The New York Times‘s paywall picked up another 33,000 customers in the fourth quarter, bringing its total to 760,000 digital subscribers.

And, importantly, the paper showed signs that it’s finally turning around its digital-ad decline. Digital ads were all but flat (excluding the extra week in fiscal 2012), down 0.2 percent.

Even more surprising, print ads were only down 1.6 percent, which counts as an excellent performance these days. That matched the decline from last quarter, suggesting that it might be more than a blip and allowed lower circulation gains to offset ad declines. Total revenue edged up 0.4 percent.

To top it off, the company’s pension fund is $270 million better off than it was a year ago, thanks mostly to stock market gains.

In other words, it was a surprisingly good quarter for the Times, and the paper expects more of the same in the current quarter.

The NYT’s performance contrasts starkly with Gannett’s, which I looked at earlier this morning. Gannett’s print-led paywall-enabled circulation growth has petered out after one year’s earnings cycle, with overall publishing revenue dropping 4.6 percent in the fourth quarter (also excluding 2012’s extra week).

If you want to sell journalism online, you have to have journalism worth paying for (obviously). The Times is a special case, though it’s false that it’s so different that other papers can’t learn from its example. The Star Tribune now has 30,000 digital subscribers, for instance, and has continued to grow overall circulation revenue.

For the Times, digital was a $312 million business in 2013, up 12.6 percent from about $277 million in 2012 (excluding that infernal extra week).

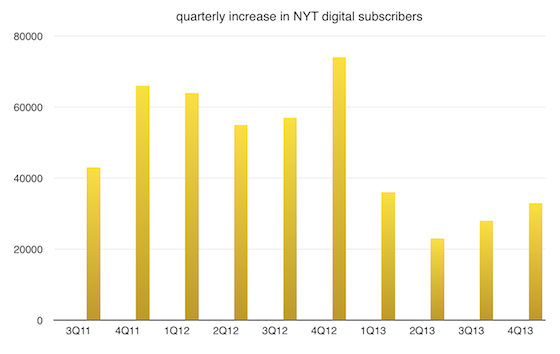

The big question going forward is how the Times can grow what has become a mature business. This is what its quarterly digital-subs growth looks like:

There was a clear slowdown last year, though it’s worth pointing out that the Times has added 84,000 digital subscribers and about $16 million in annual paywall revenue since since Quartz , for instance, wrote that the paywall had “hit a growth wall” last April. That’s 17 percent annualized growth.

The Times has said it will introduce a number of new pay options and products, including ones at lower prices, in a bid to goose digital-subscription growth. We’ll see about that.

In the meantime, it would be wise to start getting readers conditioned to an annual 2 percent or 3 percent price increase. The Times hasn’t raised prices since launching the paywall nearly three years ago. Better to raise them a bit every year than to spring 10 or 15 percent increases on people.

But the critical fact is that the Times now has created an entirely new business in less than three years that brings in $156 million a year in high-margin digital revenue.

The paper has to get digital ads growing at a good clip to secure its future, but its video efforts, for one, are showing promise.

The Times has sacrificed short-term profits during this great newspaper depression as much or more than any publisher in the country in a bet that maintaining its high quality journalism was the best way to secure its future.

That bet is looking pretty good right now, though it would look even better if the company had held off a little longer on that $24 million a year dividend.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.