I wrote Friday about a landmark for The New York Times: Its paywall revenue has overtaken its digital ad revenue—just two years after the paper bucked conventional wisdom and asked readers to pay.

GigaOm’s Mathew Ingram spins that news as negatively as possible, writing on Twitter that “‘the Times’s paywall revenue has soared past its digital ad revenue’… because ad revenue continues to sink.” My sometime colleague Felix Salmon says something similar, tweeting that “or, digital ad sales dropped to below paywall revenue.”

In a post at PaidContent, Ingram explains:

…although the Times has seen further growth in subscriptions, its overall revenue barely budged, and much of that lack of movement was due to continued declines in the paper’s advertising revenue — both in the print version and online.

In a piece at the Columbia Journalism Review, writer Ryan Chittum gushed about how the Times’ digital subscription revenue “soared past its digital ad revenue” in the third quarter — but it did so in part because digital ad revenue plummeted another 3.4 percent during the same period, compared to the year before. And that’s actually a larger drop than the Times saw in the third quarter of 2012, which means the problem is getting worse instead of better.

Well, er, yes. The reason the NYT has a paywall is because its digital advertising hasn’t grown much more quickly. If anybody has a fix for that, I’m sure they’re all ears in Times Square.

As I pointed out in Friday’s post (and 18 months before that), the Times‘s digital ad performance is terrible—alarming even: “Digital ad sales actually fell faster than print ad sales in the third quarter,” which is quite a feat.

But it’s just not “a fact, actually” that the Times‘s digital-subscription revenue overtook the paper’s digital ad revenue because of the recent digital ad declines.

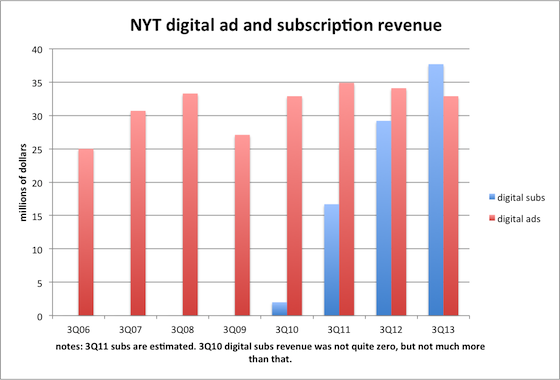

The NYT took in $37.7 million in digital subscriptions last quarter while selling $32.89 million worth of digital ads. The paywall number was up 29 percent from a year ago while the ad number was down 3.4 percent from last year, which itself was down 2.2 percent from the year before. That means the NYT’s 3rd quarter peak for digital ads was $35 million two years ago, less than the paywall’s take last quarter:

You could argue that the paywall is partly responsible for the weak ad results, but it’s worth noting that the Times hasn’t felt obligated to say that in its SEC filings, blaming them instead on programmatic buying and rate declines.

I’d counter that by noting that the numbers also don’t count the paywall’s hidden revenue, which includes several million dollars (my very rough, conservative estimate) a quarter in print revenue.

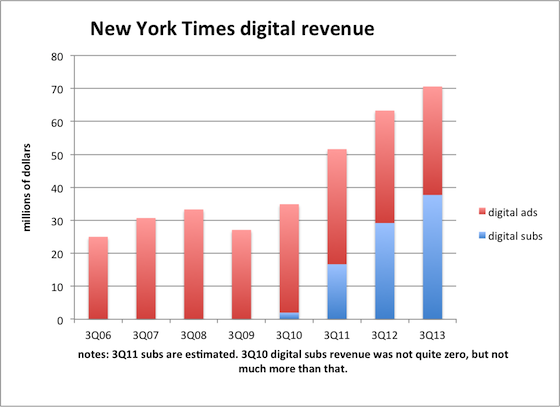

Now look at what the paywall has done for the Times‘s overall digital revenue. Here’s total third-quarter digital revenues at the paper going back several years, based on my calculations (by the way, fourth quarter digital ad revenue will probably be higher than digital-subs revenue this year due to seasonality):

If you don’t care about the minutiae of this silly dispute, I don’t blame you (so why’d you read this far?).

But frames matter.

Ingram writes that the paper’s 2 percent overall revenue increase means it’s “running hard, but staying in the same place.”

Well, maybe. But it’s worth noting that in just more than two years the paywall has doubled the Times‘s digital revenue to about $310 million this year. That’s not enough, obviously, but it’s approaching the point where the company could shut down the printing presses (exempting Sunday) and still support its massive newsroom, and it’s far closer than it could have gotten on ads alone. And unlike most places, the Times hasn’t sacrificed its editorial credibility scrambling for clicks.

While the pace of paywall growth has slowed dramatically this year, as expected, growth is still robust. The NYT is on track to grow digital subs 18 percent to 20 percent this year.

By the way, the Times‘s paywall revenue growth rate has come without any price increases. Raising its $3.75 a week base subscription by just a quarter would boost paywall revenue by 7 percent next year with little attrition. The NYT should moderately raise prices annually on its digital subscriptions.

That and another 10 percent gain in subscribers would add $25 million in high-margin revenue in 2014, bringing the paywall to $175 million next year—and that’s without considering any potential gains from the upcoming paid-content expansion.

The bottom line is, running in place is much better than falling off a cliff, which is what the Times would be doing if it had listened to the paywall naysayers.

Without its digital subscriptions, the NYT’s overall revenue would have plummeted more than 10 percent last quarter.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.