The New York Times Company’s first quarter earnings, reported yesterday, left a lot to be desired.

About.com, the company’s web-only content farm, continues to crater, weighing down the newspapers. It lost nearly a a quarter of its revenue and half its earnings from the same period last year.

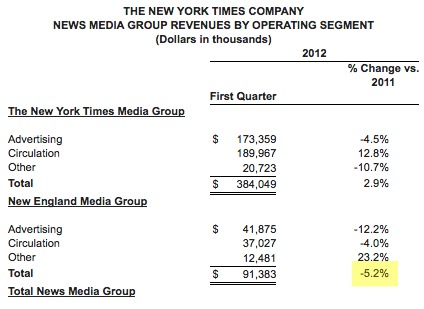

The NYT’s New England unit, primarily The Boston Globe, saw revenue fall 5 percent. The paper’s new paywall so far has not been nearly as successful as the NYT‘s. The Globe has just 18,000 digital subscribers. That means it has captured roughly 10 percent of the paper’s print daily circulation in six months. The NYT‘s paywall, by contrast, in its first six months captured more than 40 percent of its print circulation.

It stood to reason that metro dailies would have a harder time building a critical mass of paying subscribers than the national papers would. But the low level of uptake for The Globe is still a disappointment. It’s better than nothing, but it’s bringing in less than $4 million a year. Worse, it’s not making up for falling print circulation, much less ad declines.

The Globe‘s division (which also includes the much smaller Worcester Telegram & Gazette) saw circulation revenue decline 4 percent despite the addition of the new digital circ revenue stream. The low conversion rate to bostonglobe.com (and apps) might be because of the paper’s dual strategy with Boston.com, which remains a free site.

I argued yesterday that The New York Times‘s paywall would be able to counteract the decline of print advertising. That turned out to be the well-timed bright spot for this quarter, with circulation revenue jumping 13 percent and more than offsetting a 5 percent decline in advertising.

To make the digital numbers work eventually, though, the paper has got to grow its digital advertising at a solid clip. It did so in 2010 and 2011, when digital ads at its newspapers rose 18 percent and 10 percent, respectively. But it failed big time last quarter. Digital ad revenue actually declined 2 percent at the company’s papers.

To keep ad revenue flat by 2017, assuming a 7 percent annual decline in print ads, the NYT has to grow digital ads at 14 percent a year. That’s not going to happen. But the paper certainly can’t afford to go backward on digital ads.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.