We’ve talked about how the press feeds into the questionable narrative that we’re in another housing bubble. Here’s a good example from Bloomberg News:

The Chicago area’s real estate swings have been less severe than in other locales. Phoenix home prices fell 56 percent from their peak in June 2006 to their trough in September 2011, according to S&P/Case-Shiller indexes. Since that bottom, prices rose 45 percent. In Las Vegas, which peaked in August 2006, prices dropped 62 percent until bottoming in March 2012. They’ve since climbed 42 percent.

By comparison, Chicago home prices declined 39 percent from the peak to their trough in March 2012. Since then, they’ve risen 23 percent.

Sounds scary. But while the numbers are accurate, they’re probably misleading to most readers.

While it’s an old truism that journalists can’t do math, the reality is that most people can’t do math, particularly when they’re just trying to read a story on the fly. So reporters and editors have to take care that their numbers aren’t just accurate, but that they’re perceived accurately. We’ll presume Bloomberg readers are much more numerate than, say, USA Today readers. But even they deserve more clarity.

To see what I mean, look at Phoenix. The way Bloomberg runs the numbers here, it looks at first glance like Phoenix housing prices have almost entirely recovered from the housing crash. Bloomberg’s setup would lead many readers to assume that Phoenix house prices are not far behind their 2006 peak—11 percentage points if you add them together.

But that’s a statistical illusion: Percentage declines matter more than percentage increases.

Say the average house in Phoenix sold for $100,000 in June 2006. A 56 percent drop would mean it went for $44,000 in September 2011. Since then, the average price has jumped 45 percent. But that means the price of the average house would now be $64,000, not $89,000. It’s still 36 percent below the 2006 peak—and that’s not accounting for inflation.

In real dollars, that house in Phoenix is actually worth 45 percent less than it was eight years ago. That’s not the impression we got from Bloomberg’s paragraph.

A better way for Bloomberg to phrase the Phoenix numbers would be “Phoenix home prices fell 56 percent from their peak in June 2006 to their trough in September 2011, according to S&P/Case-Shiller indexes. Since that bottom, prices rose 45 percent, but are still 36 percent below 2006 levels.

Look at how Bloomberg treats Chicago:

By comparison, Chicago home prices declined 39 percent from the peak to their trough in March 2012. Since then, they’ve risen 23 percent.

Say Chicago peaked at $100,000 in 2006. The 2012 trough would have been $61,000 and the current price would be $75,000. Adjusted for inflation, it would be $65,000—35 percent lower than it was in 2006.

Bloomberg does note that Chicago’s nominal prices are still down 25 percent from 2006, but it stuffs it toward the end of the story, six paragraphs down.

And while Bloomberg’s thesis is that big-money players like Blackstone Group are fueling a boom, it also reports that 20 percent of purchases were by investors in the first half of 2013. Is that a high number? We’re not told. But data used by the Federal Reserve shows that just 4 percent of Chicago purchases in 2012 were by investors and just 1.5 percent were by large investors.

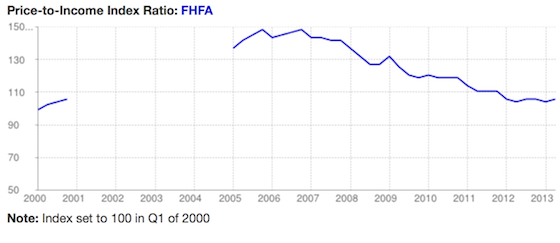

Bloomberg also doesn’t tell us anything notable about the city’s rental market. What’s the vacancy rate? What are average rents doing? What’s the price-to-rent ratio? Are the rising prices out of line with household incomes? Here’s an Federal Housing Finance Agency chart showing affordability in Chicago is far above bubble levels and a bit above 2000 levels:

You can’t really tell much about a city’s housing fundamentals—and whether investors are artificially inflating prices—without those numbers.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.