Phil Gramm and Columbia B-school Dean and Romney economic adviser Glenn Hubbard take to the op-ed pages of The Wall Street Journal to repeat just about every canard of the crisis.

Not many people have more responsibility for the crisis than Gramm, but guess who he and Hubbard, last seen under Inside Job‘s klieg lights, blame:

The more recent recession resulted from excessive government intervention to increase homeownership by expanding subprime housing loans, on which substantial leverage was built.

That’s the zombie lie of the 21st century. It just won’t die no matter how many times it’s been debunked.

There’s so much disingenuousness here it’s hard to know where to start. Take Gramm and Hubbard’s comparison of the 2007-09 recession to the 1981-82 one Reagan inherited (emphasis mine):

Fifty-three months after the start of the 1981-82 recession, total employment in the U.S. was up 7.5 million, or almost 7.5% higher than when the recession began. The labor-force participation rate rose to 65% from 63.8%, as optimism about the future pulled potential workers into the job market. Real per capita gross domestic product increased by $2,870 and was 11% higher than when the recession started.

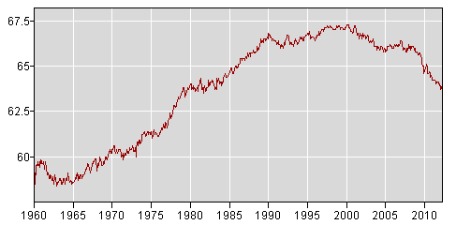

Morning in America and all that. But back up a bit and look at the trendlines. Here’s labor force participation from 1960 to this year, via the Bureau of Labor Statistics:

Funny how Gramm and Hubbard would never think of crediting the Great Society with the massive labor participation rate’s run-up, even though it started on Lyndon Johnson’s watch. The real credit goes to demographics: women joining the workforce en masse and the giant Baby Boom generation beginning to turn 18 in 1964. This is also a big reason why labor participation has dropped in Obama’s term (Gramm and Hubbard, who chaired the Council of Economic Advisors under George W. Bush, don’t mention the rate also fell under Bush).

Beyond that, comparing the 1981-82 recession to 2007-2009 is foolish or worse. The 1981 recession was created intentionally by the Federal Reserve, through huge rate hikes, to break the back of inflation. It, along with deregulation, helped bring on the S&L collapse.

The 2007-2009 recession, particularly the part where the economy fell off a cliff in the fall of 2008, was due to a housing crash of colossal proportions and the collapse (or near-collapse) of the financial system that caused the housing crash.

Back in 1982, Volcker could end the recession by slashing interest rates. Today interest rates are as low as they can go, which is why the Fed has to resort to things like quantitative easing. Beyond that, Reagan’s big government spending was a significant player in the recovery (helped along by the crashing price of oil). Here’s a Paul Krugman chart that shows how much more Reagan (boosted by cities and states) spent in his first term than Obama has:

But here’s how Gramm and Hubbard get around Reagan’s record of big government stimulus to imply that austerity did the trick:

By reducing domestic discretionary spending, setting out a three-year program to reduce tax rates, and alleviating the regulatory burden, Reagan sought to make it profitable to invest in America again. He clearly succeeded.

Later in the column Gramm and Hubbard say there is “growing evidence that government spending and mounting government debt are not stimulating growth.” But Reagan, of course, more than made up for those domestic discretionary cuts with military spending.

Nor do they mention the research showing how the aftermaths of financial crises are much, much worse than after regular recessions. Here’s Carmen Reinhart and Kenneth Rogoff, showing how our downturn compares to the typical one associated with a big financial crisis:

This paper examines the depth and duration of the slump that invariably follows severe financial crises, which tend to be protracted affairs. We find that asset market collapses are deep and prolonged. On a peak-to-trough basis, real housing price declines average 35 percent stretched out over six years, while equity price collapses average 55 percent over a downturn of about three and a half years. Not surprisingly, banking crises are associated with profound declines in output and employment. The unemployment rate rises an average of 7 percentage points over the down phase of the cycle, which lasts on average over four years. Output falls an average of over 9 percent, although the duration of the downturn is considerably shorter than for unemployment. The real value of government debt tends to explode, rising an average of 86 percent in the major post-World War II episodes. The main cause of debt explosions is usually not the widely cited costs of bailing out and recapitalizing the banking system. The collapse in tax revenues in the wake of deep and prolonged economic contractions is a critical factor in explaining the large budget deficits and increases in debt that follow the crisis.

This isn’t to excuse Obama for failing to bring the economy back around much quicker. It’s just to be honest about the hand he was dealt.

Of course, creating the false impression that stimulus has failed, that Obama greatly increased spending when he came into office, is a key part of Romney’s campaign strategy.

Peggy Noonan’s column today in the Journal fits right in there:

It became apparent some weeks ago when the president talked on the stump—where else?—about an essay by a fellow who said spending growth is actually lower than that of previous presidents. This was startling to a lot of people, who looked into it and found the man had left out most spending from 2009, the first year of Mr. Obama’s presidency. People sneered: The president was deliberately using a misleading argument to paint a false picture! But you know, why would he go out there waving an article that could immediately be debunked? Maybe because he thought it was true. That’s more alarming, isn’t it, the idea that he knows so little about the effects of his own economic program that he thinks he really is a low spender.

Of course, most of the spending in 2009 was baked into the cake when Obama came into office. Four months of the fiscal year were already over. The budget deficit was already at $1.2 trillion for 2009 the day Obama took office. It’s utterly misleading to blame him for most of that increased spending.

But that’s just part of the air they breathe over at The Wall Street Journal opinion pages.

UPDATE: I read today’s Krugman column after posting this. It’s worth a read.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.