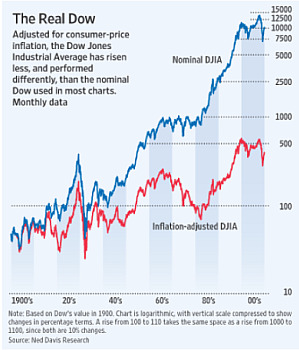

You rarely see anyone, much less the press, report stock returns in inflation-adjusted terms.

As we pointed out in October when the Dow crossed 10,000 (yet again), that Dow 10,000 was really only Dow 7,714 in original Dow 10,000 (1999) dollars.

But, behold! The Wall Street Journal‘s E.S. Browning wrote an important story over the holidays on just this topic—and even took the press to task a bit for its failure to accurately convey reality.

Despite its 2009 rebound, the Dow Jones Industrial Average today stands at just 10520.10, no higher than in 1999. And that is without counting consumer-price inflation. In 1999 dollars, the Dow is only at about 8200 and would have to rise another 28% or so to return to 1999 levels. Using today’s dollars and starting at 10520.10, the Dow would have to surpass 13460 to get back to its 1999 level in real, inflation-adjusted terms.

Bravo!

But even better, Browning and the WSJ go back to the turn of the 20th century to show how stocks have really done. The Dow at 10,500 now? It’s more like Dow Sub-500. Seen in that light, equities are a much-less appealing investment than most people think.

Or read this:

Stock analysts sometimes like to note that the Dow today is worth 27 times its value at its 1929 pre-crash peak, meaning that even if you bought at the worst moment, your stock still would be way up over time. In inflation-adjusted terms, however, the Dow today is only a little over twice its 1929 peak, according to Ned Davis Research.

By my math, that means, the Dow has returned 0.99 percent a year over the last 80 years. Yow!

Audit Reader Edwin Hamilton also notes that the Dow has performed miserably over long investment horizons. He calculates that a dollar invested in the stock market in January of 1966 was worth—you guessed it—a dollar in real terms in September of 1995. Worse, that dollar invested in 1966 was worth only about 33 cents in real terms if you happened to cash out in October 1982, just before the great bull market began.

Of course, that (like the WSJ‘s 1929 to 2009 number) is measuring from a peak to a trough, which isn’t exactly fair. But even if you measure from the very nadir of the Depression-era Dow, which hit 651 in 1932 (in 2009 dollars. The nominal number was 41.22), you still end up with a real annual return of just 3.7 percent over the last seventy-seven years. You’re not going to get rich on those kind of returns.

So why don’t the media adjust stock returns for inflation? Here’s Browning:

Controlling for inflation takes extra work and makes stock gains look punier, so it is easy to see why stock analysts almost never do it. The media almost never do it either.

I’d guess that the media don’t because they’re mostly talking to people with a vested interest in not presenting the real picture, like those stock analysts or corporate executives. It probably never occurs to most reporters or editors—much less their readers—that the Dow ought to be adjusted for inflation just like a budget number or a food price.

Also, I’d suspect most of us like to see the nominal number increase in our retirement accounts and don’t want to much think about what it’s really worth and how much it’s returned (or hasn’t). As Stephen J. Dubner writes at The New York Times‘s Freakonomics blog, “it’s exciting to see inflation working in your favor day after day.”

But it’s really not hard to crunch these numbers, folks. Here’s a really easy tool from the Bureau of Labor Statistics. Plug in your number, pick a date to adjust to, and it will calculate it for you.

One important thing that the Journal doesn’t take into account in its Dow calculations (and which I don’t above, either) is total returns, which are stock returns calculated with dividends reinvested. That would make the inflation-adjusted returns higher, though dividend yields have been low and many don’t reinvest their dividends (Dow Jones Indexes tells me the Dow’s total return from December 28, 1999, to December 28, 2009, was 15.3 percent. Inflation during that time was between 26 percent and 30 percent, meaning you still lost more than 1 percent a year in real terms).

But neither does it take into account the very real transaction costs that eat up capital. These also don’t take into any effects from dollar-cost averaging, which is what you do when you withhold money from at regular intervals for your 401(k), which means you buy at lows and at peaks over a given timeframe.

The Journal does report a total return number on the S&P 500 from an analyst who’s taken transaction costs into account, but it goes back to 1978, which is something of a cherry-picked year since it was near the inflation-adjusted trough of the market before it blew sky-high in the 80’s and 90’s. Even that nets just 4.5 percent a year.

You have to wonder if there’s a connection to be drawn between the low savings rate and the idea that took hold in the last three decades, which still hasn’t been extinguished even after this miserable decade, that investing in stocks means you’ll get big returns on your money.

The WSJ story is excellent here:

Prof. William Hausman at the College of William & Mary long has urged the media to offer people inflation-adjusted stock charts. He says newspapers and analysts frequently point to the Dow’s 2007 record of 14164.53 and talk about how far the Dow would need to climb to return to that level. In inflation-adjusted terms, however, the Dow in 2007 never quite surpassed its 2000 record, Prof. Hausman calculates. To return to an inflation-adjusted record now, he adds, the Dow would need to break 15000.

“It really puts in perspective how stocks are doing,” he says.

Indeed. The press should account for inflation when it talks about stock prices—whether it’s for the overall market or for individual issues.

The Journal‘s piece is a very good start.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.