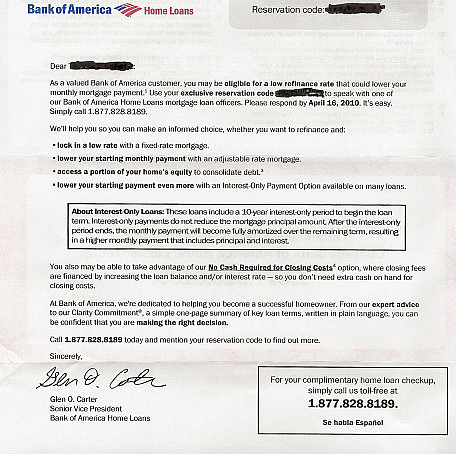

A relative of mine just got this in the mail from Bank of America Home Loans (ie: Countrywide) offering to refinance his home loan with a ten-year interest-only option ARM (well, it’s unclear if it’s actually an ARM or if it’s a fixed-rate mortgage, but I’d bet on the former). Also on offer: a second mortgage and a regular ARM.

Mind you this isn’t one of my Oklahoma relatives getting this offer in their non-bubble market. This one’s here in Seattle, a market that’s been hammered pretty bad in the crash (down nearly a quarter) and where house prices are still falling at an 8 percent clip year-over-year.

And my relative’s existing mortgage isn’t with BofA, so it’s not like they’re pulling a Wells Fargo here and trying to paper over losses and hoping the market rebounds in a decade.

So here’s a question for housing reporters out there: Why is BofA doing this and how widespread is it?

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.