The paywalled Financial Times is the real digital-first newspaper, and it had a very, very good 2013.

Online revenue now accounts for 63 percent of the FT’s overall sales, and digital subscriptions outnumber print ones by a wide margin.

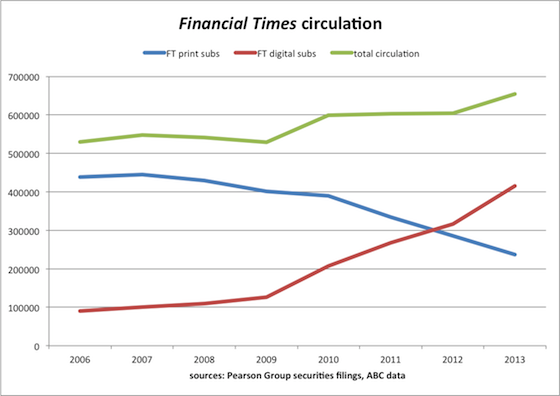

At its peak in 2001, the FT had a print circulation of 504,000. That has collapsed in the last five years, and the FT’s print run now totals just 237,000.

But the FT is now in the seventh year of its digital meter, a model it created and which has become, following The New York Times‘s successful imitation, something of a newspaper-industry standard. Look at what FT subscriptions have done overall thanks to digital subs, represented by the red line here:

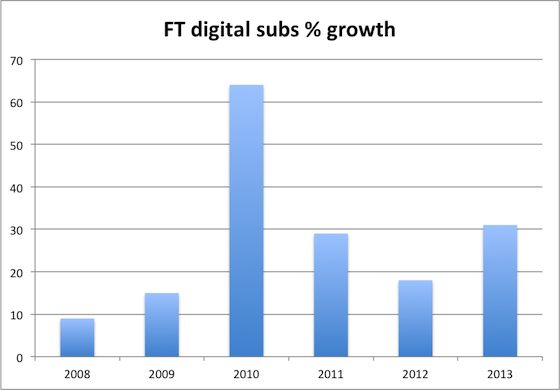

Its paid circulation is now at an all-time high despite the print plunge. The big news is that the FT’s digital subscription growth actually accelerated last year—sharply. In business, the easy growth is the early growth. As a business matures and its customer base grows, it tends to become progressively harder to maintain growth rates and, eventually, absolute growth.

But the FT broke the law of large numbers last year. It added 99,000 subscribers, which is by far the most it’s ever added in a single year. And while its annual growth rates had slowed in the last couple of years, the FT grew digital subs 31 percent last year, which is the second highest rate its ever had:

The New York Times, whose metered paywall is about to end its third year, needs to look closely at those numbers, which suggest that it may have quite a bit more room for growth. The NYT grew digital subscriber count by a solid 19 percent last year, but it grew digital subscription revenue by 36 percent, which means it got more money per subscriber.

I asked the FT what caused its spike last year and whether it could continue. Spokesman Andrew Green responded:

In 2013, we saw strong growth in both individual and corporate FT.com subscriptions, powered by mobile and product development like fastFT and mobile app redesigns. We are also seeing good growth in 2014.

The FT has now has 415,000 digital subscribers, and they pay a lot of money. A basic subscription in the UK costs $450 a year. If you want the Lex column, it’ll run you $622 total. In the US, those numbers are $325 and $467.

That’s a lot more than an FT.com subscription cost four or five years ago, when paywall growth rates were much lower, oddly enough. Importantly, the FT has made the mobile transition well too. Sixty-two percent of its subscribers’ usage comes via mobile.

Better yet. Unlike the NYT and others, it doesn’t have to fork over 30 percent to Apple or Google. Its apps use HTML5, which allows the FT to bypass the monopolies.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.