The Wall Street Journal does a good job today on how banks are plotting new fees to get around the clampdown on their old ones, which included abuses like the overdraft racket and interchange-fee gouging that made them tens of billions of super-high-margin money a year.

The biggest eye-raiser here is that the banks are talking about charging an annual fee on your debit card now:

To counter that lost revenue, banks are thinking about imposing annual fees of $25 or $30 on debit cards, according to people familiar with bank strategies. Some also considering limiting the number of debit-card transactions that a customer can make each month, these people said. Another idea circulating in the industry: Limiting the size of a purchase that a customer could make with a debit card. At the same time, reward programs for debit cards are likely to get the ax, these people say.

Axing rewards programs, of course, is perfectly fine. But it’s unclear why limiting the size and number of debit transactions would be a money-saver for the banks. Are they trying to drive people back to paper checks, which cost much more to process?

But imposing annual fees to use a debit card is a different story. Over the last two decades, the banks have intentionally driven their customers toward debit. Initially that was because it cost them much less to process than paper checks. Then they found out they could gouge retailers and consumers because of the monopoly setup of the payment system.

Here’s how The New York Times last year described how that system came about:

Fees were not an issue when debit cards first gained traction in the 1980s. The small networks that operated automated teller machines, like STAR, Pulse, MAC and NYCE, issued debit cards that required a PIN. MasterCard had its own PIN debit network, called Maestro.

Merchants were not charged a fee for accepting PIN debit cards, and sometimes they even got a small payment because it saved banks the cost of processing a paper check.

That changed after Visa entered the debit market. In the 1990s, Visa promoted a debit card that let consumers access their checking account on the same network that processed its credit cards, which required a signature.

To persuade the banks to issue more of its debit cards, Visa charged merchants for these transactions and passed the money to the issuing banks.

What’s unclear, alas, is just how much money the banks are going to earn (or lose) off debit cards under the new regulations. It seems unlikely that they’ll lose money. They’re still getting interchange money, just not as much. The WSJ reports they’ll get seven to twelve cents per transaction now, down from an average forty-four cents. Did the Fed set those fees too low—so low that banks are losing money on processing debit transations?

Somehow I doubt it, whatever the banks say.

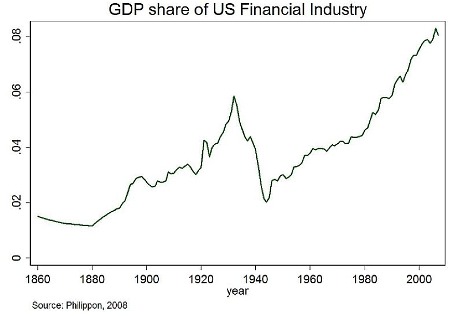

And aren’t they still making money the old-fashioned way—lending off deposits? I always thought the reason banks had services like checking and savings accounts—the whole point of a bank—was to draw your money so they could lend against it. When did it become okay for the industry to use its utility-like position as facilitator and processor of the nation’s payments system to extract rent from the economy? At some point these became profit centers in themselves.

The bankers, naturally, want to keep revenue as high as they were pre-reform in order to preserve profit margins.

But one thing nearly all of us can agree on is that the financial industry sucks far too much money out of the economy for what it returns.

I bank at a credit union these days, and I’d be interested to know how these nonprofits are reacting to the new rules.

Ryan Chittum is a former Wall Street Journal reporter, and deputy editor of The Audit, CJR’s business section. If you see notable business journalism, give him a heads-up at rc2538@columbia.edu. Follow him on Twitter at @ryanchittum.