind of biographical information shores up Fortune’s headline: “Paulson to the Rescue.”

And its subhead:

He came to Washington reluctantly. His job was almost a backwater. Today his task is momentous, wrestling down the greatest financial crisis of our time.

Trumpets please. And in case you still don’t get it, this sentence appears early on:

Paulson has established himself as a man of action, the tenacious firefighter working alongside Federal Reserve chairman Ben Bernanke to prevent an outright meltdown of the markets or, worse, the economy.

Add to this the photos accompanying the pieces, in which Paulson appears not just in suit and tie but as “Athlete of the Week” in Bloomberg:

And even sometimes with a fish, in Fortune:

Or a bird, in Newsweek:

At this point, Paulson is starting to look like a cross between Joe Namath and someone from Mount Olympus. Forget about Newsweek’s “King” Henry, just head straight to an even higher pay grade.

This wouldn’t be such a problem if the pieces didn’t end up serving as some pretty good pre-publicity for the bailout. By crafting a strong and reliable persona for Paulson, they also implicitly throw weight behind his decisions—even, like it or not, those yet to be made.

As we mentioned, the timing of these stories is strange because they came out either just before the $700 billion bailout proposal or shortly after. So while the finished products circulated in a press-wide flurry of publicity on the bailout plan and its aftermath, neither the biweekly Fortune nor the monthly Bloomberg mentions it, and the weekly Newsweek only devotes a few sentences to it.

Now, in the cases of Fortune and Bloomberg, we point out this gaping hole not so much as an editorial criticism but as an observation that business news is outpacing the magazines, especially these days. The key point is that these pieces were glaringly incomplete almost immediately—sometimes to the point of absurdity. Looking to the future, Bloomberg observes, “One of Paulson’s next challenges is to try to build a U.S. market for covered bonds.” Yeah, that and save the economy.

Because of the timing of the stories, Paulson gets largely favorable publicity without having to defend his bailout plan—which, as we now know, has a lot of problems. And because the stories focus on the man himself, even Newsweek’s knowledge of the bailout plan didn’t much improve its coverage:

Paulson again took out the bazooka: he and Bernanke crafted their plan to create a taxpayer-backed entity that would acquire mortgage-backed bonds from banks, and requested $700 billion from Congress to do so. Treasury also temporarily extended insurance to money-market funds. By the end of last week the stock markets were soaring.

In other words Paulson—now Rambo in addition to wrestler, firefighter and star of the gridiron—got it right.

Except that he didn’t. As the Times pointed out later,

[E]ven after the House finally passed the [bailout] bill on Oct. 3, markets remained in turmoil. It was not until Britain and other European countries moved to put capital directly into their banks, and the United States followed their lead, that some calm returned.

For an excellent take on the on-the-fly evolution of Treasury’s plan, read Joe Nocera’s October 25 column in The New York Times. He describes, among other things, how Paulson sold us on a plan to buy “toxic securities” and then decided to recapitalize banks instead, in an effort to free up credit.

But the kicker, according to Nocera, is that the banking industry “has no intention of using the money to make new loans.” Not only did the toxic-securities plan turn into a recapitalization plan, but the recapitalization plan is not what it seems:

It is starting to appear as if one of Treasury’s key rationales for the recapitalization program—namely, that it will cause banks to start lending again—is a fig leaf, Treasury’s version of the weapons of mass destruction.

In fact, Treasury wants banks to acquire each other and is using its power to inject capital to force a new and wrenching round of bank consolidation.

It appears that Paulson has a pretty good knack for PR. One way in which Newsweek notably tows the Paulson line is its statement about why the government didn’t save Lehman:

And although Lehman was in bad shape, unlike Bear Stearns it didn’t threaten to bring down the whole system.

This is Paulson’s argument. He made it on Charlie Rose and to The New York Times. The problem, as the Times piece points out, is that it is not at all clear the government should have let Lehman fail.

So we’ve had enough of great men. An alternative? We prefer the playfulness of the Economist cover:

The magazine doesn’t have a lengthy profile of Paulson, but rather a few pieces looking at both him and the bailout plan. The Economist supports Paulson, but also looks beyond him, as is clear immediately from the lead photo for its main piece on the bailout:

This piece, along with the cover image, pokes holes in the Great Man theory, which is to all of our benefit.

Elinore Longobardi is a Fellow and staff writer of The Audit, the business-press section of Columbia Journalism Review.