Obama’s pitch to make the ultrarich pay as high a tax rate as their secretaries sent David Brooks into spasms this morning. But it’s worth calming down a bit and thinking about the numbers.

Here’s Brooks:

He claimed we can afford future Medicare costs if we raise taxes on the rich. He repeated the old half-truth about millionaires not paying as much in taxes as their secretaries. (In reality, the top 10 percent of earners pay nearly 70 percent of all income taxes, according to the I.R.S. People in the richest 1 percent pay 31 percent of their income to the federal government while the average worker pays less than 14 percent, according to the Congressional Budget Office.)

Notice the sleight of hand there? His first number is “all income taxes.” His second number is all federal taxes. Here’s how that sentence would read if Brooks didn’t try to pull a fast one:

In reality, the top 10 percent of earners pay nearly 70 percent of all income taxes, according to the I.R.S. People in the richest 1 percent pay 19 percent income tax rate while the average worker pays 9.3 percent, according to the Congressional Budget Office.

As Timothy Noah notes, Brooks ignores the fact that the top 10 percent take home half of all income in the country. I’d add that the top 10 percent controls 73 percent of the wealth and the top 1 percent accounts for nearly half that.

And the Buffett Rule wouldn’t apply to a measly millionaire whose effective federal tax rate is already 31 percent on $1,000,001 in salary and bonus a year. It would hit folks like Buffett—the super-rich who get most of their income from capital gains (or avoid it with tax shelters), which are taxed at less than half the rate labor is.

Buffett’s effective federal tax rate last year was just 17.4 percent, and he’s no outlier amongst his class. In 2008, the last data available, the average for the top 400 tax returns was 18.1 percent. That’s all federal taxes, including income and payroll taxes. One-third of them paid less than fifteen percent of their income. Not one of them paid more than 35 percent.

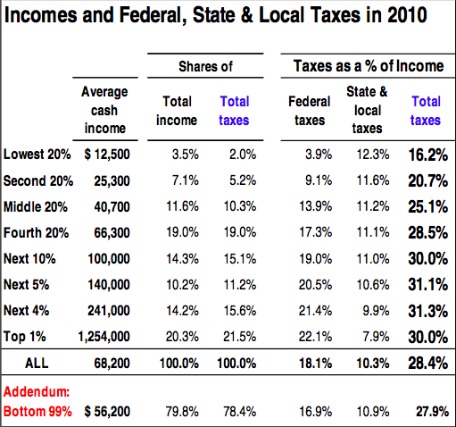

Plus, it’s always worth remembering that while the federal tax system overall is mostly progressive, the state and local system counteracts that, as this chart of 2010 overall tax-rate projections from Citizens for Tax Justice shows (h/t Jesse Drucker)

A taxpayer bringing home $100,000 a year pays the same overall effective tax rate as one bringing home $1.25 million a year, and they both pay just 1.5 percentage points more than someone making $66,000.

Just a few things to keep in mind when reading the likes of Brooks.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.