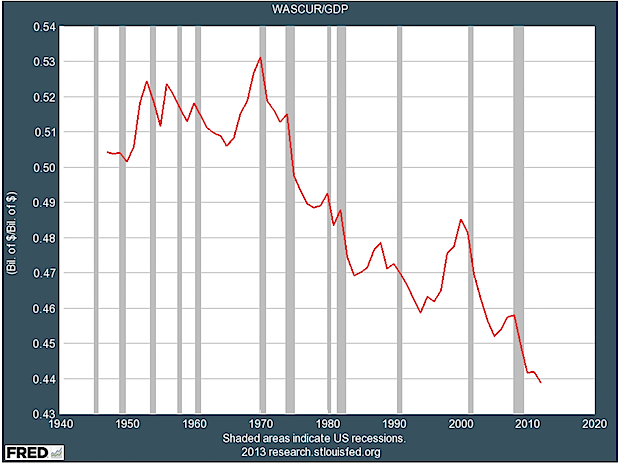

It’s May Day, and Henry Blodget is celebrating — if that’s the right word — with three charts, of which the most germane is the one above. It shows total US wages as a proportion of total US GDP — a number which continues to hit all-time lows. Blodget also puts up the converse chart — corporate profits as a percentage of GDP. That line, you won’t be surprised to hear, is hitting new all-time highs. He’s clear about how destructive these trends are:

Low employee wages are one reason the economy is so weak: Those “wages” are represent spending power for consumers. And consumer spending is “revenue” for other companies. So the short-term corporate profit obsession is actually starving the rest of the economy of revenue growth.

In other words, we’re in a vicious cycle, where low incomes create low demand which in turn means that there’s no appetite to hire workers, who in turn become discouraged and drop out of the labor force. Blodget’s third chart is one we’re all familiar with: the employment-to-population ratio, which fell off a cliff during the Great Recession and which will probably never recover. The current “recovery” is not actually a recovery for the bottom 99%, for real people who need to live on paychecks. And today is exactly the right day to point that out.

Conversely, today is exactly the wrong day to declare that these broad and inexorable trends are not really big top-down trends at all, and in fact merely reflect the inability of individual workers to “access learning, retrain, engage in commerce, seek or advertise a job, invent, invest and crowd source”. And yet that’s Tom Friedman’s column this May Day:

If you are self-motivated, wow, this world is tailored for you. The boundaries are all gone. But if you’re not self-motivated, this world will be a challenge because the walls, ceilings and floors that protected people are also disappearing. That is what I mean when I say “it is a 401(k) world.”

This manages to be both incomprehensible and incredibly offensive at the same time. I have no idea what Friedman thinks he’s talking about when he blathers on about disappearing protective floors; I can only hope that he isn’t making a super-tasteless reference to the recent disaster in Bangladesh. But it’s simply wrong that today’s world is “tailored” for anybody who happens to be “self-motivated”. Both the self and the motivation are components of labor, not capital, and as such they’re on the losing side of the global economy, not the winning side.

Friedman is a billionaire (by marriage) who — like all billionaires these days — is convinced that he achieved his current prominent position by merit alone, rather than through luck and through the diligent application of cultural and financial capital. His paean to self-motivation recalls nothing so much as Margaret Thatcher’s “there is no such thing as society” quote: “parenting, teaching or leadership that ‘inspires’ individuals to act on their own will be the most valued of all,” he writes, bizarrely choosing to wrap his scare quotes around the word “inspires” rather than around the word “leadership”, where they belong.

True leadership, in a society where the workers are failing to be paid even half the fruits of their labor, would involve attempting to turn the red line in Blodget’s chart around, and to spread the nation’s prosperity among all its citizens. Rather than telling everybody that they’re “on their own” and that if they’re not a success then hey, they’re probably just not “self-motivated” enough.

The ultimate Friedman kick in the balls, however, doesn’t come from his lazily meritocratic priors. Rather, it comes from his overarching metaphor: the idea that if you have a 401(k) plan, then you’re somehow in charge of your own destiny. Friedman might be right that we’re living in a 401(k) world, but if he is then he’s right for the wrong reason. In Friedman’s mind, a 401(k) plan is an icon of self-determination: you get out what you put in. “Your specific contribution,” he writes, italics and all, “will define your specific benefits.”

In reality, however, a 401(k) plan is an icon of futility and the way in which the owners of capital extract rents from the owners of labor. Yves Smith is good on this, as is Matt Yglesias, although the real expert is Helaine Olen: the 401(k) is a way for both your government and your employer to disown you, and to leave your life savings to be raided by the financial-services industry and its plethora of hidden and invidious fees. The well-kept secret about old-fashioned pension funds is that, for the most part, they’re actually very good at generating decent returns for their beneficiaries. They tend to have extremely long time horizons, and are run by professionals who know what they’re doing and who have a fair amount of negotiating leverage when they deal with Wall Street. Savers are always strengthened by being united: disaggregating them and forcing them to take matters into their own hands is tantamount to feeding them directly to the Wall Street sharks.

Yglesias says that in a 401(k) world, “you’ve got to save a lot of money for retirement. More than you think.” This is true for five big reasons. Firstly, because wages are shrinking, any given level of savings will constitute a steadily-increasing proportion of any given worker’s GDP-adjusted paycheck. Secondly, because the employment-to-population ratio is shrinking, all workers need to save to support not only themselves in retirement, but also a number of dependents which is also growing over time. Thirdly, because 401(k) plans have lower returns than traditional pension plans, you need to save more in order to make up the difference. Fourthly, life happens: while the money in your 401(k) is nominally there for your retirement, in practice there’s a good chance that you’re going to tap it, at some point, to pay some kind of large and unexpected bill, whether that comes from unemployment or divorce or ill health. And finally, 401(k) plans don’t have the clever cross-subsidy that traditional pension plans have, where people who die early cross-subsidize people who live for a long time. With a pension plan, you get income when you need it — when you’re alive — and you don’t get money when you’re dead, and don’t need it any more. With a 401(k), by contrast, you have to save more than you really need, because there’s always a chance that you’re going to live to 102.

Add them all together, and to a first approximation you arrive at our current world, where pretty much no one relying on their 401(k) is actually saving enough for retirement. If you’re rich today, you’ll probably be fine when you retire. But if you’re someone who (in contrast to Tom Friedman) actually lives on your paycheck, then there’s almost no chance that your retirement savings will be enough, when the time comes. That’s not your fault: the reasons are deeply systemic. And as a result, the solutions cannot possibly be the kind of bottom-up schemes that Friedman is extolling. They have to come from the top: from real leaders, rather than jumped-up “thought leaders“.

Felix Salmon is a financial writer, editor, and podcaster. A former finance blogger for Reuters and Condé Nast Portfolio, his work can be found at publications including Slate and Wired, as well as his own Substack newsletter.