The consolidation boom in the media business may soon extend, albeit on a vastly smaller scale, to newspapers, especially the smaller ones. And no, that’s not an applause line.

Several key financial players and newspaper operators have publicly expressed interest in buying, and are doing so privately as well.

“Everybody’s talking to everybody,” says one top executive of a major newspaper company.

Among those that have made recent acquisitions or have publicly said they are looking are the soon-to-be-spun-off Tribune Publishing Company, which recently bought some smaller papers around Baltimore and Hartford and said in a recent financial filing that it expects acquisitions to be “an important component of our business strategy”; News Corp., whose main man Rupert Murdoch was recently heard strongly hinting along these lines; and an under-the-radar owner of smaller newspapers, GateHouse Media, among others.

The main reason for all this is pretty simple: Newspapers, having crashed in value, are now cheap, have more or less stabilized, and are still throwing off lots of cash. More on this below.

Warren Buffett noticed this a couple of years ago and made a much celebrated foray into the market, though opinions differ on how well that deal is working out. More quietly, Halifax Media Group, backed by, among others, a unit of Stephens Inc., an investment bank based in Little Rock, Arkansas, has made a string of deals in recent years, including 16 papers from The New York Times Co. in 2012.

Meanwhile, Digital First Media, a combination of the old Journal Register Company and Dean Singleton’s Media News Group and one of the larger newspaper concerns in the country, laid off employees as part of a major cost cutting initiative, which is sometimes a prelude to a sale, and is the subject of an uncontradicted report by Ken Doctor that it’s massive portfolio is indeed going on the market.

Dallas Morning News owner A.H. Belo sold its Riverside, CA, paper and has the Providence Journal on the block, the sale of which could be announced any time now.

And so on.

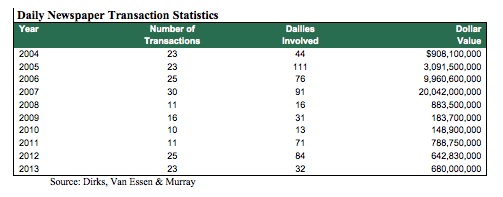

Now, it’s important to keep some perspective. As Owen Van Essen, president of Dirks, Van Essen & Murray, a Santa Fe, NM, merger-and-acquisition firm specializing in newspapers, reminds me with a chart, any merger activity will not even remotely resemble the crazy days of the pre-crisis era, when credit was gushing as through a fire hose, prices were sky high, and deals were fast and furious.

The 2007 figure was primarily the ill-fated sale of the Tribune Company to Sam Zell’s group, and News Corp.’s purchase of Dow Jones & Co.

Still, it’s as if the market has hit a giant “reset” button, and buyers are back on the market with a new rationale. “People just have different expectations for newspapers today,” Van Essen says. In this case, different means much lower profit and growth expectations.

GateHouse, whose parent company is now called New Media Investment Group Inc., has been the most explicit about its interest in the market. Its history gives a clue as to why newspapers might be in play now.

GateHouse was once a chain of more than 200 mostly community papers known as a Liberty Group Publishing, which in 2005 was scooped up by private equity giant Fortress Investment Group LLC, now a public traded owner of everything from railroads, to old folks homes, to Umami Burger.

The newspaper deal, as the WSJ recounted later, followed the classic private equity formula for slow-growing but still profitable industries: Add huge debt and pay investors a dividend using the cash flow. It didn’t work out. GateHouse ended in bankruptcy court within three years, the victim of unraveling newspaper finances and its own debt load, among other things.

But now it’s poised to start all over again. After entering bankruptcy and shedding debt (corporations, unlike students, get to do that), a newly reformed entity still controlled by Fortress began to buy up newspapers, even while it was still in bankruptcy—including a deal last September for the former Ottaway newspaper chain from News Corp., which includes the Times Herald-Record of Middletown, NY, and Massachusetts’s Cape Cod Times. And now it’s out of bankruptcy, its debt reduced, and spun off into a new public company, New Media, better known by its GateHouse unit.

New Media already owns about 85 dailies, 240 weeklies, and 96 shoppers, with a combined paid circulation of more than million paid and three million total, making it one of the largest newspaper companies in the United States. Most of the dailies are small—The Siskiyou Daily News, in California, the Sleepy Eye Herald Dispatch, in Minnesota—but it also owns what it calls “large dailies,” mostly between 30,000 and 50,000 circulation, like the State Journal Register, in Springfield, IL, the Observer-Dispatch, in Utica, NY, and the Peoria Journal Star, in Illinois.

