Everybody who skipped Bank Transfer Day ought to read this New York Times story today on how giant banks are hitting customers with new fees.

Not so long ago, banks had a couple of multibillion-dollar rackets going that hit consumers directly via overdraft charges designed to turn a $2 overdraft into a cascade costing hundreds of dollars or used the debit-card companies’ duopoly power to gouge retailers—costs that retailers, at least in part, passed back onto their own customers.

Congress and the Fed have reformed those practices, costing the banks billions of dollars a year in high-margin revenue. Between the loss of that revenue and the decline in profitability of lending and investing deposits, banks need to make up between $15 and $20 per month from each customer to get back to past levels of profitability, the Times reports. About 60 percent of that is due to revenue lost from overdraft and swipe-fee reform.

Not that banks don’t still make money off checking accounts, despite the impression you may have gotten from the banks and other press coverage. The Times reports that most accounts are still profitable. They’re just not as profitable anymore. Here’s what the banking industry thinks about that:

“They have got to make up the income some place,” said Vernon Hill II, the founder of Commerce Bank whose retail-oriented approach transformed it into a large regional player before it was sold to TD Bank.

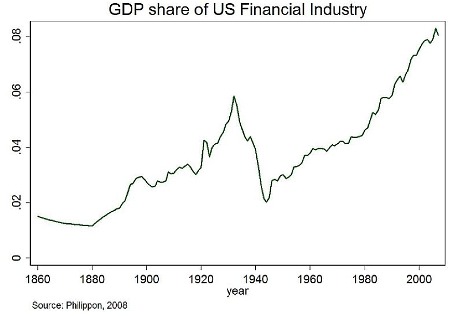

But that’s just not true. If past profit margins were inflated by ill-gotten revenue, it stands to reason that margins will settle at a lower number if fees are really transparent. High banking industry profit margins are not a God-given right. In fact, lower margins would be a sign that reform is actually working. Just about everyone but bankers (and even many of them concur) agrees that the financial industry has sucked way too much money out of the economy in the last few decades:

The banks’ skimmed billions subsidized an enormous expansion of their retail footprints in the last decade or so, snapping up the best commercial real estate, pushing up retail rents, and dulling street life. So the Times is good to report that banks are closing branches, which have declined 1.4 percent since 2009. Will the banks retrench even more? I’d like to see a story about that.

Meantime, this quote just about sums it all up on how the big banks think of their customers:

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.Banks may also be betting that consumers will not notice the quiet creep of existing fees. As Richard K. Davis, U.S. Bancorp’s chief executive, told investors on a recent conference call: “We’ll see if our customers complain and move, or just complain,” he said.