Does it rankle you that when S&P or Moody’s issues a credit warning on, say, Japanese debt, not to mention the credit profile of the United States, it still matters?

It does me. It especially frosts my flakes because—despite the fact they are embedded in the financial system by their official status as Nationally Recognized Statistical Rating Organizations—when their conflicted ratings turn out to be bogus, they seek refuge behind the First Amendment. They fend off fraud claims by claiming they were just expressing an opinion. (Hey, man, it’s just my ‘pinion.) And it works!

Unlike journalists, however, the rating agency is paid by the institution whose work it is covering. Imagine that model at a newspaper:

LOCAL COLUMNIST: “Mayor, you’re doing a great job—AAA!”

MAYOR: “Thanks!” (hands over bag of cash).

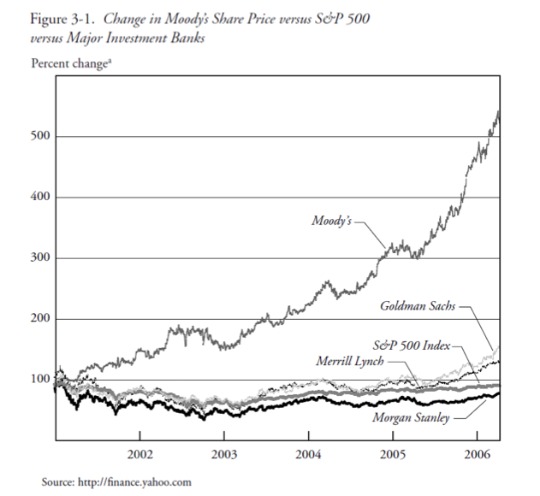

And if you really want a case of agita, you might leaf through the rating agencies section in the Levin-Coburn report (a treasure trove) for a review of the raters’ record during the mortgage frenzy. Did you know Moody’s stock performance not only crushed the broader market, but also the likes of Goldman Sachs and Morgan Stanley, which were paying them to give AAA ratings to bonds that would quickly implode?

As the journalism world searches frantically for sustainable models, it’s interesting to look back to before the agencies adopted the irremediably conflicted issuer-pays model in 1970. For the first eighty years or so of their existence, raters charged subscription fees, just like CJR, not to issuers, but to readers, the investors that actually bought the bonds. Moody’s and S&P gave opinions all the time.

And……no one cared. Not only that, it was a terrible business. Why? Because not enough people cared enough about what they had to say.

Bond ratings began in the late 19th century, when various entrepreneurs began classifying mostly railroad bonds, among them, Henry Varnum Poor and then John Moody, who published the first ratings scheme in 1909. There wasn’t much demand until the boom of the 1920s, when the bond-rating business actually got quite competitive. But, according to an eerily insightful 2005 paper by Frank Partnoy, “How and Why Credit Rating Agencies Are Not Like Other Gatekeepers” (pdf) cited on p. 247 of the Levin-Coburn report, the business hit the skids after 1929, mainly because of a familiar reason: bad ratings.

Following the 1929 crash, the credit rating industry began a general decline.(19) Investors were no longer very interested in purchasing ratings, particularly given the agencies’ poor track record of anticipating the sharp drop in bond values beginning in late 1929. One infamous case involved a default by the Chicago, Rock Island & Pacific on bonds that all of the major agencies had given their highest ratings.(20) Investors recognized that the ratings were not of especially great value and in any event were based largely on publicly available information.

Think: Enron! And business stayed in the doldrums.

The rating business remained stagnant for decades. According to a study of 207 corporate bond rating changes from 1950 to 1972, credit rating changes generated information of little or no value; instead, such changes merely reflected information already incorporated into stock market prices (indeed rating changes lagged that information by as much as eighteen months).(21) Concern about the failure of the rating agencies to generate accurate and reliable information led to public arguments for regulation of the credit rating industry.(22)

Instead of regulating them, the SEC in the mid-1970s created the Frankenstein-like NRSRO concept, which designated them to make certain regulatory determinations, starting with calculating net capital requirements for broker-dealers. Over time, the SEC and Congress established other rules that depended on NRSRO ratings, and their role as gatekeepers ballooned to the current cockeyed ratings system with its poisonous conflicts.

Over the years, Moody’s et al. would claim they were in the publishing business, but, as Partnoy archly notes, no one, especially the market, ever believed it. Recognizing raters’ rent-collecting power, the market has always given Moody’s stock a much higher valuation than other financial publishers, like Dow Jones or Reuters.

But it’s important to remember that when the raters had to rely on actual demand by readers for its bread and butter, they did about as well as the rest of us.

For me, if S&P and Moody’s want to be treated like journalists, they should be paid like journalists. Then no one would care if they downgraded the U.S. to junk and made Libya AAA.

But that’s just my opinion.

Dean Starkman Dean Starkman runs The Audit, CJR’s business section, and is the author of The Watchdog That Didn’t Bark: The Financial Crisis and the Disappearance of Investigative Journalism (Columbia University Press, January 2014). Follow Dean on Twitter: @deanstarkman.