And as John Chesto has noticed, GateHouse is on the hunt.

GateHouse representatives didn’t reply to an email requesting comment. But in financial filings, the company puts acquisitions at the center of its strategy.

We have created a national platform for consolidating local media businesses and have demonstrated an ability to successfully identify, acquire and integrate local media asset acquisitions. We have acquired over $1.7 billion of assets since 2006. We have acquired both traditional newspaper and directory businesses. We have a very scalable infrastructure and platform to leverage for future acquisitions.

The logic for the strategy, and the argument for newspaper bulls generally, is neatly summarized in this New Media investor presentation, and it has a few key elements.

First, as indicated, the industry has already seen a string of bankruptcies and/or bargain-basement sale prices. Major ones are listed here:

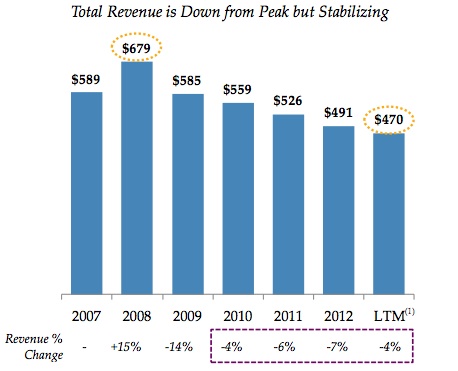

Revenues are no longer in free fall:

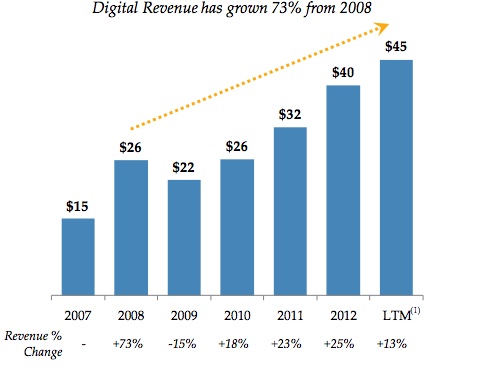

And digital revenue, while still smallish, is rising:

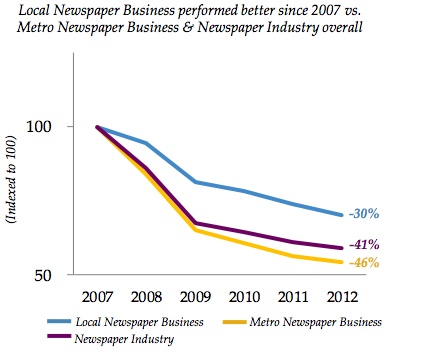

And here’s an interesting graphic that documents what we’ve seen anecdotally: smaller papers, called here “local,” have performed better financially than midsized papers, called here “metro.” (Local performance, the presentation says, is based on the performance of GateHouse’s own newspapers, while “metro” is an unnamed publicly traded company that owns mostly midsized papers.)

For investors, it’s all very interesting; for the public, less so. Consolidation is a mixed bag, at best.

On one hand, a merger wave would mean that professional investors see a future for newspapers at least for the medium term and are willing to put some money behind that belief. That’s a good thing. Of course, they could be wrong, as Fortress was in 2005, but it seems unlikely that the industry will again see two epic shocks at once as it did with the rise of internet followed by the financial crisis. What’s more, there’s the possibility that new investors will actually invest in the product. New Media/GateHouse, for instance, says it is targeting papers “that have undermanaged the online opportunity,” and there are plenty of those. And it has a big unit that sells online marketing services to small businesses, one of the more promising sidelines newspapers have come up with in recent years.

That all said, consolidation is almost always accompanied by cost cutting—part of the logic of these deals is to do just that. When GateHouse bought the Ottaway papers, that was one of the first things it did.

But like it or not, it’s probably coming.

Dean Starkman Dean Starkman runs The Audit, CJR’s business section, and is the author of The Watchdog That Didn’t Bark: The Financial Crisis and the Disappearance of Investigative Journalism (Columbia University Press, January 2014). Follow Dean on Twitter: @deanstarkman.